This article first appeared in The Edge Financial Daily on March 25, 2020

KUALA LUMPUR: The US Federal Reserve (Fed) on Monday launched an unlimited quantitative easing (QE) programme that would purchase Treasuries and mortgage-backed securities in order to support the financial market without limit.

With more confirmed Covid-19 cases in the US each day raising concerns on the country’s economic health.

Considering the Covid-19 outbreak would deal a big blow to the American economy, the Fed’s QE programme is expected to last for a few quarters.

The ringgit slid to three-year low at 4.44-level versus the US dollar. Having seen the nerve-wrecking downtrend of the ringgit against the US dollar in the past two weeks, how would the Fed’s massive money-printing activity affect our local currency performance? Does Malaysian’s buying power get better or worse?

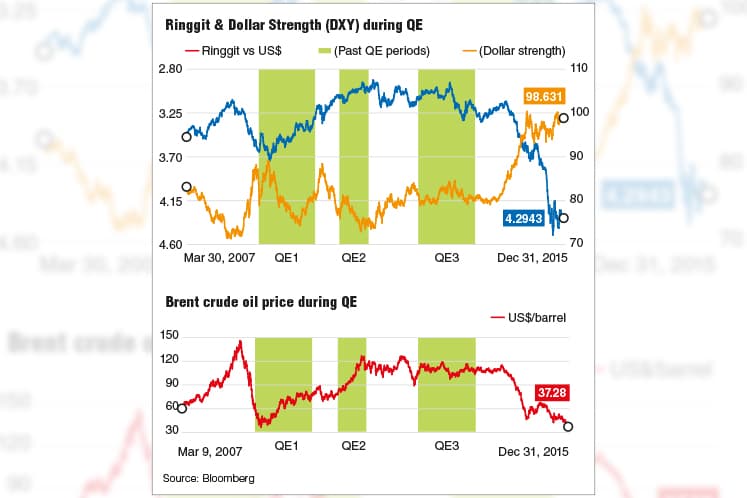

The Edge Financial Daily had a brief look at the historical performance of the ringgit throughout the Fed’s past three QE launching period.

How did ringgit fare during QE1

Two months after the height of the global financial crisis, which saw the collapse of Lehman Brothers, the Fed’s Federal Open Market Committee (FOMC) announced on Nov 25, 2008, that it would purchase up to US$600 billion (RM2.65 trilion) in agency mortgage-backed securities (MBS) and agency debt, marking the beginning of QE in the world’s largest economy that was facing severe liquidity crunch. The first massive QE lasted until March 2010 — for a total period of 16 months.

During this period, the US Dollar Index (DXY) which measures the strength of the US dollar against a basket of currency, weakened 6.52% from 86.72 to 81.07. Meanwhile, Brent crude oil had staged a strong rally, which surged from US$47.97 per barrel by a whopping 72.40%, to US$82.70 per barrel.

Relatively, the ringgit had strengthened from 3.6289 to 3.2638 against the greenback, rising in a magnitude of 10.06%.

The unemployment rate in the US at that time was almost doubled from 5% to 9.5%, while the US annual gross domestic product (GDP) contracted 0.4% in 2008 compared with 1% growth in 2007.

Ringgit performance in next two QE

For the eight-month period, between November 2010 and June 2011, the Fed announced that it would further purchase US$600 billion of longer dated treasuries, at a rate of US$75 billion per month. That programme was popularly known as “QE2”.

Throughout the period, the DXY had fallen 3.87% from 77.29 to 74.30. Concurrently, Brent crude price had gone up from US$84.62 per barrel to reach US$112.48 per barrel — surged a total 32.92%. Meanwhile, ringgit escalated 2.43% against the dollar, rising from 3.0950 to 3.0198.

At that time, US unemployment stayed high at the range of 9% to 9.5%.

Subsequently, the FOMC launched the third round of QE on Sept 13, 2012, which provided for an open-ended commitment to purchase US$40 billion agency mortgage-backed securities and added US$45 billion worth of longer-term Treasury securities per month.

The stimulus programme which lasted for 16 months, officially ended on Dec 18, 2013. Within the period, the DXY had weakened 1.44% from 81.21 to 80.03. However, the ringgit had lost some strength from 3.1125 dipped to 3.2757 against the US dollar — representing a drop of 5.24%.

At the same period, Brent crude price had dropped 4.3% from US$115.78 per barrel to reach US$110.80 barrel. This explained the ringgit’s weakness.

Meanwhile, things were looking up again in the US. The country’s labour market improved, where its jobless rate dropped from 8% to 6.9% and eventually normalised back to below 6% in subsequent months.

There came the concern of an overheating economy with ample supply of cheap money. The FOMC then decided to cut back on the QE programme in December 2013 and officially ended the programme 10 months later.

In conclusion, the Fed’s aggressive monetary stimulus programme did directly affect the US dollar’s performance. However, the ringgit was more directly dictated by the crude oil price performances given Malaysia is an oil producing nation.