This article first appeared in The Edge Financial Daily, on April 8, 2016.

KUALA LUMPUR: Funds outsourced by the Employees Provident Fund (EPF) to external fund managers rose 14% to RM98 billion last year from RM86 billion in 2014.

EPF said this allocation was invested in both equity and fixed-income instruments, representing 14% of its total investment assets.

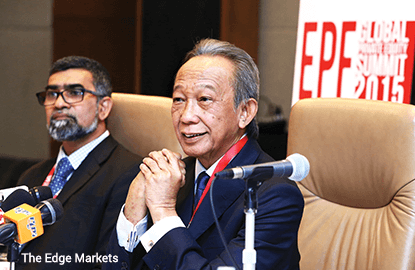

“As a retirement fund, we are obligated to meet our members’ expectation of good returns,” the fund’s chairman Tan Sri Samsudin Osman said in his keynote address at the EPF External Portfolio Managers Annual Awards Dinner 2016 yesterday.

“Investments through external fund managers allow us to leverage on their knowledge and skills, especially in the global financial marketplace. This approach is in line with EPF’s initiative to support the development of the asset management industry in Malaysia,” he said.

Samsudin also remarked that the EPF is committed to declare no less than 2.5% nominal dividend on a yearly basis and at least 2% real dividend on a three-year rolling basis.

“The EPF also continues to explore higher yielding assets which fits our risk return profile as a retirement savings fund, such as equities and real assets, as well as investment diversifications using a multi-asset class approach,” he said.

The awards event saw 17 Awards presented to top-performing external portfolio managers.

For 2015, the EPF included two award categories, namely Best Global Sukuk Portfolio Manager and Best International Equity Syariah Portfolio Managers for Asia ex-Japan and Developed World, to reward fund managers who achieved good performance in managing EPF’s Islamic investment portfolio.

“The awards reflect the EPF’s efforts to promote and develop the Malaysian Islamic Financial Centre agenda. This is especially significant as the EPF prepares to introduce the syariah saving scheme in 2017,” Samsudin said.

The EPF’s exposure to syariah-compliant investments covering multi-asset classes currently exceeds 40% of total assets.

“The EPF sets high standards on performance and we are appreciative that our external fund managers have given their full commitment in managing our funds insofar that we were able to declare a dividend rate of 6.4% for 2015. This was highly commendable indeed, considering that 2015 was quite a challenging year,” Samsudin said.

As at Dec 31, 2015, EPF’s total investment assets stood at RM684.53 billion, up 7.54% from RM636.53 billion a year ago.