This article first appeared in The Edge Malaysia Weekly, on March 21 - 27, 2016.

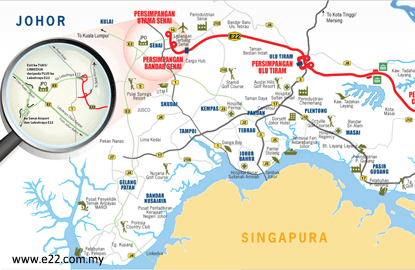

SENAI-Desaru Expressway Bhd (SDE), the concession holder of the 77km highway connecting Senai with Pasir Gudang and Desaru in Johor, could be a thorn in owner Tan Sri Hamdan Mohamad’s side. The company is bleeding red ink, raising concerns over its sustainability.

Hamdan is the largest shareholder of the recently listed Ranhill Holdings Bhd with a 33.52% stake. His holding in SDE is held through Rancak Bistari Sdn Bhd, which has a 70% stake in the highway concessionaire.

According to SDE’s independent auditor Ernst & Young (EY), the financial statements indicate that the company incurred a net loss of about RM262.6 million for the financial year ended June 30, 2014 (FY2014). As at that date, SDE reported a shareholders’ deficit of about RM1.025 billion.

“These conditions indicate the existence of a material uncertainty that may cast significant doubt on the company’s ability to continue as a going concern,” EY states in the independent auditor’s report.

When asked about the sustainability of SDE, Hamdan says the financial and operational aspects of the highway have been restructured. “The bond (sukuk) has been extended (restructured), yield reduced, concession period extended. So, no problem,” he tells The Edge in a text message.

It is worth noting that SDE’s FY2015 audited accounts have not been filed with the Companies Commission of Malaysia.

SDE undertook a debt restructuring in FY2014 whereby it restructured its senior and junior Islamic medium term notes (IMTN) into a single class sukuk with a longer maturity date and lower profit rate. The company has also been granted a term loan facility of up to RM150 million by the government.

In FY2014, SDE’s revenue increased 14% to RM44.88 million while its gross profit slipped to RM15.94 million from RM17.25 million the previous year. However, a huge finance cost of RM193.55 million resulted in the company registering a loss.

The bulk of the finance cost arose from profit charges on the IMTN programme of RM90.5 million, and interest expense on irredeemable convertible unsecured loan stocks (ICULS) of RM66.7 million.

SDE’s shareholders’ deficit of RM1.025 billion, which was an accumulation from 2013’s RM762.2 million, shows that it has yet to turn in a profit since toll collection commenced in 2009. To be fair, it has only been six years, but the staggering size of the shareholders’ deficit is a concern.

Thus, will Hamdan exit SDE? According to a source, the company is up for sale for between RM2 billion and RM3 billion. Besides Hamdan, SDE is 30%-owned by YPJ Holdings Sdn Bhd, a unit of Yayasan Pelajaran Johor.

When asked about the rumour, Hamdan denies having any plan to offload his stake in the highway concessionaire. “I’m not selling, and will not sell now or in the future, my stake in SDE,” he replies.

While he may not sell his shareholding, SDE’s FY2014 annual report paints a less-than-convincing picture of the sustainability of the company.

SDE states in the annual report that its ability to continue as a going concern is dependent on continued financial support from its creditors, sukuk holders, loan stock holders and the government, and its future profitable operations.

The highway concessionaire restructured its sukuk twice between 2010 and 2014 to reduce its finance cost and improve its cash flow.

To recap, on Dec 28, 2010, SDE issued two IMTN of up to RM5.58 billion in nominal value. The IMTN comprised senior sukuk of up to RM1.89 billion in nominal value and junior sukuk of up to RM3.69 billion in nominal value.

The junior sukuk was issued to redeem earlier-issued Bai Bithaman Ajil Islamic debt securities (BaIDS) of up to RM1.46 billion in nominal value. The senior sukuk had a tenure of 20½ years from the date of first issuance while the junior sukuk’s tenure was for 28 years.

The refinancing of the BaIDS was completed in January 2011 with the issuance of the IMTN. The IMTN had a yield to maturity of 7.98% per annum for the senior sukuk and 8.82% per annum for the junior sukuk.

However, in 2013, an amount of RM1.33 billion of the IMTN became due and was listed as a current liability in the annual report. This begs the question of whether any of the IMTN’s covenants were breached, or whether it was just a prudent financial step by SDE’s management.

Nevertheless, as such a large sum had to be redeemed, the IMTN was restructured into a single sukuk of RM1.89 billion in nominal value in 2014. As at June 30, 2014, the total restructured sukuk in SDE’s book amounted to RM1.4 billion. The restructured sukuk matures in 2053.

The debt restructuring reduced the profit rate from 8.5% per annum under the previous IMTN programme to 6.5% per annum.

The restructured sukuk was rated by Malaysian Rating Corp Bhd (MARC), which assigned a BBB- rating on May 8, 2014. This rating was affirmed on May 12, 2015, reflecting satisfactory traffic performance and SDE’s improved cash flow coverage.

However, the rating agency noted that SDE was constrained by the lack of catchment areas along key stretches of the highway, which limited traffic growth prospects, and relied heavily on planned developments to spur traffic growth.

“Any delay in the commercial operation date of the RAPID (Refinery and Petrochemical Integrated Development) project would affect traffic growth prospects and impact SDE’s ability to build up sufficient cash flow for debt service,” MARC states in the May 12, 2015, report.

According to the rating agency, SDE’s debt service ability hinges on scheduled toll hikes or timely compensation from the government in the event of a deferral.

It adds that while SDE is being compensated by the government, any prolonged delay in receiving the compensation will result in the company defaulting on the restructured sukuk.

SDE also has to widen some part of the highway starting this year, as per its supplemental concession agreement. According to the MARC report, the highway concessionaire has applied for a deferment of the expansion works as the traffic volume has not reached the required service level.

“If the company were to undertake the widening works as required under the supplemental concession agreement, SDE would default on the restructured sukuk in FY2017,” the rating agency states in the report. The next rating review should be up in May.

At the moment, SDE is still afloat as it managed to restructure its debts, extend the concession period and obtain financial support from the government and its shareholders. However, this is unsustainable if traffic on the highway does not grow quickly.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.