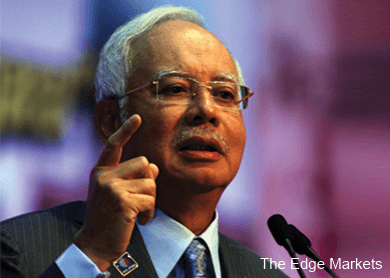

(July 2): Prime Minister Datuk Seri Najib Razak has defended Lembaga Tabung Haji's purchase of a piece of land from controversial state investment vehicle 1Malaysia Development Berhad (1MDB), saying that it generated RM170 million in profit.

He said the land purchase was a profitable move that benefitted those keeping their money in the pilgrims fund.

"Before this, there was talk that Tabung Haji money was being used to save 1MDB.

"Actually it was a land purchase, a business move that has brought RM170 million in profit to Tabung Haji," he said at a breaking-of-fast event with the press and bloggers in Shah Alam today.

Tabung Haji chairman Datuk Seri Abdul Azeez Abdul Rahim said Najib had asked Tabung Haji to sell off the land it had bought for RM188.5 million a month earlier, in order to respect the "sensitivity" of the depositors.

He however defended the decision of the Tabung Haji board in making the purchase, saying that they did "no wrong" and it was merely a "commercial decision".

Najib, who is also 1MDB's advisory board chairman, reiterated today that the land purchase was not a bailout.

"Surely we won’t be using the people's money to bailout 1MDB.

"That is not a responsible government," he said.

The land purchase by Tabung Haji sparked anger among various parties, especially depositors, as the deal involved 1MDB, a company that was reported to have raked RM42 billion in debts over the recent years.

Tabung Haji bought the 1.56-acre plot land in the Tun Razak Exchange (TRX) project at RM188 million in April with a plan to build a residential tower.

1MDB had purchased the entire 70 acres of the TRX land from the government for a mere RM194.1 million.

Some critics had viewed the purchase as a bailout to rescue 1MDB that had been experiencing cash flow problems, which was affecting its ability to pay back its debts.

Others have also stressed that there was conflict of interest in the deal since several top executives at Tabung Haji also sat in the 1MDB board. – The Malaysian Insider