KUALA LUMPUR (May 6): Half of the top 20 listed companies on Bursa Malaysia with the highest paid chief executive officers (CEOs) last year were family-controlled companies, according to the Securities Commission Malaysia's (SC) inaugural Corporate Governance (CG) Monitor 2019.

The top three companies with the highest paid CEOs were Genting Bhd, Genting Malaysia Bhd and Sapura Energy Bhd.

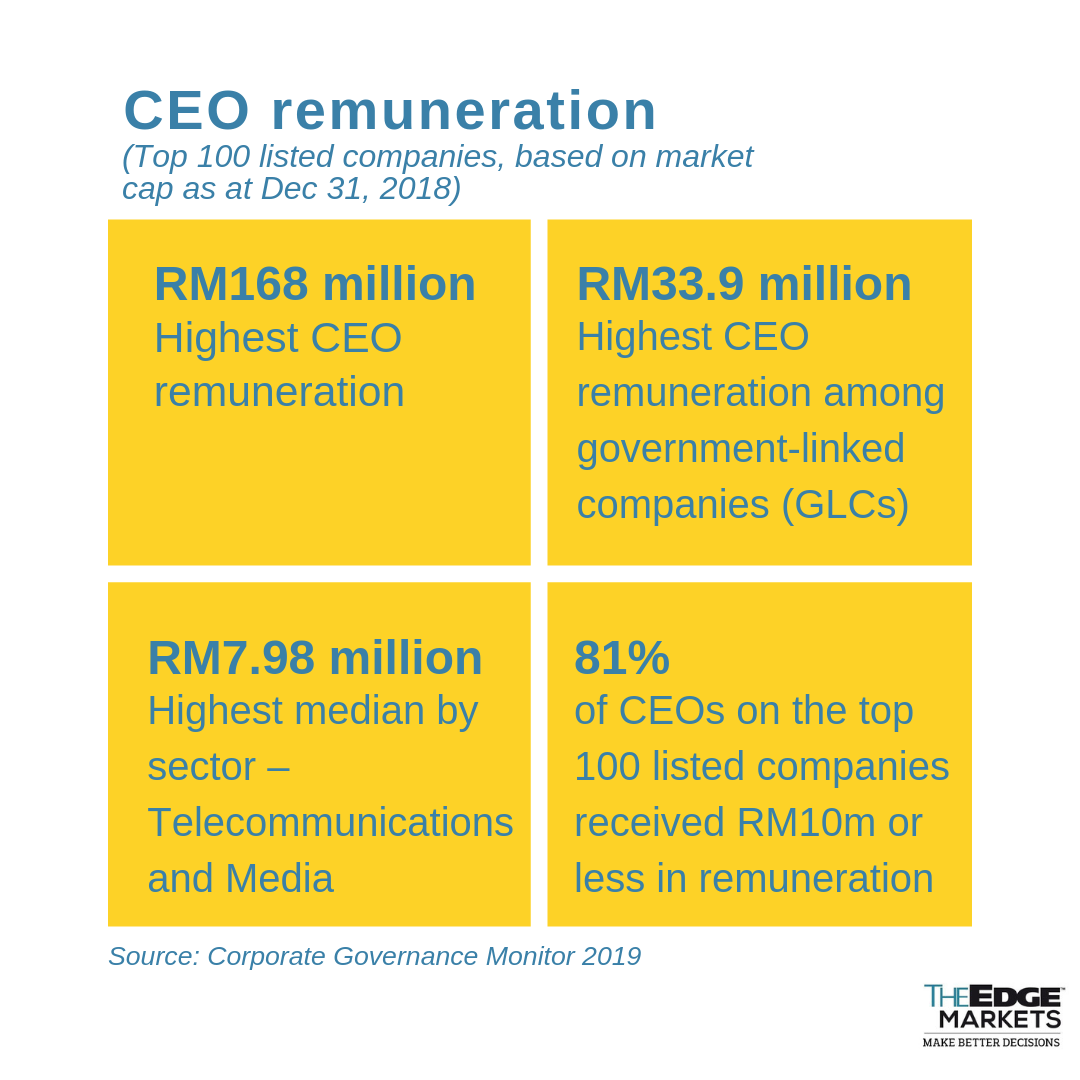

The CG monitor, launched today, studied the top 100 listed companies on the Main Market of Bursa Malaysia, based on their market capitalisation as at Dec 31, 2018. However, data on CEO remuneration were only available for 84 companies, comprising 25 family-controlled companies, 28 government-linked companies (GLCs) and the remaining 31 were categorised as other listed companies, the SC said.

The analysis breaks up these companies into two categories, namely those with market capitalisation of above and below RM40 billion, and those that paid CEOs more or less than RM10 million in 2018.

Contrary to popular perception that remuneration of GLC heads are very high, an SC spokesperson said the CG Monitor 2019 showed that listed companies with market capitalisation of more than RM40 billion but with CEOs' total remuneration below RM10 million, were GLCs.

"The CG monitor showed that listed companies with market value of less than RM40 billion, but their CEOs' total remuneration [being] more than RM10 million, were actually mostly family-controlled," the spokesperson said.

A total of 81% of CEOs received remuneration of RM10 million or less in 2018.

The median CEO remuneration ranged from RM1 million to RM7.98 million across 13 sectors.

The top three sectors with the highest median CEO remuneration were telecommunications and media, followed by financial services, and then the utilities sector. Real Estate Investment Trusts recorded the lowest median for CEO remuneration.

The CG monitor also analysed the relationship between CEOs' remuneration and the companies' return on equity (RoE) and return on assets (RoA).

"It is observed that listed companies which are ranked high in terms of CEO remuneration, may not necessarily be ranked high in terms of RoE and RoA, and vice versa," it noted.

The SC will issue the CG monitor annually to gauge the adoption of the Malaysian Code on Corporate Governance (MCCG) by listed companies, which the SC had released in 2017.

This year's CG monitor consists of three thematic reviews, namely CEO remuneration, long-serving independent directors and gender diversity. The data presented in this year's CG monitor were gathered from 841 listed companies on the Main Market and ACE Market of Bursa as at Dec 31, 2018.

It is encouraging to note that there was a reduction in the average tenure of independent directors from seven years in 2015 to five years last year, the SC spokesperson said.

"A total of 164 listed companies used the two-tier voting process to vote on retention of independent directors with tenure of more than 12 years. This reflects greater scrutiny by boards, and shareholder activism," she said.

The CG Monitor 2019 also revealed that 116 independent directors with tenures of more than 12 years resigned in 2018, and a remainder of 391 directors under this category. Meanwhile, there were 394 independent directors with tenures ranging between nine and 12 years.

In fact, some CG advocates have called on the SC to include the two-tier voting process for independent directors in Bursa's listing regulations. To this, the spokesperson said the SC is currently discussing the matter with Bursa.

The SC encourages companies to limit independent directors' tenure to nine years, in order to maintain objectivity in scrutinising business operations.

On gender diversity, the CG monitor notes that Malaysia has made slow but steady progress in improving gender diversity on boards.

In December 2018, there was a 7 percentage point increase in women participation for the top 100 listed companies, compared with the year-ago period. There was also a 4 percentage point increase for all listed companies from 12% to 15.69%.

The SC said it had achieved its target set in 2017, to have no all-male boards on the top 100 listed companies on the bourse.

"For the remaining 286 companies with all-male boards, the SC will engage these companies to ensure gender diversity on these boards," the SC spokesperson said.

The CG Monitor 2019 also found that there was a higher percentage of women directors in the younger age groups, which provides a strong pipeline for gender diversity on boards in future.