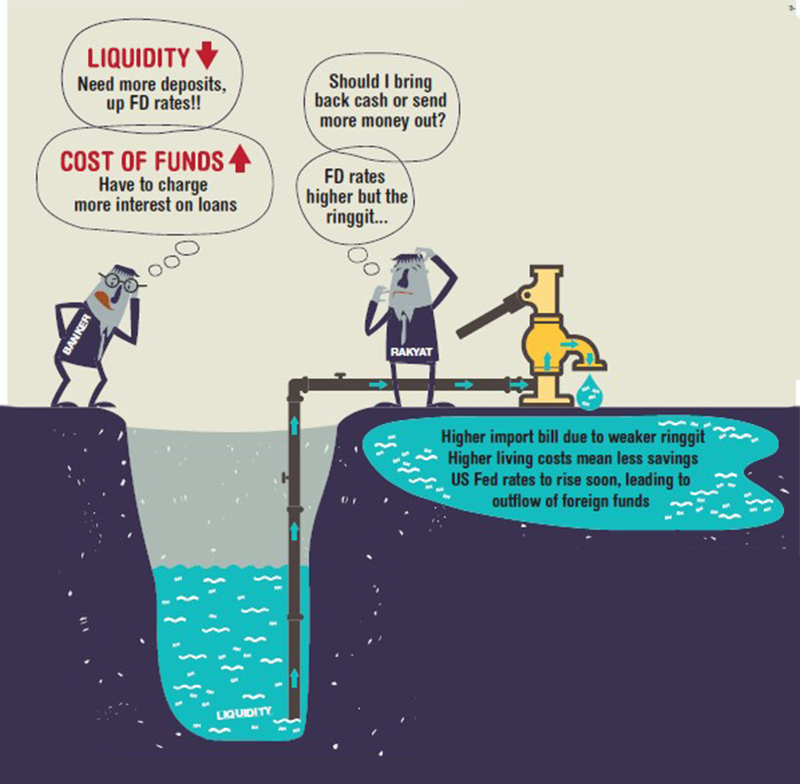

KUALA LUMPUR (Dec 5): Shrinking liquidity has led to stiffer competition for deposits in the Malaysian banking sector, The Edge Malaysia business and investment weekly (Edge Weekly) reported in its latest Dec 7-13 issue.

Edge Weekly, quoting bank officials and economists, reported that raising deposits was crucial to mitigate the impact of a high loan-to-deposit (LDR) ratio.

“We expect the current LDR level to stay elevated for a while and unlikely to have any significant reversal in the short term. For banks, this has the implication of driving higher cost of deposit, hence resulting in either higher loan pricing or compressed margins but most likely, it would be a combination of both," CIMB Group Holdings Bhd group head of treasury and markets Chu Kok Wei said.

“There is no concern of any liquidity crunch at all. Of course, with all the developing trends, we expect the banks will react accordingly in product pricing and strategy,” Chu said.

Edge Weekly reported that the banking industry's LDR, derived from dividing loans to deposits, had risen past 90% in recent months.

Quoting Bank Negara Malaysia data, Edge Weekly reported that the LDR reached 91.2% in October as deposits grew slower than loans.

It was reported that deposit expansion in year-to-date annualised terms, was 0.3% versus loan growth at 8%.

For a better understanding on the Malaysian banking sector, kindly pick up and read the latest Edge Weekly issue.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.