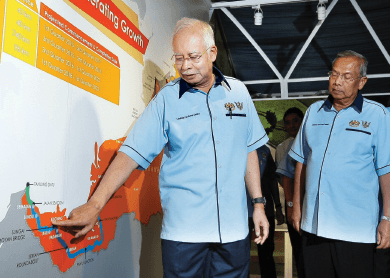

LAST WEEK, Sarawak saw the groundbreaking ceremony for the first phase of the Pan-Borneo Highway. The ceremony also signifies the large number of construction contracts that will be awarded to Sarawak-based companies soon.

However, there is a refreshing change as, according to sources, the Federal Government has given Lebuhraya Borneo Utara Sdn Bhd (LBU) the mandate to plan and construct the RM15 billion Sarawak portion of the highway. In the past, Cahya Mata Sarawak Bhd (CMS), a company controlled by the family of the former chief minister and current Yang Di-Pertua Negeri Tun Abdul Taib Mahmud, won most of the infrastructure contracts in the state.

LBU is controlled by a little-known, privately held company called Maltimur Resources Sdn Bhd. With a majority stake of 55% in LBU, Maltimur Resources is expected to play a key role in awarding construction contracts for the 936km stretch in Sarawak, sources say.

Checks with RAM Credit Information indicate that Maltimur, which is an investment holding company incorporated on June 5, 2012, has a paid-up capital of RM1 million and little in terms of assets. Its financials indicate a loss of RM10,496 without any revenue for the year ended December 2013.

The company’s shareholders are Zaidi Abang Hipni, who has 40% equity interest, and Safuani Abdul Hamid and Tan Sri Abang Ahmad Urai Datu Abang Mohideen, who have 30% each.

Abang Ahmad Urai, a well-known Sarawak politician, was the Dewan Negara president from 1988 to 1990. Zaidi is said to be close to Tan Sri Bustari Yusuf, brother of Works Minister Datuk Fadillah Yusof.

The remaining 45% of LBU is owned by Jalinan Rejang Sdn Bhd. Its shareholders are Sharifah Noor Ashikin Sy Aznal (40%), Mohd Khalil Dan (30%), Muliana Munir (20%) and Abang Abdul Rahim Abang Ali (10%).

Set up in July 2012, Jalinan Rejang is a dormant company.

The 936km stretch, which is slated to link Lundu to Lawas, will be toll-free, as announced by Prime Minister Datuk Seri Najib Tun Razak at the groundbreaking ceremony.

The three sections of the highway are Nyabau-Bakun, which stretches 43km and is scheduled for completion by mid-2017; Tanjung Datu-Sematan-Miri, which is 780km long; and Tedungan Merapok-Sindumin in Limbang/Lawas, which is 96km long. The entire highway is slated to be completed in mid-2023.

Although the main contractor’s jobs may have already been awarded, CMS (fundamental: 3.0; valuation: 1.5) and other companies could still benefit from the job awards. A merchant banker suggests that since the highway will be toll-free, there could be payment in kind in the form of land, which would mean that companies awarded the jobs must have deep pockets to finish their jobs. This could result in many familiar companies bagging the contracts.

For its financial year ended Dec 31, 2014, CMS registered a net profit of RM221.3 million on revenue of almost RM1.7 billion. As at end-

December last year, the company had cash and bank balances amounting to RM829.6 million, short-term borrowings of RM74.6 million and long-term debt commitments of RM30.2 million. Its share price closed at RM4.50 last Thursday.

A likely beneficiary of the highway project is Hock Seng Lee Bhd, which posted a net profit of RM76.9 million on the back of RM604.7 million in sales for the financial year ended Dec 31, 2014. As at end-December, Hock Seng Lee (fundamental: 2.6; valuation: 0.6) had RM149.4 million in cash and bank balances, a RM4.1 million in deposits and other assets and very little in terms of borrowings. Its share price closed at RM1.83 last Thursday.

Another potential beneficiary is the Shin Yang Group, which is controlled by the Ling family. While its shipping arm, Shin Yang Shipping Corp Bhd, is listed in Singapore, the group’s construction and civil engineering units are privately held.

Naim Holdings Bhd is another construction company that could take a huge chunk of the large contracts.

For its financial year ended Dec 31, 2014, Naim (fundamental: 1.9; valuation: 1.2) registered net profit of RM220.3 million on RM656.5 million in revenue. It had cash and bank balances of close to RM161 million, short-term borrowings of RM134.3 million and long-term debt commitments of almost RM124 million.

Naim, which closed at RM2.58 last Thursday, has seen its value shedding 21% since end-February.

The company is 16.5%-controlled by Datuk Amar Abdul Hamed Sepawi, a cousin of Taib.

Note: The Edge Research’s fundamental score reflects a company’s profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations. Visit www.theedgemarkets.com for more details on a company’s financial dashboard.

This article first appeared in The Edge Malaysia Weekly, on April 6 - 12, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.