This article first appeared in The Edge Financial Daily, on November 19, 2015.

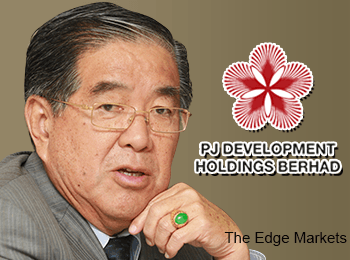

KUALA LUMPUR: PJ Development Holdings Bhd (PJD), which has turned more cautious in relation to new project launches now, will be happy even if its earnings growth this year comes in flat when compared with the last financial year ended June 30, 2015 (FY15), according to chairman Tan Sri Ong Leong Huat.

Ong, who spoke to reporters after PJD’s annual general meeting yesterday, said “it is not a prudent approach to aim for fantastic growth during tough times”, as he acknowledged that the property development sector had weakened amid current economic headwinds.

Meanwhile, regardless of the challenges in the property sector now, Ong said PJD’s developments had not encountered any issues of property overhang, whereby units remain unsold after nine months, as the group had strategised to cater to serious homebuyers who are looking for more affordable properties.

Ong said PJD’s planned development launches in Malaysia will have a potential gross development value (GDV) of RM1.6 billion next year. These include the third phase of You City in Cheras, Kuala Lumpur, and its land in Section 13, Petaling Jaya, Selangor.

“There are no extraordinary plans for new significant businesses next year. Our strategy at this stage is to become more efficient and build [on] our human capital. It might not be a short-term boost, but it will benefit the company in the long run,” he explained.

PJD plans to launch a development in Australia — a reported US$1.5 billion (RM6.59 billion) plan for a six-tower project — at the end of next year, “at the earliest”. The 2.03ha land in Southbank, Melbourne, could be a big contributor to PJD’s earnings for the next few years, said Ong.

In total, Ong said PJD’s 2,500-acre (1,011.71ha) land bank had an estimated GDV of RM15 billion that can last the group for seven to eight years.

Its property development segment made up 62.31% of the group’s FY15 profit before tax (PBT) of RM127.61 million. The group’s other businesses included: construction (25.57% of FY15 PBT), industrial cable provider (12.44%), building materials (13%), investment in hotel and leisure investment (4.15%), and a loss-making investment holding segment.

PJD, which told Bursa Malaysia that its 60-year-old managing director Wong Chong Shee (brother of Ong) was retiring yesterday, also said it had achieved a net profit of RM17.48 million for the three months ended Sept 30, 2015, on the back of a RM210.95 million revenue.

A single-tier interim dividend of 2.5 sen per share in respect of the financial period ending Dec 31, 2015, to be paid on a date to be fixed, was also declared. Due to the change of its financial year end from June 30 to Dec 31 from the financial year ended June 30, 2015, there is no comparative quarterly segmental information for the current quarter under review.

Meanwhile, Ong said the group intends to continue paying out dividends to reward its existing shareholders. Its total dividend payout in FY15 was 6.5 sen a share, a 4.42% yield, going by the group’s closing price of RM1.47 yesterday. In total, PJD disbursed RM29.46 million, net of tax, to its shareholders, which was 33.74% of its FY15 net profit of RM87.33 million.

“During difficult times, shareholders need returns from their investments. Everybody needs cash at this juncture,” said Ong, whose OSK Holdings Bhd owns 89.36% of PJD after it completed its takeover bid for PJD at RM1.56 per share on Sept 7.

To recap, OSK Holdings launched its takeover bid for OSK Property Holdings Bhd (OSKP) — at RM1.95 per share — and PJD earlier this year to enable the enlarged OSK Holdings group to consolidate the property development businesses of OSKP and PJD.

The takeover of OSKP was completed last month and the securities were delisted last Thursday. OSK Holdings intends to maintain the listing status of PJD — PJD was given six months until March 6, 2016 to meet the minimal 25% public shareholding spread requirement.