SINGAPORE (Nov 22): Prosecutors say former BSI wealth planner Yeo Jiawei accumulated a net worth of some S$23.9 million in just 15 months through “secret profits” after he left the bank in June 2014.

Yeo, who turned 34 on Monday, is on trial for four counts of witness tampering. He faces seven other counts of money laundering, which will be heard next April.

In court on Tuesday, Yeo revealed that his net worth was around S$2 million when he left the now-defunct BSI bank in Singapore. This was from his basic salary and bonuses earned while he was an employee there.

When the Commercial Affairs Department raided Yeo’s house in Oct 2015, the investigators seized Yeo’s iPad containing a document titled “Wealth Statement”.

In this document, Yeo had a list of his assets, including three properties in Singapore and two in Australia, as well as cash held in various currencies at several banks such as HSBC and OCBC. The total value of assets listed amounted to S$25,988,735.

This meant that in just 15 months after leaving BSI bank, Yeo had accumulated some S$23.9 million.

Court exhibit

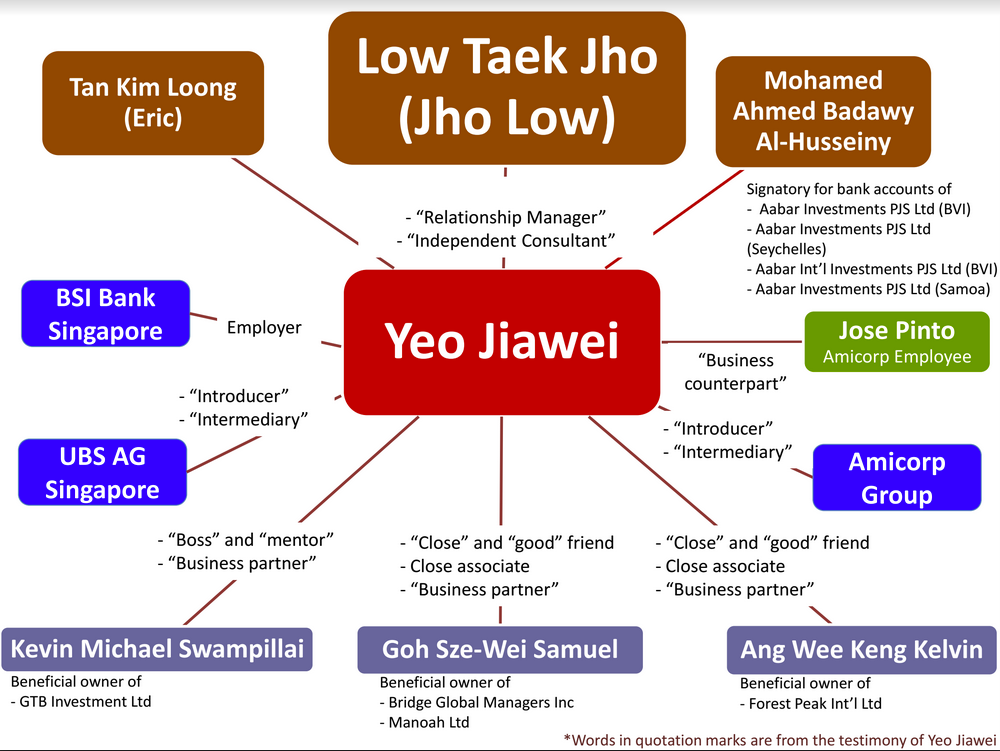

In his cross examination on Tuesday, Deputy Public Prosecutor Tan Kiat Pheng said it was “quite unbelievable” that Yeo could amass so much by acting as a mere “introducer, intermediary, independent consultant or relationship manager”.

Yeo had earlier used these terms to describe himself, disagreeing with the prosecution’s portrayal of him as someone at the centre of the web and close to 1MDB mastermind Low Taek Jho.

“Mr Yeo, I am putting it to you that your wealth of about S$25.9 million includes funds that you earned through illicit means, including taking secret profits, during and after your BSI days. Do you agree or disagree?” added Tan.

“Your Honour, I totally disagree,” said Yeo. “At that time, the client is a sovereign wealth fund, one of the biggest sovereign wealth funds in the world.”

While he did not mention his clients by name, the court had heard earlier in the trial that Yeo’s clients included 1Malaysia Development Bhd (1MDB) and Abu Dhabi-owned International Petroleum Investment Company (IPIC) subsidiary Aabar Investments PJS.

DDP Tan pointed out that Yak Yew Chee, Yeo’s senior colleague at BSI and the private banker for 1MDB mastermind Low Taek Jho, only earned S$27 million over four years.

Yeo claimed that this was because he was an independent consultant and could negotiate his fees directly, while Yak only earned his commission through BSI.

He also maintained that there was nothing wrong with earning fees from introducing his own clients, such as Aabar and Low, to service providers such as Amicorp.

"In my mind, there's nothing illicit. There’s nothing to hide,” said Yeo.

Yeo pointed out that this was actually a common way in which BSI, his former employer, generated its revenue. He estimates that half of BSI’s revenue of between US$100 million to US$200 million came from such intermediary fees. He didn’t specify which financial period he was referring to.

The subject of Yeo’s salary and net worth came about because earlier in the trial, Yeo was said to have been paid S$500,000 a year by Low. This was according to Yeo's former supervisor at BSI, Kevin Swampillai, who was testifying against Yeo.

Yeo maintained that he had never worked for Low, also known as Jho Low. He added that he had also never taken a single cent from Low.

To debunk Swampillai's claim, Yeo voluntarily put forward his 2015 notice of income tax assessment, which indicated he earned S$441,000 in 2014.

In addition, he produced an offer of employment from rival wealth manager UBS for S$490,000.

Yeo said this had probably led to Swampillai having the false impression that Yeo was joining Low for S$500,000.

Yeo said he would not have joined Low, reportedly a billionaire, for just S$50,000 more.

DPP Tan pointed out that since Yeo had left BSI in June 2014, that S$441,000 was based on just half a year of work, up from S$379,000 for the preceding year.

However, under re-examination by Yeo’s lawyer Philip Fong, Yeo then added that his income for 2014 included “very significant” bonuses earned for 2013 that were only paid in March 2014.

Yeo also maintained that it was inaccurate for the prosecution to portray him as someone at the centre of a web of cross-border money-shuffling, which involved numerous entities and individuals.

For example, BSI and Amicorp helped manage transactions of Aabar Investments PJS Ltd, a British Virgin Island-incorporated entity headed by Mohamed Badawy Al-Husseiny.

Husseiny was also CEO of the real Abu Dhabi-based IPIC subsidiary which uncannily bore the same name – Aabar Investments PJS.

Yeo argued that, as an intermediary, he should not be fingered as the one sole responsible. After all, Yeo reasoned, the financial institutions, with their teams of legal and compliance people, did not step in to stop the transactions.

“I feel that is an unfair representation,” said Yeo, referring to the chart produced by prosecution showing Yeo at the centre, with links to other individuals such as Low and Low’s close associate, Eric Tan Kim Loong.

Yeo maintained that it was only when news surrounding 1MDB became widely known that various prosecution witnesses such as Swampillai and Samuel Goh Sze-Wei turned against him.

Yeo also questioned why Jose Renalto Cavarlho Pinto, a relationship manager with Amicorp, would call him “arrogant” when they had good working relationship.

Yeo said that these three individuals were all complicit in one way or another, but are now pushing the blame to him.

“These witnesses are lying to save their own skin,” said Yeo.

After 12 days of trial, the court will announce the verdict on Dec 21.