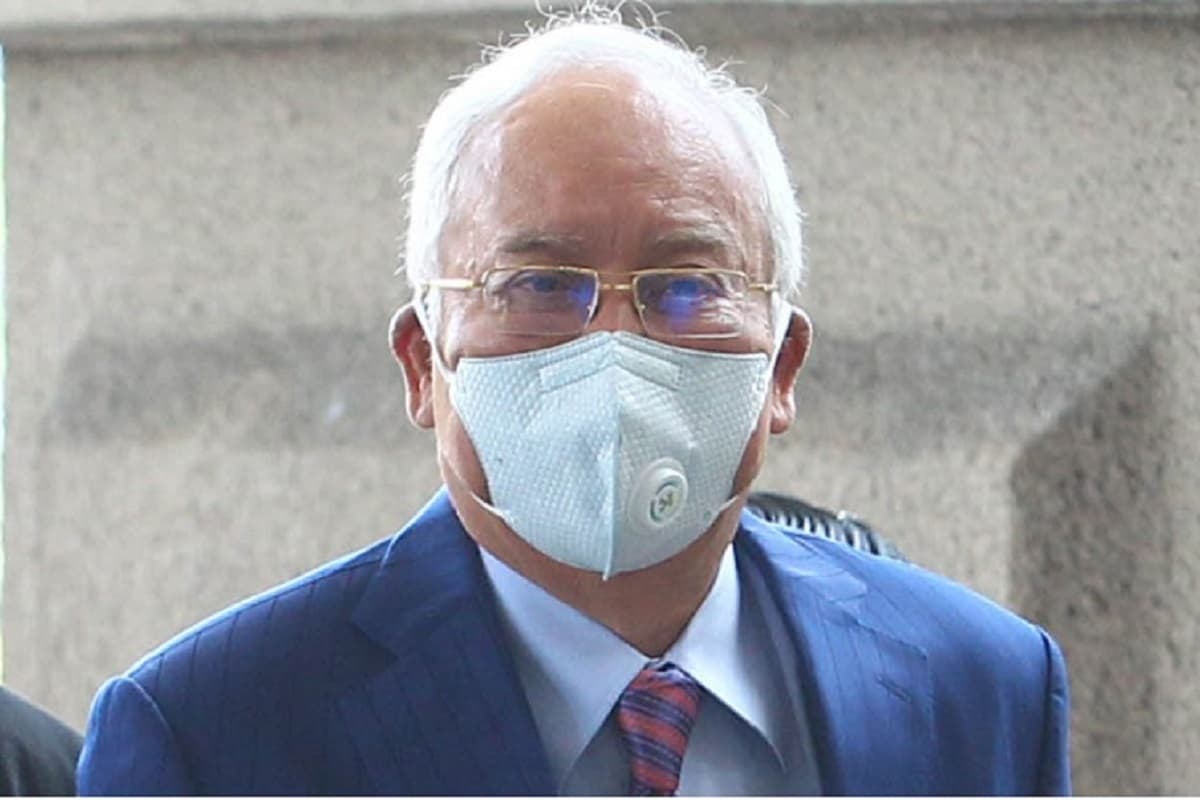

This article highlights Justice Mohd Nazlan Mohd Ghazali’s key rulings — as well as their legal significance — in the case of Pendakwa Raya v Dato’ Sri Mohd Najib bin Hj Abd Razak [2020] MLJU 1254. The full judgment, as delivered by Justice Nazlan on July 28, 2020, is 536 pages long and contains 3,057 paragraphs.

The decision is noteworthy as it held the holder of Malaysia’s highest office guilty of all charges. The decision dealt with laws relating to anti-corruption, criminal breach of trust, corporate fiduciaries, anti-money laundering as well as evidential burdens relating to these complex fields.

Seven criminal charges were made against the former prime minister — three charges concerned the offence of criminal breach of trust (CBT) under Section 409 of the Penal Code, three were under Section 4(1) of the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) and, the last, of abuse of position for gratification under Section 23 of the Malaysian Anti-Corruption Commission Act 2009 (MACC Act).

The setting up of SRC International Sdn Bhd (SRC) under the Companies Act 1965 and the manner in which funding of the same came from the Retirement Fund (Incorporated) or Kumpulan Wang Persaraan (Diperbadankan) (KWAP) and was backed by government guarantees and how the funds from the same were deposited in the personal banking accounts of Najib Razak formed the factual matrix upon which the judicial decision was pronounced.

The two key ingredients of any criminal charges that are required to convict an accused are the proof of act and evidence of intention. For the prosecution to succeed, the burden of proof is beyond reasonable doubt. For the defence to succeed, the involvement of the accused in the alleged misconduct has to be rebutted.

After sifting through thousands of documents and evaluating witnesses’ testimony, the learned judge noted poignantly, “There is little merit in this Court pontificating or lamenting on why the accused had did what he did despite (or because) of his standing at the apex of vast wealth of power and unparalleled authority. The accused is a person with a keen sense of intellect and must surely have a firm sense of right and wrong. I need only, in concluding, emphasise three points. First, the accused has been convicted of seven serious criminal charges which he had committed when he was the Prime Minister of the country, thus betraying the public trust of this august office. Secondly, he must in consequence be punished in accordance with the law. Thirdly, it falls upon me to fulfil my judicial oath to preserve, protect and defend the Constitution in sentencing the accused by ensuring that the provision of Article 8 of the Constitution that all persons are equal before the law is upheld.”

The Court held the accused guilty of all seven charges and sentenced him to:

- 12 years of imprisonment and a fine of RM210 million (in default, five years’ jail) for the single charge under Section 23 of MACC Act for abuse of position for gratification; and

- 10 years of imprisonment for each of the three charges under CBT; and

- 10 years of imprisonment for each of the three money-laundering charges under Section 4 of AMLA.

The custodial sentences, given their intimate connection with each other, shall run concurrently.

The court permitted a stay of execution on recognised principles, given the presence of special circumstances, there being novel points of law that may have yet received judicial consideration.

The judgment will be examined under the following headings.

Company law

The Court held that by SRC’s constitution and by his conduct, the accused is a shadow director of SRC.

Citing specific clauses from SRC’s articles of association together with the fact that Minister of Finance (Incorporated) (MOF Inc) is the sole shareholder of SRC, it was held that the decisions of SRC were the decisions of the accused.

The accused was held to be a director under Section 4 of the Companies Act and Section 409A of the Penal Code. He was also a fiduciary and trustee of the assets, so he had to act in the best interest of the company.

The judge adopted the approach of a UK Court of Appeal decision so as to determine the establishment of who is a shadow director (Secretary of State for Trade & Industry v Deverell). The Court approaches this in an objective evaluation of whether any particular communication or instruction is a direction or advice that is followed by the de jure directors. The Deverell case established that it is not a necessary requirement that a shadow director must “lurk in the shadows”.

Justice Nazlan referred to (a) Article 67, which conferred upon the accused the power to appoint and remove members of the SRC board and (b) Article 117, which was a newly amended article introduced by MOF Inc, as sole shareholder, that provides for a post of advisor emeritus, who is also the accused/prime minister with powers that compelled all major investment and strategic decisions of SRC to be referred to the advisor emeritus for approval. At the time of writing, in a SSM search of SRC, its Memorandum and Articles of Association (M&A) did not disclose Article 117. (Note: It has been pointed out that my search did not disclose Article 117 of SRC‘s AA as the search revealed only the original AA of 2011. As a result of SRC‘s resolution dated May 15, 2012, Form 11 is available in SSM's records. If my search had been done on Form 11, in SSM's records, the amendment for the appointment of advisor emeritus would have been available.)

Whether the accused, as prime minister, was an officer of a public body under the MACC Act

This element is necessary to a finding of guilt for a charge of use of position for gratification.

The Court ruled that the accused is an officer of a public body, which includes being a member of the administration, a member of Parliament and a person who receives any remuneration from public funds.

The issue of interest: Implications for public governance

Section 23(2) of the MACC Act provides that for an offence of use of office for gratification, there is a presumption, “until the contrary is proved …” that when an accused person “makes any decision, or takes any action … has an interest, whether directly or indirectly”.

One of the important rulings is in regards to (a) whether by virtue of the accused having multiple roles as prime minister and minister of finance, that the holder of such offices is placed in a position of conflict and (b) whether it is legally necessary for such a holder of multiple offices to recuse himself in any deliberations and decisions relating to transactions being tabled.

Justice Nazlan noted that the minutes showed the participation of the accused in two Cabinet meetings (which were confirmed by subsequent meetings with no amendments) that approved the guarantees for financing by KWAP to SRC for a total of RM4 billion.

Justice Nazlan held that “the law is that even if an accused has declared his interest in a matter under consideration at a meeting, his failure to withdraw from and leave the meeting would still amount to him having used his position for gratification”.

Interestingly, Justice Nazlan also referred to the Code of Ethics for Members of the Administration (D559 and D559-A), which states the importance of recording the withdrawal and non-involvement for deliberation of the matter where there is a conflict between public position and private interest. The judge also noted that there was testimony to the effect that this ethical practice had been adhered to in other instances previously.

The learned judge also evaluated the antecedent and subsequent conduct of the accused as relevant facts demonstrating his “interest” in SRC (as per Section 8 of the Evidence Act 1950).

The judge then proceeded to list down relevant evidence leading to the setting up of financing, arrangement of guarantee and ownership structure. Evidence was given by the Economic Planning Unit and KWAP’s management that led to the movement of funding for SRC.

When former CEO of KWAP, Datuk Azlan Mohd Noh, was cross-examined that he was not compelled or obliged to follow a notation of the accused on an SRC request, the judge observed from the CEO’s testimony that, “the notation in the letter addressed to me came from the Finance Minister, the Prime Minister, the Minister in charge of KWAP. He is my ultimate boss”.

The judge also embarked on the examination of KWAP’s internal approval processes and gave weight to evidence of KWAP chairman Tan Sri Dr Wan Abdul Aziz, who also holds the position of Secretary General of the MOF. The Court noted that the accused had, during side meetings at the Prime Minister’s office, told Tan Sri Dr Wan to expedite KWAP’s loan process. The judge held that from the KWAP chair’s testimony that if there had not been communication from the prime minister to him on the loan application, the investment panel of KWAP would have maintained its provisional approval of RM1 billion only.

At the KWAP’s investment panel meeting, a financing of RM2 billion was given to 1Malaysia Development Bhd (1MDB) and not SRC but SRC disagreed and the CEO, Nik Faisal Ariff Kamil, wrote to the chairman of KWAP for direct financing. So, the investment panel’s decision was varied by way of a circular resolution.

Justice Nazlan’s ruling on the scope of the Retirement Fund Act 2007 is important in that the law vests the approving authority for financing by KWAP wholly on the investment panel and the role of MOF is “only on general and policy matters”.

The learned judge was persuaded that the accused’s actions and decisions were outside that of his official position despite it being an atypical species of “interest”. The learned judge’s finding was that “the foundation and mainstay of the nature of the interest of the accused in SRC is the feature of control”. The accused was held to have “… an overarching authority and power ... this control was rooted in the various seemingly lawful capacities in the governance and ownership of the company exercisable by the accused. The accused had a secret design and private interest in a company he controlled as demonstrated in the course and series of his conduct and action concerning the establishment, financing, guarantee and ownership of SRC, which were outside the remit of exercise of official and public responsibilities.” The judge also observed from testimonies of public officers that the interactions with such officers were “pervasive and imperious”, both directly and indirectly.

The learned judge rejected the defence’s contentions that the accused was merely expressing a request and agreement and in no way instructed or issued a directive.

Gratification

The court noted that the charge specifies that the accused’s use of position was for gratification of RM42 million, which was transferred into two personal AmBank accounts as evidenced by the money trail. Despite the defence’s case that the approval of government guarantees were in 2011/2012 and the monies were deposited in the personal bank accounts only in 2014/2015, the court rejected that the transactions were not related. The learned judge ruled that “… a series of acts that are separated by intervals of time may nevertheless be construed to form one transaction if they are connected with a single intent for the furtherance of a continuous plot”. The defence tried to establish that there was no nexus between the acts. However, the judge ruled that the accused had overwhelming knowledge of and involvement in the financing by KWAP and the necessity of government guarantees. The learned judge concluded that “having conducted a maximum evaluation of all credible evidence made available before this Court, I find the elements of the offence of using position for gratification under Section 23(1) of MACC Act have all been proved by prosecution”.

Criminal breach of trust under Section 406 of the Penal Code

1. Being an agent under the Penal Code

One fascinating part of the decision is whether an accused can be convicted for being an agent when there is an absence of a principal-agent relationship. Justice Nazlan, relying on Section 402A of the Penal Code, confirms that earlier decisions suggesting that only professional agents (for example, brokers) are agents are no longer good law. The Hansard dated Aug 4, 1993, which introduced Section 402A, was referred to in assisting the court to rule that the amendment was “to overcome the technical interpretive difficulties” to the determining of the true application of the law on the crime of CBT under Section 402 of Penal Code. This means that a director is an agent for the purpose of CBT within the reach of the Penal Code.

A substantive argument of the defence was that the accused in his capacity as prime minister and minister of finance in relation to SRC was not personal to himself as these were qua functionary of the government vis-à-vis an MOF Inc entity. The court rejected this argument and distinguished a Supreme Court of India decision, which acquitted the Chief Minister of Tamil Nadu as being not entrusted with or have dominion over the property of Tamil Nadu Small Industries Corp Ltd (TANSI). Justice Nazlan held that unlike the Chief Minister of Tamil Nadu, the accused was directly conferred with the authority as the prime minister and advisor emeritus in addition to being the shareholder of SRC as MOF Inc. The learned judge held that as the accused is construed on evidence to be a shadow director as defined under the Companies Act and Penal Code, he is held to be entrusted within the CBT offence.

The learned judge also rejected the defence’s contention and accepted the testimony of Datuk Mat Noor Nawi, the then Deputy Secretary General of Treasury with oversight of MOF Inc or Bahagian MKD (BMKD) that the accused’s notation on the SRC letter was not a referral for review to another minister but instead, a “top down decision-making process”.

There was also an interesting defence that was rejected by the court — that the accused had no entrustment of SRC’s properties because of a deficiency of reporting mechanism from SRC to BMKD in MOF in accordance to MKD guidelines.

The learned judge held that such “deficiencies” were attributable to the actions of the CEO, Nik Faisal, who could brush aside procedures simply by representing that SRC had the support of the accused. The court accepted the narrative of the prosecution that the MOF personnel had “difficulty getting cooperation from SRC”. The court noted that Nik Faisal and SRC were not compliant and failed to cooperate even in submitting SRC’s financial statements to BMKD. The judge tersely observed, “not only was effective monitoring lacking if at all existed, due to such blatant lack of cooperation (never mind respect) attempts by BMKD to rein in SRC were similarly unsuccessful, if not altogether impeded”.

2. The failure of SRC’s board

The Court held that, on the evidence, the board’s reliance on Nik Faisal as a bridge between the board and the accused when queries were raised and that they were met with Nik Faisal’s response that the matter had been discussed and agreed to by the government (kerajaan) — again, it is understood by the board that “kerajaan” meant the accused.

3. The money trail

The court noted that the RM42 million was channelled into the accused’s personal bank accounts through two corporate entities, Gandingan Mentari Sdn Bhd (GMSB) and Ihsan Perdana Sdn Bhd (IPSB). This was effected to avoid detection.

The defence attempted to demonstrate that the monies were channelled to IPSB for CSR purposes.

The defence’s argument was that the accused had no personal knowledge of the operation of the two personal bank accounts and had entrusted the same to his principal private secretary, the late Datuk Azlin Alias, and also Nik Faizal. The judge also assessed in detail the flow of funds through Affin Bank and Maybank, and the redepositing of the same back to the AmBank accounts and sums of RM449,586.95 be credited to the accused’s personal Visa Platinum credit card and RM2,833,147.21 to the accused’s Mastercard Platinum card. Banking records also showed that overdrawn accounts of the accused were credited from fund flows deriving from the RM42 million from SRC.

The prosecution also tendered 15 cheques amounting to RM10,776,514.00 issued from the accused’s accounts and signed by himself. The cheques’ beneficiaries included bloggers, orphanages, news analysts of Chinese media, including promotion of Facebook persona “Ah Jib Gor”, renovation works at his personal residence in Kuala Lumpur and Pekan, Pahang, and funding of United Progressive Kinabalu Organisation (Upko) and Umno. There was also a cheque of RM3.5 million issued to a law firm, Hafarizam, Wan & Aishah Mubarak; the judge noted that the recipient had not been called to testify as to its purpose.

The learned judge rejected the defence’s submission that “funds for CSR and political donations are legitimate” as “patently misconceived” and although “some could be generously construed as charitable and intended to assist the social and economic wellbeing of the less fortunate of the society, they at the same time promoted the personal interest and political standing of the accused … evidence reveals that the same was in fact utilised for the personal benefit of the accused”.

4. The accused’s knowledge of how his AmBank accounts were being operated

One of the key arguments of the defence was that the accused had no knowledge of how his accounts were being operated. The court evaluated the BlackBerry Messenger text messages between Jho Low and Joanna Yu, a bank officer of AmBank, and concluded that Jho Low had knowledge of how the accounts were being operated to the extent of issuance of cheques by the accused. The BlackBerry Messenger messages from Joanna were to the judge, “contemporaneous evidence that the accountholder, namely the accused, had tasked Jho Low … in the management of the accounts to ensure that the accused had sufficient funds to pay for his credit card purchases and expenses and to pay for the cheques already issued by him or intended to be issued by him”.

The court made the finding that there was strong and irresistible inference that the accused had had actual knowledge of the status and of countless transactions relevant to the seven charges, which occurred in late 2014 and early 2015.

The AMLA charges

There were three AMLA charges relating to three CBT charges of RM27 million, RM5 million and RM10 million respectively, which aggregates to RM42 million. This overview will not deal with the intricacies of AMLA offences and defences. Suffice to point out that the court held that AMLA charges under Section 4(1) (b) must be predicated on commission of unlawful activity that has been held to have been committed.

Justice Nazlan observed “that it beggars belief and stretches one’s credibility for the accused not to have known … that the deposit of a massive total sum of RM42 million into two of his personal accounts is proceeds of an unlawful activity, especially when he immediately utilised the entire sum”. The court also held that Section 4(2)(b) encapsulates what the law terms as wilful blindness. The Court found that the accused had knowledge and also failed without reasonable excuse to ascertain that the RM42 million was not proceeds from unlawful activity.

The defence’s case was then examined scrupulously through 2,926 paragraphs of careful evaluation.

The Arab donation story

One major defence was that the monies found in the accused’s personal accounts were gifts from King Abdullah, the Saudi monarch.

The court had to assess differing accounts of the meeting in January 2010 between the accused and the king and whether there was a promise made in a private meeting on Jan 11, 2010, by the king to transfer a monetary sum to the accused’s personal account.

One of the critical components leading to the learned judge’s dismissal of the Arab donation claim as a fabrication was the court’s finding that the then Minister in the Prime Minister’s Office in Charge of Islamic Affairs, Datuk Jamil Khir’s (JK) testimony that he was present in Riyadh on Jan 11, 2010, was false. The court accepted that a February 2010 digital edition of a JAKIM publication mentioning that JK had given a speech at an event in Malaysia, complete with photographs showing his presence at the event, was admissible under Section 90A of the Evidence Act 1950. The learned judge also took into consideration the contradictory evidence of the accused on the meetings and also that of the Minister of Foreign Affairs. The court also assessed certain letters as evidencing the king’s gift and communication of the accused’s gratitude as being unreliable.

The court concluded that the Arab donation from the late Saudi King was “at best an elaborate but weak fabrication. It is very difficult not to characterise the entire narrative … As a poorly orchestrated self-serving evidence … the Arab donation monies simply cannot hold water”.

The court was also asked to accept that MACC officers flew to Riyadh to ascertain the identity of the sender of letters. The court rejected evidence that the signatory of the alleged letters was from the Royal House of Saudi as the signatory never confirmed his identity or showed his passport to the MACC officers. The court ruled that the statement purported to be from a prince was riddled with infirmities, rendering it inadmissible in law.

The court further examined the timing of funds’ arrival in the accused accounts to cover existing shortfalls and intended issuance of cheques. The learned judge held that it belies logic and common sense that the king timed the gift of monies into the personal accounts. It was furthermore noted by the court that an alleged further gift of £50 million arrived after the accused purportedly returned US$620 million to the king. The court rejected the contention that transfers to and remittances from Blackstone Asia Real Estate Partners and Tanore Corporation were gifts from King Abdullah as nominees of Arab royalty.

The defence argued that in the accounts in 2014/2015 and the use of amounts of RM162 million where 98% of funds were utilised towards contributions to political parties, CSR initiatives and charitable or non-governmental organisation (NGO) contributions is not acceptable in law.

Justice Nazlan dismissed this contention as offering a valid defence and characterised that these activities are “nothing particularly notable, let alone noble …”

In passing, the learned judge rejected the suggestion that personal expenses in the purchase of jewellery (the De Grisogono purchase), a watch worth RM466,000 and repairs to personal residence as being less than 3% of the total utilised funds amounting to RM261 million as insignificant, considering the size of Arab donations, as preposterous.

Mitigation and concluding observations

Justice Nazlan exceptionally allowed the accused person to address the court as it is normal for the defence counsel to make the mitigation plea. The Court noted that the accused ended his mitigation by taking the “Islamic Oath”, that he had never demanded the RM42 million, never planned for it and that it was never offered to him. He additionally said he had no knowledge of the RM42 million.

The learned judge poignantly noted that, "the accused did not express any remorse and even maintains his defence of no knowledge. Yet, I cannot deny he was the Prime Minister of the country nor can one question that the accused had made contributions to the well-being and betterment of the peoples of this nation, probably in different ways, for he was, after all, the Prime Minister for nine years. Whether the moral compass of the nation requires some recalibration is deserving of a separate discourse. What the Court seeks to affirm is the sanctity of the rule of law and the supremacy of the Constitution. No one, not even one who was the most powerful political figure and the leader of this country, enjoys a cloak of invincibility from the force of law … The ascension of the accused to the pinnacle of leadership of the nation and his grip of political power reposed on him by the citizens of this country the position of trust in our system of constitutional democracy. His conviction of all seven charges concerning abuse of position, criminal breach of trust and money laundering constitutes nothing less than an absolute betrayal of that trust.

"Political history will continue to debate whether he has done on balance more good than harm but this very process would arguably be inimical to the ideals of a clean administration that does not tolerate corruption and abuse of power.”

With keen interest, concerned citizenry and legal-judicial stakeholders await the appellate process and the judgment of the apex court.

In the meantime, Justice Nazlan’s decision is law. His wide-ranging robust judgment has clarified what is conducive for good public and corporate governance.

Philip Koh Tong Ngee is an advocate and solicitor of the High Court of Malaya