This article first appeared in The Edge Malaysia Weekly, on November 17 - 23, 2014.

Documents sighted by The Edge show that the primary objective of the Bridge Global Absolute Return Fund SPC is to seek long-term capital appreciation and/or steady income from investments in listed and/or unlisted companies.

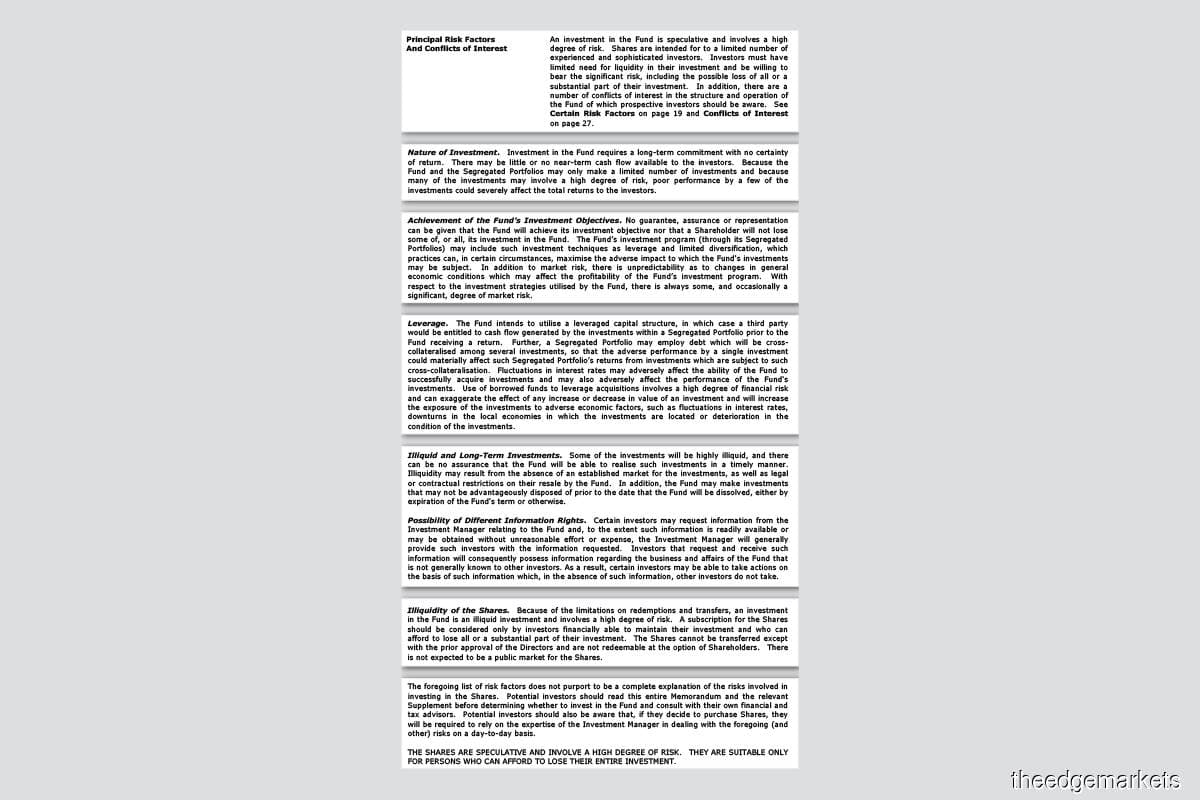

The fund, however, lists a number of risk factors, suggesting that its investments will be of a high-risk nature. Following are excerpts from the fund’s documents:

The people managing the fund are as following:

- Samuel Goh is said to have a decade of experience in the financial services industry, advising corporates and family business owners on private equity opportunities. He has an honours degree in business studies from Nanyang Technological University and is a CFA charterholder.

- Lobo Lee has over 20 years’ experience in investment in New York and Hong Kong and is licensed by Hong Kong’s Securities and Futures Commission to deal and advise on securities and asset management. He has a master’s degree from the State University of New York and a degree from Canada’s University of Toronto.

- Monica Lin Wai Yan has over 15 years’ experience and is licensed to trade and advise on securities, and do asset management and corporate finance work. She has a master’s degree from Heriot-Watt University in Edinburgh, Scotland.

Lee and Lin are shareholders/directors of Bridge Partners Investment Management Ltd, while Goh is a director of Bridge Global Absolute Return Fund.

From the information about the Bridge Global Absolute Return Fund and the people managing it, it raises the question of why 1MDB parked US$2.3 billion (RM7.67 billion) of borrowed money in such a high-risk portfolio fund. And how does it fit in with 1MDB’s stated mission to drive sustainable economic development and promote foreign direct investments?

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.