This article first appeared in Personal Wealth, The Edge Malaysia Weekly on July 8, 2019 - July 14, 2019

As the baby boomer population ages, it presents a goldmine of opportunities that all stakeholders should take advantage of. Experts share their views in The Edge’s first Third Age Economy Symposium.

Growing old is often equated with negative biases such as poor health, incompetence and irrelevance but advances in science, increased longevity, technological innovation and growing affluence allow us to choose how we want to live out the rest of our lives.

This was the overarching theme of The Edge Malaysia’s inaugural Third Age Economy Symposium held at Mandarin Oriental, Kuala Lumpur on June 29. Over 300 people attended the event.

As the population of the aged increases, it has become pivotal that stakeholders such as policymakers and businesses recognise that it is a force to be reckoned with.

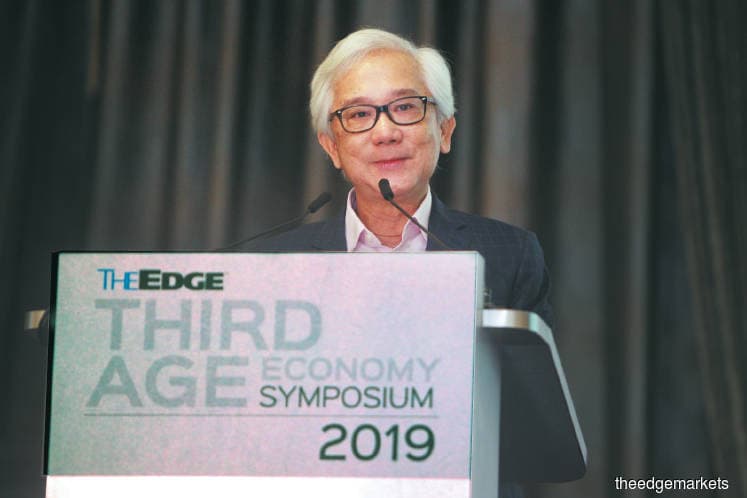

“The senior population is a sizeable one and it will get bigger. The global ageing trend, changing demographics and better healthcare all point to this — more people are living longer and fitter lives,” said The Edge Media Group publisher and group CEO Datuk Ho Kay Tat in his opening remarks.

Citing global population data from the United Nations, Ho said the number of older persons in Asia-Pacific will more than double by 2050. “In Malaysia, the number of people aged 60 and above is expected to reach 3.5 million next year, according to University of Malaya’s Social Wellbeing Research Centre. In 2040, this figure is expected to rise to 6.3 million, making up about 20% of the population.

“This will create a market that cannot be ignored as it is a group that has considerable spending and investing power,” said Ho, adding that statistics show that the spending power of consumers aged 60 and above will reach US$15 trillion globally by 2020.

The one area that presents a goldmine of opportunities is technology for the elderly.

Dr Teh Pei Lee, associate professor at the School of Business, Monash University Malaysia, said that the segment is a hot commodity as seniors are drawn to innovative assistive technology that makes their lives easier and more comfortable.

“It is a myth that older adults do not like technology. The fact is, they do not like bad technology. Product developers and designers have often neglected how product value changes with age. Technology developers and product designers will have to work harder to excite and delight older consumers with innovative products and services,” said Teh in her presentation.

Similarly, property developers looking to tap the silver-haired market need to embed assisted-living and aged-care components into their master plan, instead of fitting them in as an afterthought, said Anton Alers, director of VERITAS Architects Australia Pty Ltd, in his presentation.

“Aged-care and assisted-living facilities can add value immeasurably to the overall development, just like developers often let private schools come in at a bargain price because they know it’s going to add value to their overall townships,” said Alers, who is an advocate of the use of universal design principles in developments.

He added that present homebuyers should start demanding that the units they purchase caters for their lifestyles in the present and into the future. “[This is] so that we don’t have to move out of our linked house [because] the bedrooms are upstairs or [when] we can’t get ourselves into the toilet anymore.”

“I am very happy to say that I see a lot of these features being incorporated into the buildings that mainstream developers have rolled out,” he added.

Sharmila Sinnathurai, co-founder of post-retirement job specialist platform Hire.Seniors, focused on engaging the aged population so that they can continue contributing to the economy.

In the advent of a multi-generational workforce, the aged are another source of untapped talent, she stressed, to the agreement of the engaging crowd.

“[My co-founder and I] got together and realised that on one hand, we have corporates saying that they really want good talent but can’t find them. On the other hand, we have a group of wonderfully experienced people who have retired and want to contribute to society but are not being tapped,” she said in her talk titled “The silver talent: Our nation’s untapped potential”.

It is also crucial for seniors to plan their finances to prepare for their longer lifespan.

Although Malaysia is becoming the fastest ageing nation in the world, most of its working-class citizens are financially ill-prepared for life after 55, pointed out Nurhisham Hussein, head of the economics and capital market department at the Employees Provident Fund (EPF).

In his keynote address titled “The third age: The end of the beginning, not the beginning of the end”, Nurhisham said Malaysia is expected to become an aged nation in 25 years. In an aged nation, the post-working population — who are those aged 65 and above — constitutes 14% of the population.

However, many Malaysians are not contributing enough to their older years. Citing the EPF’s statistics, Nurhisham said that every two out of three members at the age of 54 have retirement savings of less than RM50,000.

“This puts them at risk of living below the poverty line,” he said, adding that 50% of EPF members above 55 exhaust their EPF savings in five years and 31% of them only achieve a basic savings amount [RM228,000] when they reach 55.

“The challenge that the EPF and the government are facing now is in addressing retirement adequacy. People don’t have enough money for their retirement,” he said.

Speaking on wealth management, Areca Capital Sdn Bhd CEO Danny Wong said older investors, particularly those who are about to hit retirement, cannot afford to ignore the effect of inflation on their portfolios.

Despite the 0.2% inflation rate in April and May this year, Wong cited the near doubling in price of a 1kg pack of sugar over the last 10 years. “This is just one of the ways in which your portfolio gets smaller over time, thus affecting your retirement prospects,” he said in his presentation titled “Managing your golden wealth”.

Wong called on older investors to leverage the capital markets to protect their nest eggs. “Ideally, a diversified portfolio should consist of sufficient liquidity (cash), hard assets (such as real estate), a portion of fixed income, as well as equities, to provide returns.”

Areca Capital was the main sponsor of the symposium. Other partners, exhibitors and prize sponsors were Gamuda Land, Matrix Concepts, Rozel Corp, Sharp Electronics Malaysia and Poh Kong.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.