This article first appeared in Capital, The Edge Malaysia Weekly, on December 7 - 13, 2015.

IN the past four years, bottled water producer Spritzer Bhd has not only doubled dividends, but also seen its profit grow at an average of 29.5% a year, from RM8.1 million for the financial year ended May 31, 2011 (FY2011), to RM22.8 million in FY2015. Earnings were helped by higher average selling prices and lower bottling costs.

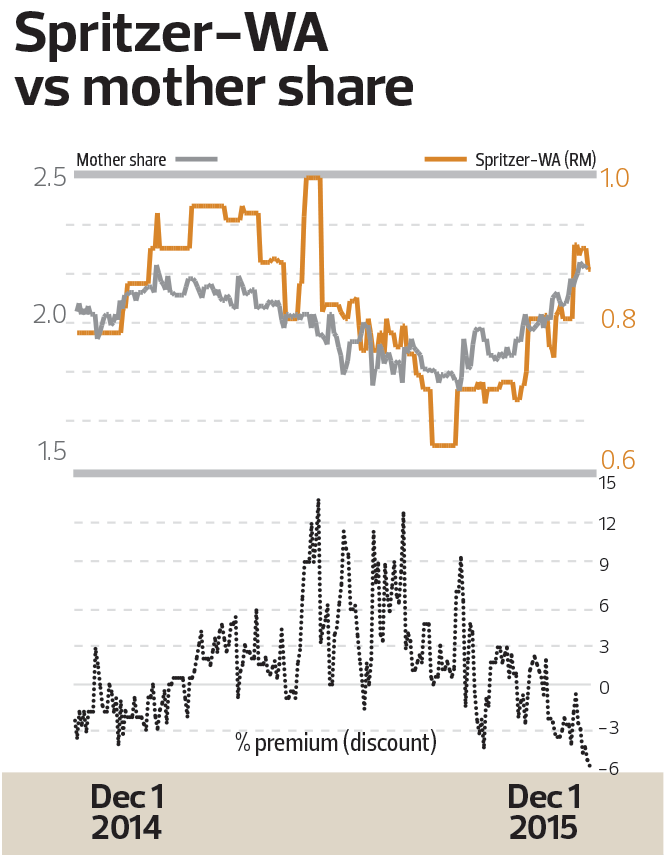

The stock traded last Wednesday without the entitlement to five sen dividend per share, up from 2.5 sen in FY2011 and four sen last year. Spritzer shares reached as high as RM2.14 on Nov 26 — 27.3% higher than their recent low of RM1.681 on Sept 4 — before closing at RM2.10 last Wednesday.

Its warrants, Spritzer-WA, gained 28.6% over the same period. With a RM1.18 strike price and one-to-one conversion ratio, Spritzer-WA, which expires on Dec 13, 2016, continues to offer a slight 2.38% discount to the underlying securities at last Wednesday’s closing prices. An investor who bought Spritzer-WA at the recent low of 62 sen on Aug 17 and converted it into shares before the dividend ex-date would enjoy some 2.78% yield — above the yield for someone who bought shares then.

Whether Spritzer can continue paying generous dividends for years to come could well hinge on how successfully it expands in China, where competition is tough. On Nov 30, Spritzer said newly-incorporated unit Spritzer (Guanzhou) Trading Ltd (SPR GZ), with RMB30.01 million registered capital, had been issued a 30-year licence. SPR GZ principal activities include being a wholesale and retail dealer, importer and exporter of beverages, peanuts, mixed nuts, water dispensers and coffee machines. The Nov 30 announcement did not say how SPR GZ would impact the group, only that it is not expected to materially change earnings and net assets for FY2016.

According to theedgemarkets.com, the likelihood of a corporate exercise for Spritzer (fundamental: 1.40, valuation: 0.80) is high.

As at Nov 3, Mercury Securities had a “hold” call on Spritzer with a RM2.12 target price, which was attained on Nov 20. It reckons that Spritzer’s challenges include the implementation of the minimum wage, higher electricity tariffs and volatile raw material prices. At zero premium, a RM2.12 share price would value Spritzer-WA at 94 sen, implying 8% upside potential from 87 sen at the time of writing.

Those familiar with Spritzer — which operates a 330-acre natural mineral water source site in Taiping, Perak, and produces some 550 million litres of bottled water a year — would know it manufactures and distributes mineral water, sparkling mineral water, distilled drinking water and carbonated fruit-flavoured drinks. Having built a strong brand here, the challenge is to expand overseas.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.