Parkson Holdings Bhd

(Nov 25, RM2.40)

Maintain reduce with target price of RM2.17: Parkson Holdings Bhd’s revenue for the first quarter of financial year 2015 ending June (1QFY15) inched up 2.1% year-on-year (y-o-y) to RM848.6 million, mainly due to: (i) 15% y-o-y revenue growth in its property and investment holdings segment and (ii) 2% y-o-y revenue growth for its retail division.

However, higher rental and costs from new store expansions caused operating expenses to tick up 6.1% y-o-y, which in turn caused 1Q earnings before interest and tax (Ebit) margins to slip 3.6 percentage points y-o-y to 5.4%.

By the same token, 1Q earnings contracted 34.2% y-o-y, attributed to: (i) a flattish showing from Malaysia due to dampened consumer sentiment and (ii) slower China operations (-56% y-o-y). Against 4QFY14, revenue for 1QFY15 increased 4.3% q-o-q due to the festive season in Malaysia and Indonesia. However, earnings fell 25% y-o-y due to the continued challenging environment in China.

Going forward, we understand that the group is currently constructing a mall in Qingdao, China, which will open its doors by end-2015. The group is also targeting to build one mall each in Melaka and Cambodia which will be completed by 2017. Even though we are hopeful of its plans to create another income stream for the group, which we believe would be positive for the long-term outlook; we believe the high gestation costs for its new malls will continue to pressure earnings in the next few years.

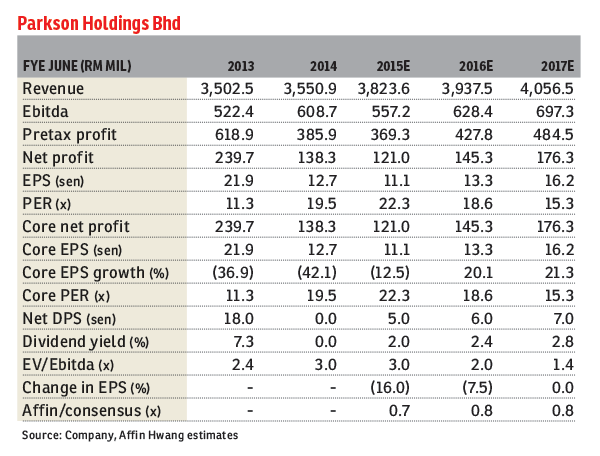

In view of the disappointing results, we cut our FY15 earnings by 16% and FY16 by 7.5% as we raise our overall marketing and rental expenses. Going into 2015, we continue to expect the operating environment to remain challenging given: (i) increased operating costs from growing staff, rental and new store expenses; (ii) persisting economic weakness over the region and (iii) near- to mid-term pressure on consumer sentiment after the implementation of the goods and services tax in April next year.

We maintain a “reduce” call with lowered sum-of-parts-based target price of RM2.17 (from RM2.20). Key risks to our view include a strong rebound in consumer discretionary spending in China and across the Asean region. — AffinHwang Capital, Nov 24

This article first appeared in The Edge Financial Daily, on November 26, 2014.