"They personally minded and tended to the intricate scheme they devised on an almost daily basis for a prolonged period of 14 months, taking steps to evade detection by the authorities. They did so for financial gains. By the crash, immense harm was caused.” — Singapore High Court Justice Hoo Sheau Peng in her oral judgement against John Soh and Quah Su-Ling.

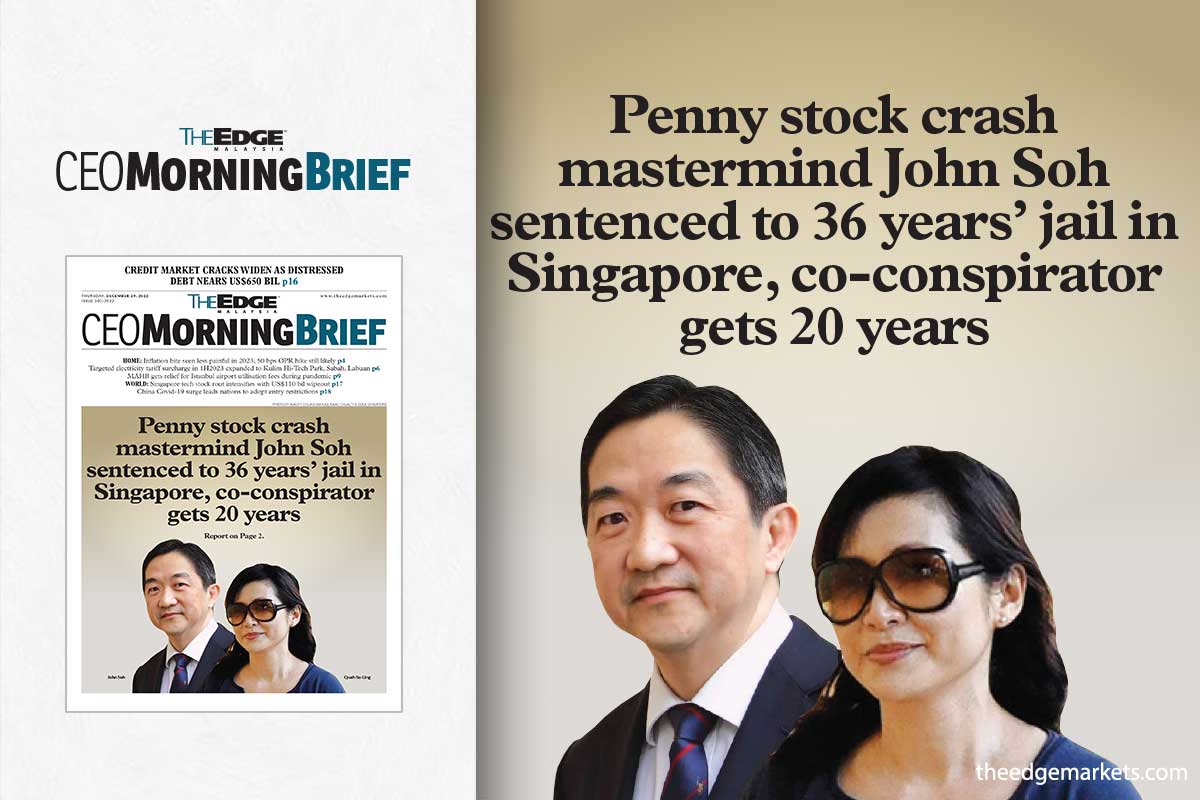

SINGAPORE (Dec 28): John Soh Chee Wen, who has been found guilty of masterminding the 2013 penny stock crash, has been sentenced to 36 years in jail while his co-conspirator Quah Su-Ling is given 20 years.

Both Soh and Quah are appealing against their sentences.

The prosecution had previously sought 40 years' jail for Soh and 19-and-a-half years inprisonment for Quah.

In issuing the sentences, judge Hoo Sheau Peng adjusted Soh’s sentence downwards to ensure that the sentence is not “crushing” for the 62-year-old. The 36 years’ imprisonment includes his time of remand since Nov 25, 2016.

Meanwhile, Quah’s sentencing is two-thirds of Soh, given that she is less culpable and less involved in the scheme. Quah was the former CEO of IPCO International, renamed Renaissance United in 2018.

In her oral judgement, Hoo highlights the necessity of the substantial sentencing to capture the gravity of the duo’s wrongdoing. She emphasises that Soh and Quah have perpetrated a scheme of substantial scale, complexity and sophistication, “boldly” exploiting the system armed with a good understanding of the securities and financial markets, as well as tapping on their extensive connections and networks.

“They personally minded and tended to the intricate scheme they devised on an almost daily basis for a prolonged period of 14 months, taking steps to evade detection by the authorities. They did so for financial gains. By the crash, immense harm was caused.”

Legal action threat

Soh and Quah were on May 5 found guilty of a whole litany of the charges they were facing under three groups of criminal conspiracy including for forced trading, price manipulation and deception.

Soh was convicted of 180 of the 188 charges he faced while Quah was found guilty for 169 of the 178 charges she faced. Both were convicted of share manipulation and cheating charges but were each acquitted of eight charges of deception.

The two “long-term partners in both business and personal affairs” had been on trial since March 2019 for orchestrating the manipulation of three penny stocks, Blumont Group, Asiasons Capital and LionGold Corp — collectively known as BAL — between 2012 and 2013. The stocks crashed in October 2013 and destroyed some S$8 billion (RM26.2 billion) in market value.

Now under new shareholders and management, Blumont has been renamed Southern Archipelago, Asiasons was first named Attilan Group before it was delisted while LionGold has been renamed Shen Yao Holdings.

The episode has been described as Singapore’s largest-ever case of share manipulation and involved 189 securities trading accounts held with 20 financial institutions and 60 individuals and companies.

Investigations into the case started in 2014. Some 140 individuals were hauled up for questioning before investigators narrowed their focus to Soh and Quah.

The Edge Singapore first reported in September 2014 — a year after the crash — that Soh might have been involved.

The duo were formally charged on Nov 25, 2016 and Soh has been held in remand since. Quah, meanwhile, is out on bail for S$4 million.

On Sept 1, 2014, The Edge Singapore published the article “Hunting for the truth”, which marked the first anniversary of the crash. Following this, the companies and individuals mentioned in the article had threatened legal action — with Blumont and LionGold subsequently filing defamation suits against The Edge Singapore and then editor Ben Paul — although neither suit went to court.

Another company that threatened The Edge Singapore with legal action after the story was published is ISR Capital (renamed to Reenova Investment Holding), which claimed that the article made false statements about Soh’s association with the company.

During a court hearing on Dec 20, 2016, prosecutors said the authorities had found links between ISR and Soh while investigating the sudden fall in ISR’s share price after Soh was arrested.

Crushing sentence

On Nov 4, Soh’s defence counsel N Sreenivasan of K&L Gates Straits Law argued against deputy public prosecutors' (DPP) push for a 40-year jail term which he described as a “crushing sentence” for Soh given his age.

Sreenivasan drew comparisons to 1985’s Pan-Electric crash, which resulted in the temporary closure of the Singapore and Kuala Lumpur stock exchanges. Tan Koon Swan, who played a significant role in the demise of the company, was sentenced to two years’ imprisonment and a fine of S$500,000 for one criminal breach of trust.

He also drew comparison to the collapse of Barings — in 1995, rogue trader Nick Leeson, who was the bank’s head of derivatives in Singapore, lost billions of the bank’s money via unhedged, unauthorised speculative trades. Leeson was sentenced to six and a half years in jail after pleading guilty to two counts of “deceiving the bank’s auditors and cheating the Singapore Exchange (SGX)”.

DPP Nicholas Tan, however, argued that the penny stock saga is “no Pan-Electric”, as the loss in market capitalisation of the crash is equivalent to 33 Pan-Electric, which had a market capitalisation of about S$230 million. He further pointed out that two of the largest companies listed on the SGX — ComfortDelGro and Sembcorp Industries, have market capitalisations of S$2.8 billion and S$5.5 billion respectively.

“Indeed, this is no Pan-Electric. This case is far, far worse,” said Tan.

The sentencing of Soh and Quah draws the court case closer to closure — having spanned over 200 days of trial in nearly four years.

Originally, another co-conspirator — Goh Hin Calm, the “treasurer” for Soh and Quah was charged together with the duo in 2016. However, Goh chose to plead guilty and has testified against them.

Goh, who was interim CEO of IPCO International, pleaded guilty to two charges pertaining to his involvement in the scheme.

He managed payments for the numerous trading accounts controlled by the duo and kept track of the shareholding schedules of those accounts.

Goh also gave Quah and Soh control of trading accounts held in his and his wife’s name, which were then used to manipulate the shares.

Other key witnesses included Soh’s old colleague Dick Gwee Yow Pin as well as brokers Ken Tai Chee Ming, Leroy Lau Chee Heong, Gabriel Gan Tze Wee and Henry Tjoa Sang Hi. The brokers claimed to have received instructions on trades to be made from either Soh or Quah.

Gan and Lau were, at different points in time, brokers with DMG Securities, while Tai was running Algo Capital at the time when the alleged offences took place. Tjoa, meanwhile, was a remisier with Phillip Securities.

To receive CEO Morning Brief please click here.

Read also:

2013 penny stock saga mastermind John Soh and co-conspirator Quah Su-Ling await sentencing

Singapore court finds John Soh and partner guilty of share price manipulation

Penny stock saga alleged mastermind Soh maintains he did not give instructions, was 'sounding board'

There is a difference between confirming and reporting instructions, says Soh

What happened at Asiasons, Blumont and LionGold?

Stiff sentences on manipulators show Singapore's resolve in safeguarding its capital markets