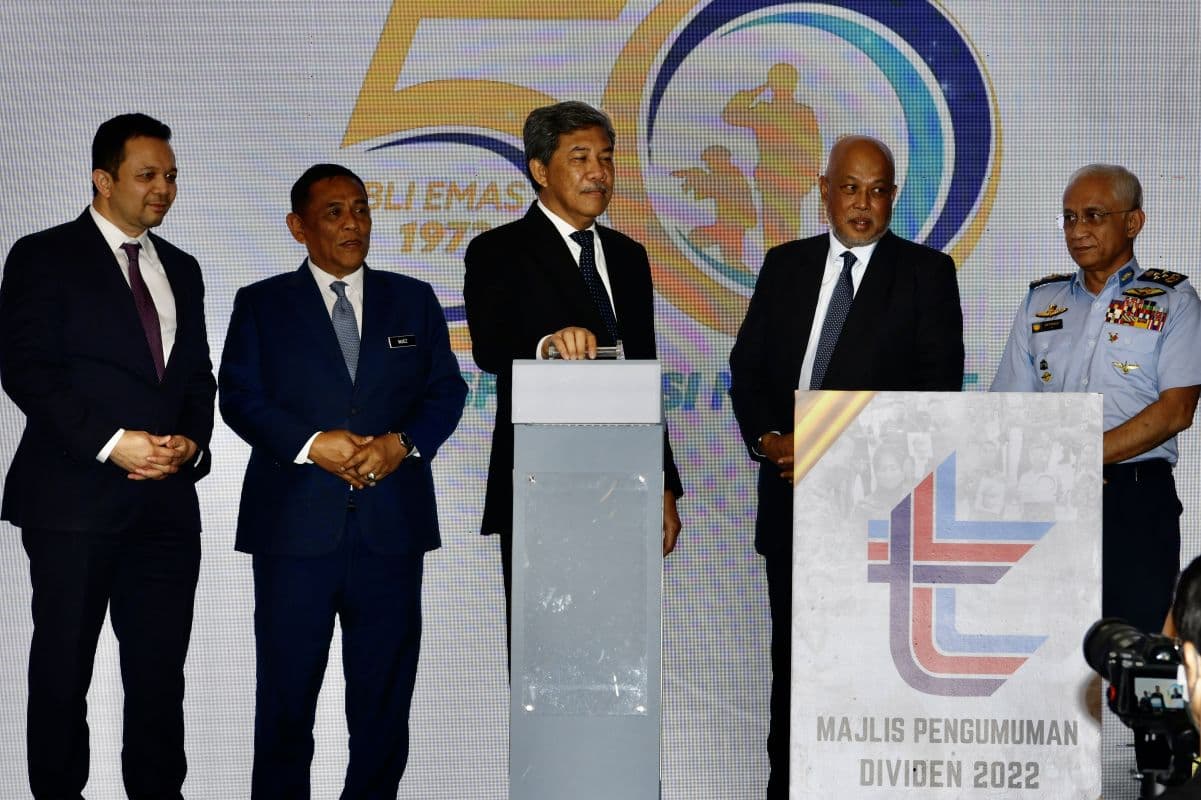

KUALA LUMPUR (March 13): The voluntary takeover offer price of 85.5 sen per share from Lembaga Tabung Angkatan Tentera (LTAT) to take Boustead Holdings Bhd private is “fair”, according to Defence Minister Datuk Seri Mohamad Hasan.

“It is a very good margin. [Share price of] Boustead was closed at 65.5 sen, and we offered 85.5 sen, [over] 36% of the market price,” he told the media after the announcement of LTAT’s dividend.

When asked whether LTAT’s offer price for Boustead is low considering the company has many prime assets, Mohamad Hassan, who is also known at Tok Mat, replied that the high take up rate is a reflection of a “good offer”.

“It is a very good offer price, and [I think] a lot of people have already taken up our offer, so no issue on that,” he commented.

Earlier this month, LTAT launched a conditional voluntary takeover offer to Boustead Holdings to buy out the 40.58% stake or 822.51 million shares that it does not already own, at 85.5 sen per share in order to take the debt-laden conglomerate private.

The offer, however, came on the heels of Boustead Holdings’ large quarterly loss of RM402 million in the fourth quarter ended Dec 31, 2022 (4QFY2022) dragged down by the massive RM552 million impairment of unsold Covid-19 vaccines at its pharmaceutical unit Pharmaniaga Bhd.

Nonetheless, Mohamad Hasan hints at the likelihood of relisting Boustead Holdings in the future.

Mohamad Hasan told the media that there is a possibility of Boustead Holdings being listed on the Bursa Malaysia again. The privatisation exercise aims to help facilitate the restructuring of the conglomerate, which was once the key contributor to LTAT’s dividend payments.

Being the controlling shareholder, LTAT’s immediate plan is to restructure Boustead Holdings’ business operations, said the minister.

“LTAT made the decision based on commercial decisions. We are in the process of restructuring our business model. Maybe next year or [in the] next two years, we can list [Boustead Holdings] again, no issue,” Mohamad Hasan said.

“But it is a lot better if we delist ourselves (Boustead) because sometimes being a listed company, there are so many regulations and compliance.

“This is a major exercise we want to undertake, it is compulsory and important for us to delist Boustead Holdings [at the moment] then offer back to the public with a better balance sheet,” he said.

As at end-2022, Boustead Holdings’ total borrowings stood at RM6.79 billion, of which more than half amounting to RM4.04 billion was short-term loans, against its shareholder equity funds of RM3.325 billion.

On top of that, it has perpetual sukuk of RM609.8 million.

On the other hand, the group also owns a large portfolio of real estate assets, some of which are considered prime.

According to Boustead’s FY2021 annual report, it has notable assets with a book value of over RM1 billion. These assets include the Curve, industrial lands in Kapar and Bukit Raja, Nucleus Tower, Royale Chulan Damansara, two plots of development land in Hulu Langat, Menara Affin, Menara Boustead, Menara UAC, and Royale Chulan Seremban.