This article first appeared in Capital, The Edge Malaysia Weekly on February 17, 2020 - February 23, 2020

THE global economy has been caught in a perfect storm. Still reeling from the after-effects of the US-China trade war and protectionist measures instituted by major economies, the outbreak of COVID-19, which has now spread to more than 20 countries, has further hit growth prospects, conceivably for the first six months of the year at least.

Last week, Bank Negara Malaysia announced that gross domestic product growth had slipped to 3.6% in the fourth quarter of 2019, dragging full-year GDP growth down to 4.3%, below official and non-official projections.

Not surprisingly, the stock market has suffered in tandem with the FBM KLCI tumbling 3.15% so far this year. The benchmark index closed at 1,538 points last Thursday.

In January alone, RM65.8 billion, or 3.9%, was wiped off Bursa Malaysia’s Main Market, according to CGS-CIMB Research.

Which sectors are likely to hold up this year, and which are likely to be adversely affected by COVID-19 and slowing growth?

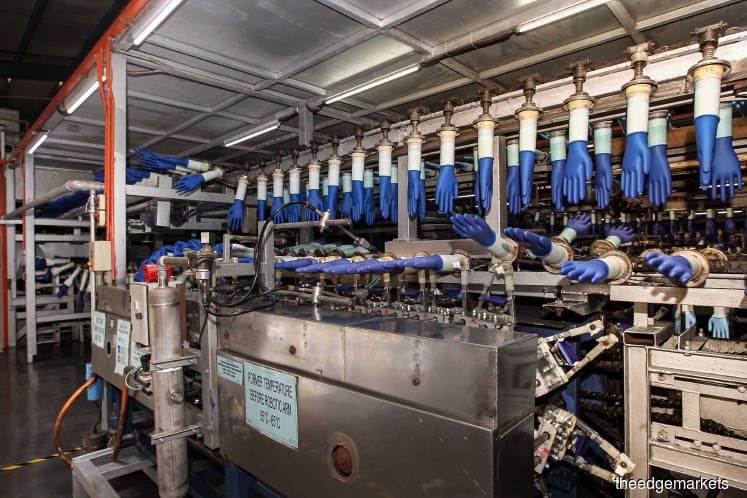

Danny Wong, CEO and principal fund manager at Areca Capital, suggests that investors stick to companies with strong fundamentals and those in sectors that can benefit from the virus outbreak, such as rubber gloves, pharmaceuticals, non-discretionary consumer products and even telecommunications. But he also says a lot depends on when the virus is contained and eradicated.

“If we look back to during the SARS [severe acute respiratory syndrome] pandemic in 2003, it lasted for only about three months until a treatment was discovered. But if the situation persists, then we are looking at a much dimmed earnings outlook for many sectors,” Wong tells The Edge.

A Jan 29 analysis by UOB Kay Hian shows that it took five months from the first suspected human infection of SARS in November 2002 to a major breakthrough in treatment in April 2003. Two months later, the World Health Organization (WHO) announced the containment of the outbreak.

The 2009 H1N1 outbreak was more severe, lasting 16 months from the first human infection to containment. During the period, the demand for rubber gloves was more apparent than during the SARS outbreak, the research firm says.

“We looked at the previous outbreaks to determine the possible impact COVID-19 could have on the glove sector. That said, back in 2003 ... the glove industry was still underdeveloped.

“Fast forward to 2009, the H1N1 outbreak had a pronounced impact on the sector. Volume grew more than 20% against higher economies of scale and better demand-supply imbalance; profit margins improved to 14.5% from 10.5% in the four quarters after the H1N1 outbreak.

“Incremental demand for hospital care and, by proxy, medical-grade gloves, appears to be dependent on the extent of the epidemic, infection rate and time taken to discover a vaccine,” the research firm says in the report.

While rubber gloves are easily the winners during a major health scare, the effect of the H1N1 outbreak on earnings was delayed for over two quarters, says UOB KayHian. After the first suspected H1N1 infection, it took two quarters of incremental demand to significantly boost earnings.

Nevertheless, research houses have been upgrading their forecast earnings and price targets for glovemakers since late last month. Hong Leong Investment Bank, for example, raised its price-earnings ratio (PER) for Top Glove Corp Bhd to 35 times on Feb 3, from 26 times. It also bumped up its target price to RM6.76 from RM5.02.

As at last Thursday, Top Glove was trading at RM5.85, which values the counter at a FY2020 annualised PER of 33.5 times, based on the first quarter ended Nov 30 earnings per share of 4.36 sen.

Other rubber glove companies have also seen upgrades.

UOB KayHian upgraded its FY2020 and FY2021 earnings forecasts for Kossan Rubber Industries Bhd by 17% and 10% respectively. It also lifted its PER peg to 26 times FY2020F earnings from 23 times, to factor in earnings growth. Its target price for the stock is RM6.22, giving it an upside potential of 27.9% from last Thursday’s close.

The COVID-19 outbreak has caused disruptions, particularly to the transport, tourism and hospitality sectors.

Major events — including global exhibitions such as the Mobile World Congress 2020, scheduled to take place from Feb 24 to 27 in Barcelona, Spain — have been cancelled because of the epidemic.

Events that have proceeded as planned have seen thin crowds, such as the Singapore Airshow 2020, which started last Tuesday.

Airport operator Malaysia Airports Holdings Bhd’s (MAHB) share price has shed 7.9% year to date to RM7.

Budget carriers AirAsia Group Bhd and AirAsia X Bhd (AAX) have not been spared, although their share prices have also declined because two of the airlines’ top executives are being investigated over graft allegations.

AirAsia has lost a significant 31.2% to RM1.17, and AAX has declined 22.6% to 12 sen. MIDF Investment Bank Bhd has downgraded AirAsia to a “hold” from “buy” with a lower target price of RM1.20 from RM1.86.

The disruption to travel and tourism is a further brake on global activity when the growth cycle is already slowing.

In October last year, the World Trade Organization (WTO) reduced its trade growth forecast for 2020 to 2.6% from an April forecast of 3%. Global trade data for 2019 has yet to be released, but economists expect it to be stagnant.

In Malaysia, its diplomatic dispute with India as well as adverse weather conditions earlier in the year have impacted the demand for and supply of crude palm oil (CPO).

On Feb 11, the Malaysian Palm Oil Board (MPOB) reported that CPO exports to India fell 85.3% year on year in January to 47,000 tonnes, while exports to China dropped 44.7% year on year to 177,000 tonnes.

On the supply side, production of CPO was 32.9% lower year on year in January, at 1.17 million tonnes, due to adverse weather conditions and a low fertilisation rate.

Putrajaya has promised to unveil an economic stimulus package by the end of this month to inject some life into the lacklustre economy.

During the SARS scare, the government launched a RM7.3 billion stimulus package in May 2003, which was equivalent to 1.9% of GDP at the time.

However, can the country afford the same level of stimulus this time around given its sticky fiscal deficit?

“Given the current fiscal challenges, we think an economic package of similar standing as the one launched during the SARS period in 2003 is likely out of the question,” says Vincent Loo, senior economist at KAF Research in a Feb 7 report.

“This would require a fresh injection of about RM30 billion, which could bump up the current fiscal deficit from 3.2% of GDP to 5% of GDP for 2020. This could impact the country’s sovereign credit rating by international credit rating agencies,” Loo says in the report.

However, he points out that there are ways to launch a stimulus package without straining the balance sheet.

First, the government could look to tap the RM2 billion contingency fund, which was set aside in Budget 2020, as well as ramp up spending by RM3 billion to rejuvenate the travel, hospitality, tourism and transport industries. This would nudge the fiscal deficit up to only 3.4%, estimates Loo.

There are other measures that would not impact the fiscal budget or derail fiscal consolidation, he asserts, which include providing credit facilities or financing guarantees to businesses and small and medium enterprises for their immediate working capital requirements.

The employee contribution to the Employees Provident Fund could also be reduced from the current 11%, as was done in 2003 during the SARS outbreak as well as in 2009 and 2016.

While slower economic growth could hit bank earnings, Wong advises investors to consider buying battered down shares as the dividend yield could prove attractive.

On the flip side, the prospect of another policy rate cut by Bank Negara could dampen bank earnings. Lower-than-expected GDP growth in 2019 could be a precursor to more rate cuts, although some analysts believe the rate is conducive at the moment.

Malayan Banking Bhd, which has lost 10.8% of its market value over the last one year, is currently trading at a trailing four-quarter (T4Q) dividend yield of 6.74%, while Alliance Bank Malaysia Bhd is trading at a T4Q dividend yield of 5.89%.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.