This article first appeared in Wealth, The Edge Malaysia Weekly on January 30, 2023 - February 5, 2023

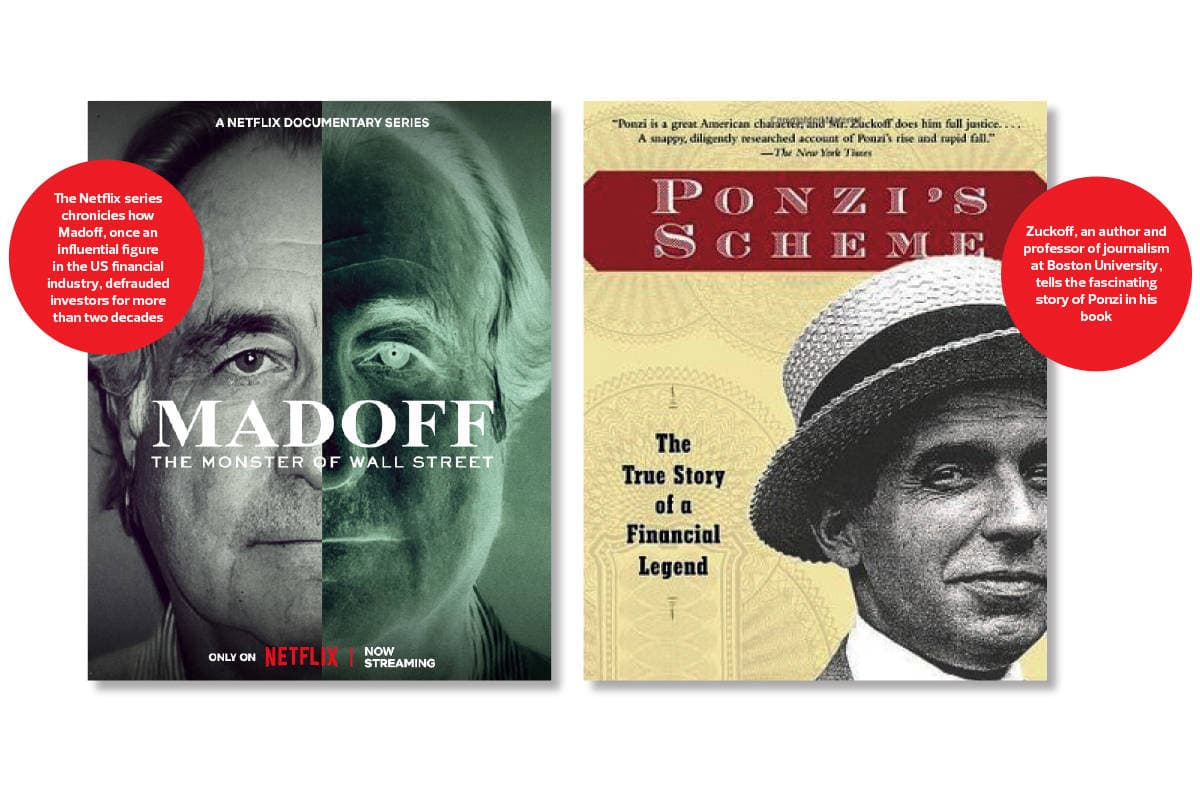

If you want to know more about the colourful stories of money games and how they work, look no further than the Netflix series Madoff: The Monster of Wall Street and Ponzi’s Scheme, a book by Mitchell Zuckoff.

Bernie Madoff was one of the most reputable figures in the US financial industry, having been chairman of the Nasdaq at one point. His firm, Bernard L Madoff Investment Securities, was once the biggest market maker on the stock exchange.

Madoff built his reputation on one of the darkest days in US stock market history — Black Monday in 1987 — when the Dow Jones Industrial Average plunged 22% in a day. When most market-making firms (which facilitate share trading for commissions) ignored their clients, he was one of the very few who kept their doors open and continued doing business with investors. That won him tremendous respect from industry players and provided him with much legitimacy.

Ironically, his good name provided him the perfect opportunity to defraud investors. To put it in the local context, imagine a former chairman of a stock exchange running a money game. Simply unbelievable.

Charles Ponzi, born to a middle-class family in Italy in 1883, is the man who gave rise to the term “Ponzi scheme”. Unlike Madoff, who had a solid track record on which to leverage, he was coaxed by his uncle to go to the US after squandering much of his family’s inheritance on gambling, cafés, operas and the fine things in life.

Landing on foreign soil almost penniless, Ponzi made his way to Montreal, Canada, where he was employed by a bank that eventually collapsed for promising depositors unrealistic returns. The bank owner had dipped into customers’ savings to pay out those returns and was ruined when there was a bank run. Ponzi went to prison and after he was released, wandered across the country doing all kinds of jobs.

It was in Boston that Ponzi made his fortune by exploiting the International Reply Coupon (IRC), which allowed someone sending a letter to another country to pay for the postage for the reply in advance. He raised funds by promising investors a mouthwatering return of 50% in 90 days and provided them with a detailed explanation on how the money could be made.

Little did investors know that while the logic behind Ponzi’s business idea did make sense, it wasn’t executable. It was also rather complicated, which prevented them from asking him further questions.

Investors trusted Ponzi because of his reputation as a person who genuinely cared for his fellow man. Word had spread that he once got 122 square inches of his skin removed by a doctor for a nurse who had been severely burnt when she was cooking a patient’s meal. The skin from his back to his legs was mostly gone for a good cause without any material benefit in return.

Ponzi is remembered as a scammer who ruined lives decades later, but there is no doubt he had some good in him, which added to his charm.

It is interesting to note that, unlike Ponzi’s scheme, Madoff’s money game did not promise investors the moon and the stars with spectacular returns. According to an interviewee in the Netflix series, it offered investors steady returns instead of outsized gains. But the catch was that the fund never lost money. From month to month, it was only a matter of making more or less.

Madoff’s scheme is more sophisticated than that of Ponzi. Madoff hired specialists who would tinker with the computer system to show auditors and regulators fake transactions and trades. He also sent investors statements that contained falsified information over a specific period, which provided his clients with some comfort. It was not until the 2008 global financial crisis that he could no longer sustain his scheme.

As in many other financial scandals, various parties were questioned on why they never dug deeper into Madoff’s scam despite the obvious red flags. JPMorgan Chase, one of the world’s largest banks, handled Madoff’s bank account that was associated with his scheme. Huge amounts of money flowed in and out, but the bank never looked into the matter.

Then, there was the US Securities and Exchange Commission (SEC), the regulator tasked with enforcing laws against market manipulation, which conducted sloppy investigations into Madoff or simply looked the other way after receiving complaints from industry players.

Just like Ponzi, Madoff once marched into the SEC’s offices and surrendered to the officers in charge of his account, who would have found him guilty had they actually checked the account. But they didn’t and Madoff was let off the hook for a little longer. His scheme lasted more than 20 years and wiped out US$20 billion in investors’ money.

Both Madoff and Ponzi had a glorious time, amassing great wealth that didn’t belong to them in the prime of their lives. But when the downfall finally came, it wasn’t a pretty sight. Madoff was sentenced to 150 years in prison and died on April 14, 2021. His two sons, who seemed not to know about their father’s secret scheme, died at a relatively young age. One committed suicide while the other died of cancer a few years later. Madoff’s wife was stripped of her assets apart from a car and some belongings.

Ponzi, on the other hand, was deported to Italy and was separated from the wife who loved him tremendously and was always by his side. He would move to Brazil and continue writing letters to his wife to demonstrate his love for her, at times asking her to join his money-making ideas. He died in the charity ward of a Rio de Janeiro hospital in 1948.

A lot more personal stories about Madoff and Ponzi, as well as their families, friends, adversaries and victims, are vividly told in the Netflix series and the book. Zuckoff, an author and professor of journalism at Boston University, certainly told a fascinating story of Ponzi in his book.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.