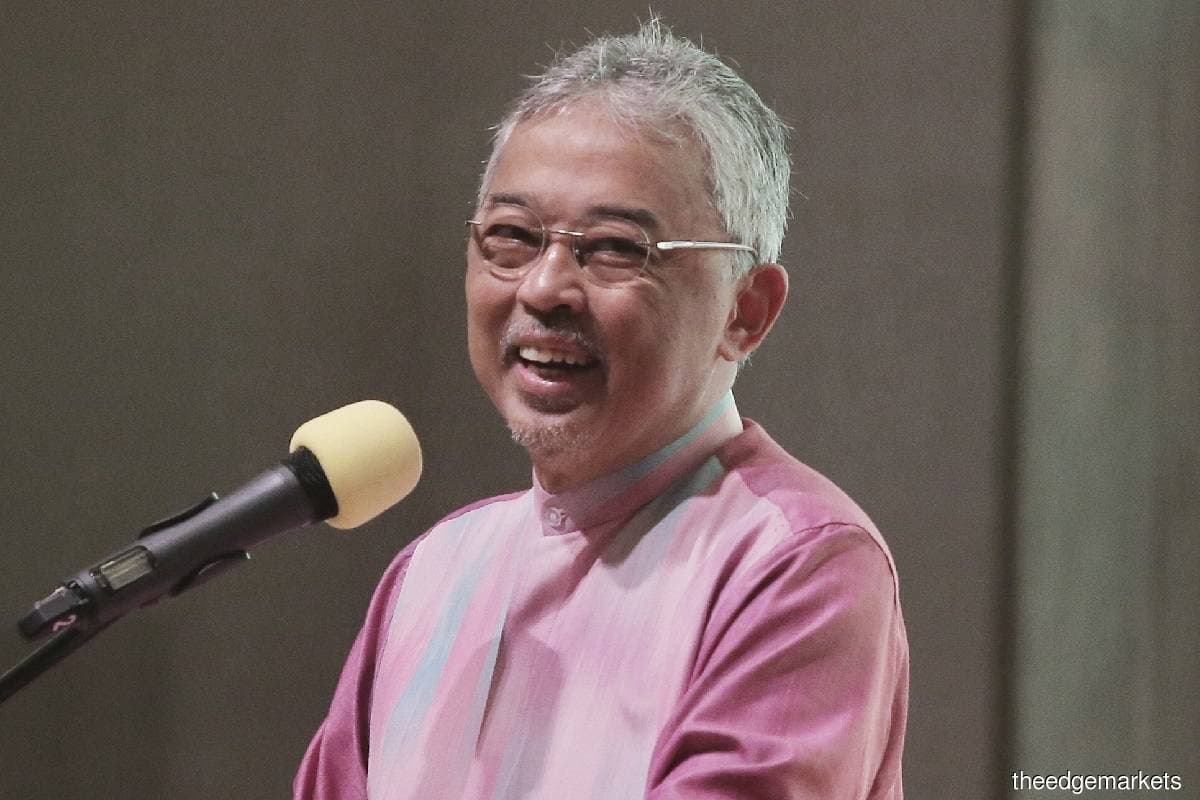

KUALA LUMPUR (Dec 22): Yang di-Pertuan Agong Al-Sultan Abdullah Ri'ayatuddin Al-Mustafa Billah Shah has emerged as a substantial shareholder of technology group Microlink Solutions Bhd with a 10.76% indirect equity interest, according to Microlink in a filing with Bursa Malaysia.

This is by virtue of his shareholding in Gading Sari Ventures Sdn Bhd (GSV), which has acquired 115 million shares in the customised turnkey software and system solutions provider from Omesti Bhd for RM63.25 million, or an average of 55 sen apiece.

After the transaction, Omesti remains Microlink's largest shareholder with 390.59 million shares or 36.55% equity interest, followed by GSV (10.76%) and RHB Trustees Bhd (5.71%).

In a separate filing, Omesti said the consideration was agreed on a willing buyer-willing seller basis.

Shares in Microlink closed one sen or 1.06% higher at 95.5 sen on Thursday (Dec 22), giving the group a market capitalisation of RM1.02 billion. Year to date, the counter has risen by 54.03%.

For the first nine months of 2022, Microlink traded between 54 sen and 64.5 sen. Subsequently, the counter saw an 80.65% jump from 62 sen on Oct 3 to a record high of RM1.12 on Dec 6.

GSV is a wholly-owned subsidiary of Gading Sari Holdings Sdn Bhd and is principally engaged in agricultural activities for crop production on a fee or contract basis, as well as the wholesale of agricultural raw materials and live animals.

According to Omesti, the King's son Tengku Amir Nasser Ibni Tengku Ibrahim is one of GSV's directors.

For the second quarter ended Sept 30, 2022 (2QFY2022), Microlink’s net profit remained largely flat recording a 3.1% increase to RM7.34 million from RM7.12 million a year earlier, as revenue declined 11.09% to RM56.01 million compared with RM62.99 million.

The group attributed the decline in revenue to lower order fulfilments and progress billings, particularly in its distribution segment, which logged a 21.69% decrease in revenue contribution to RM34.32 million from RM43.82 million.

Microlink’s financial services segment and solution delivery segment also pencilled in declines in revenue contributions of 24.02% — to RM11.85 million from RM15.6 million — and 63.64% — to RM104,000 from RM286,000 — respectively.

Meanwhile, its enterprise solutions segment achieved an 80.54% increase in revenue contribution to RM12.51 million compared with RM6.93 million.

Microlink is involved in the provision of business and technical services for financial institutions, emerging technologies for enterprises, distribution and maintenance of computer equipment and software, and project and software solutions delivery services.