This article first appeared in The Edge Financial Daily on December 16, 2019

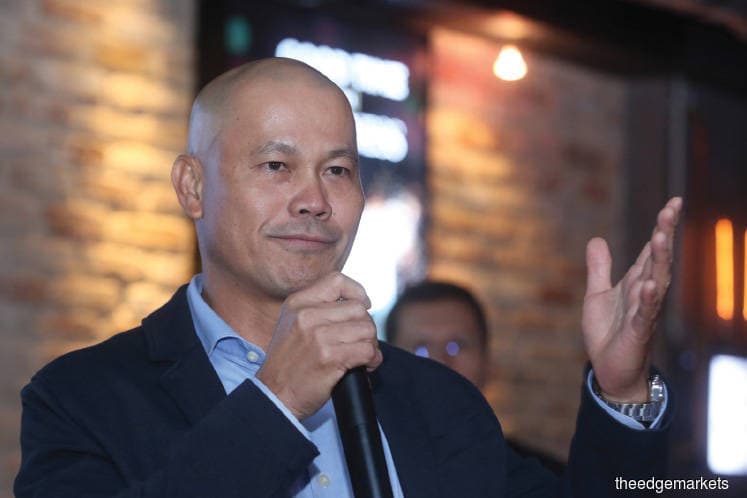

KUALA LUMPUR: It has been over a year since Sarawakian Roland Bala stepped in as Heineken Malaysia Bhd managing director — the first Malaysian to assume the role at the Dutch brewer’s Kuala Lumpur-based operations — and his report card is looking good so far.

In the nine months ended Sept 30, 2019, Heineken Malaysia’s net profit grew 21.5% to RM221.8 million from RM182.52 million in the same period a year ago, as revenue strengthened by 19.9% to RM1.64 billion from RM1.37 billion.

Notably, its third quarter (3QFY19) recorded a 31% jump in net profit to RM103.3 million from RM78.87 million a year ago, while revenue improved by 17.7% to RM602.53 million from RM512.01 million, driven by improved sales performances across all core brands and new product launches. The results were also helped by better cost efficiency.

In tandem with the better financial results, the group’s share price has been on the rise. It hit an all-time high of RM26.50 on Nov 21, just a week before its 3QFY19 results were out on Nov 28, before settling at RM26.36 last Friday, 35% higher than 12 months earlier.

With 4Q traditionally a peak sales period for Heineken Malaysia, Roland is expecting the group’s revenue to stay strong.

The group will also continue to focus on sharpening its commercial execution in preparation for an earlier 2020 Chinese New Year festive sell-in and improving operational efficiency across the business, Roland told The Edge Financial Daily in a recent interview.

Hence, he is confident of delivering a satisfactory FY19 performance, driven by the group’s efforts in unlocking cost efficiencies, and top-line growth on the strong performance of its core brands and new products.

Still, his optimism is tempered by caution, given the softening economic environment, a still competitive market and continued threat from the illicit trade. He anticipates these — especially intensified commercial activations planned by all brewers in the market for the final three-month run of the year — to have some impact on the group’s profitability in 4QFY19.

“Nevertheless, we will stay focused on improving our performance by strengthening our commercial execution across our route to market, while sharpening our channel focus and accelerating growth in our big innovations and e-commerce capabilities,” said Roland.

Keeping things simple and focused

Roland’s priority remains unchanged from when he first took over the job from Hans Essaadi, who left to head Heineken Egypt.

“We made it a lot clearer now that the purpose we’ve lined up for the company is all about sustainability,” said Roland. It is about “brewing a sustainable future for our people, business and planet”, he said.

The key to achieving that is to keep it simple and focused, he said. How? By focusing on simple questions like, “what are the portfolio we need” or do not need, as the case may be, and “do we have good enough coverage, in areas which we would need to expand”, Roland explained.

As an example, while Heineken has launched new products this year, namely Heineken 0.0 and Tiger Crystal, Roland said the brewer has shelved some non-performers so that the group only focuses on core brands and innovations that have scale and potential.

Among the products it discontinued in Malaysia are: Guinness Bright, Tiger Radler, Tiger White, Strongbow (Elderflower and Dark Fruit), Anchor Smooth Draught and Smirnoff Ice. “We made the hard decision to remove those non-performing innovations. Sometimes, as managers, you get a bit emotional about some brands, but when you look at it... If it’s not growing and you don’t see it going anywhere, then you have to slash it off,” Roland said.

Apart from cleaning up its brand portfolio, the group has also changed its management team and reorganised its commercial team, to ensure it has “the right people in the right place”. “I’m happy that the team can be rolled out with minimal disruptions to operations,” said Roland, adding that the group has also been cutting down on a lot of bureaucracy.

The shift towards well-being and moderation

On consumer preference, Roland shared there has been a shift towards well-being and moderation.

“Today and tomorrow’s consumers are seeking healthier options, natural ingredients and products that are low in calories,” said Roland. “It is different from my time. Back then, when you got your pay cheque, the first thing you did was hit the bar,” the 53-year-old added with a laugh.

Thus, he said Heineken 0.0 presents a great alternative for all occasions that consumers want to enjoy a beer but not the effects of alcohol. The drink contains only 53 calories per serving, versus the average 140 calories from carbonated soft drinks.

There is also a growing demand for less-bitter-tasting beer, as well as those with a lower alcohol content. This has led to the rising popularity of cider, which is seen as an alternative for those who do not enjoy the bitterness of beer, said Roland.

Asked if Heineken will be increasing its prices next year, Roland said the brewer will only do so if necessary, and very selectively at that.

According to Bloomberg, there are nine research houses covering the stock, with eight ‘buy’ calls and one ‘hold’. Target prices range between RM25.50 and RM30.30, with the top-end of the range giving Heineken shares a headroom growth of 15%, based on its current share price of RM26.36. It currently has a market capitalisation of RM7.96 billion.