This article first appeared in Corporate, The Edge Malaysia Weekly, on May 9 - 15, 2016.

U Mobile Sdn Bhd, the country’s youngest telecommunications operator, is flexing its muscles in an effort to grab market share from the Big Three — Maxis Bhd, DiGi.Com Bhd and Celcom Axiata Bhd.

Launched in 2007, U Mobile has made an impact, growing its subscriber base from less than 50,000 to over four million in less than five years.

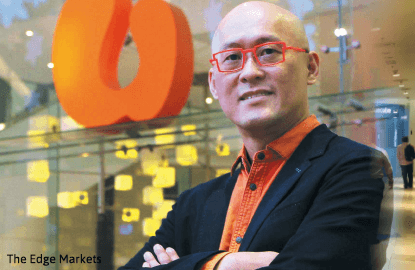

Today, with a market share of nearly 8%, U Mobile is the fourth largest mobile operator in Malaysia, but group CEO Wong Heang Tuck is not resting on his laurels. “We don’t intend to stay No 4 for long, that’s why we have been very aggressive in the last two years. I would say by 2018, we will be much closer to them (the Big Three). In terms of revenue and subscriber base, we will also be more meaningful and bigger than before,” he tells The Edge.

However, Wong quickly stresses that it is not a realistic target for U Mobile to dethrone the three Goliaths, for now at least.

“Are we able to surpass them? I don’t think so, not in 2018. Our market share has to reach at least the mid-teens, so it really depends on how competitive we are in rolling out the services,” he says.

Wong was appointed CEO in April 2014. Since he joined the company as chief operating officer in 2013, U Mobile’s revenue and market growth have outperformed industry averages.

Previously, Wong was chief financial officer of WBL Corp Ltd, a Singapore-listed multinational conglomerate. He has more than two decades of experience in finance, business and corporate development.

A quick check on the Companies Commission of Malaysia’s website shows that U Mobile’s net loss contracted to RM191.82 million in the financial year ended Dec 31, 2014 (FY2014) from RM363.24 million in FY2013. Revenue rose from RM919.17 million to RM1.26 billion.

Wong reiterates that the loss-making U Mobile is still targeting a positive earnings before interest, taxes, depreciation and amortisation (Ebitda) and an initial public offering (IPO) by 2018. However, he declines to reveal the company’s Ebitda figures.

It is worth noting that U Mobile saw a single-digit revenue growth in 2015, although Wong had expected a double-digit growth.

“By my standards, it (revenue growth) wasn’t good enough, but compared to the industry, which was stagnant, we were much better,” he comments.

Going forward, says Wong, U Mobile will continue to offload its non-strategic assets, mainly telecom towers, by sticking to its “light capital expenditure, lean operating expenditure” model.

“Time has evolved. We will lease infrastructure as much as we can. To us, there is no strategic advantage in building and owning towers anymore, because this is not our core business,” he says.

Wong goes on to say that U Mobile still owns about 1,000 telecom towers, but it is not in a hurry to sell them unless the price is right. “A tower is a tower. The key thing is how you design the network and the electronics that you put on the top. Are you able to make a difference if you build your own tower? The answer is no, and more so for a fourth operator like us,” he says.

U Mobile has a 10-year partnership with communications infrastructure services company edotco, which will see the latter leasing tower site space while providing power and site maintenance to the former.

However, Wong highlights that U Mobile will still invest in necessary infrastructure to prove that it is a serious telco rather than a “fly-by-night player” that is reluctant to pour money into the business.

“Over the last two to three years, we have demonstrated ourselves by putting in a huge amount of investment, not only for rolling out new packages but also for infrastructure,” he says.

Indeed, U Mobile has also allocated a capex of RM3 billion to RM4 billion for its five-year expansion plan, mainly to expand its third generation (3G) and fourth generation long-term evolution (4G LTE) network infrastructure by rolling out 5,000 new base stations to cover the whole country.

Interestingly, Wong points out that mobile subscribers no longer stay loyal to one brand because there is no such thing as a “premium brand” in the telecom market.

“Last time, there was this perception that if you are a Maxis subscriber, you are a premium customer. Today, things have changed. For the younger generation, whether you are using Maxis, DiGi or Celcom, would that make a difference? It’s all about which telco can give you a better experience, [one] that meets your expectations,” he explains.

Wong adds that U Mobile is moving away from premium branding as its targeted customers — the younger generation — simply do not care about brand premium anymore.

“For the masses, they couldn’t care less. I don’t think people will be laughing at you because you’re using U Mobile. If you are a Maxis user, so what? Do you feel better? Do you feel good about yourself?” he asks.

Wong opines that U Mobile could still attack the corporate customers segment in the future, but that would only happen after it has expanded its subscriber base.

“Corporate [customers] are very bureaucratic. They are very fixated, and they have an old mindset – Maxis is Maxis, Celcom is Celcom, there is no art in that. This is a game that we are not keen to play,” he says.

Currently, Straits Mobile Investments Pte Ltd, a unit of Singapore Technologies Telemedia, is the single largest shareholder of U Mobile with a 49% stake.

U Telemedia Sdn Bhd, owned by local tycoon Tan Sri Vincent Tan Chee Yioun, is the second largest shareholder with a 21.46% stake. Tan, who is the chairman of U Mobile, also has a 6.2% direct stake in U Mobile as well as 2.01% equity interest via Berjaya Infrastructure Sdn Bhd.

Last December, U Mobile announced that the Sultan of Johor, Sultan Ibrahim Sultan Iskandar, had acquired a 5% stake in the company, increasing his holding to 15%. The Sultan acquired his initial 10% equity interest in 2014.

Locally listed Magnum Bhd has a 6.33% stake in U Mobile. Low-profile Thai-born tycoon Tan Sri Surin Upatkoon, who is the non-executive chairman of Magnum, also sits on the board of U Mobile as a director.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.