This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on Feb 8 - 14, 2016.

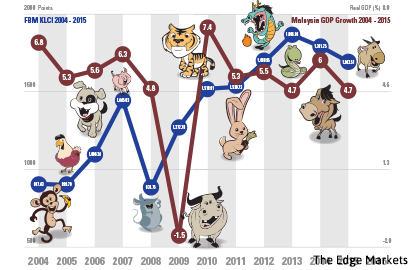

In the spirit of the Lunar Year of the Fire Monkey, Personal Wealth looks back on the last 12 years, highlighting the key events that helped shape today’s global economic and investing landscape.

2011

Metal Rabbit

The year 2011 was the Year of the Metal Rabbit, or also known as the white rabbit. This rabbit in particular was nervous and uncertain. The year came hard on the heels of the Arab Spring, a revolutionary wave of demonstrations, protests, riots and civil wars that began in Tunisia on Dec 18 the year before and spread throughout the countries of the Arab League.

In February, there was an energy crisis owing to uncertainty over Libyan oil output because of the unrest. Prices quickly escalated when protests intensified, causing crude oil prices to rise 20% in two weeks. The low spare production capacity also challenged the Organization of the Petroleum Exporting Countries to provide incremental supply to an already tight market.

In March, a massive earthquake and tsunami struck Japan, leading to radiation leak at the Fukushima Daiichi power station. The impact of the tsunami caused an additional uncertainty to markets that was already jittery about oil prices and the volatile political situation in the Middle East.

Asian markets ended sharply lower, with Japan’s Nikkei 225 falling 17.5% in three trading days following the catastrophe. It wiped ¥37 trillion off equities. On top of that, oil prices fell, global stock markets wobbled and the yen rose on the foreign exchange markets.

There was another sharp drop in the global stock markets in August, presumably from fears of contagion from the European sovereign debt crisis and debt ceiling crisis in the US. After a 10-hour discussion in Brussels, the EU announced an agreement to manage the sovereign debt crisis, which included a write-down of half the Greek bonds, a recapitalisation of European banks and increasing the bailout fund, the European Financial Stability Facility, to €1 trillion.

In Malaysia, the Securities Commission Act 1993 was amended so that it was in line with global standards and Prime Minister Datuk Seri Najib Razak announced 113 new commitments to invest in Malaysia from foreign and domestic investors in the 2011 Economic Transformation Programme (ETP) report, with a total value of US$57 billion, across all 12 ETP target sectors.

Overall, the Malaysian economy continued to outstrip world growth at 5.3% to 3.09%. The inflation rate was up at 3.2% and the ringgit closed slightly weaker against the US dollar at 3.17. The KLCI ended only marginally higher at 1,530.73 points.

2012

Water Dragon

The dragon is the only imaginary animal in the Chinese zodiac and is believed to be a symbol of good fortune and intense power. But 2012 was anything but a harbinger of fortune as there was chaos across the global financial markets, more banking scandals, the start of a civil war in Syria, intense demonstrations, quantitative easing policies and hotly contested elections.

The gross manipulation of the London Interbank Offered Rate, which has infamously come to be known as the “Libor Scandal”, came first. Libor serves as the first step to calculating interest rates on various loans throughout the world. The problem started brewing on the heels of the global financial crisis when The Wall Street Journal reported that some banks might have understated borrowing costs during the 2008 credit crunch that may have misled others about their financial position.

Banking giants under probe, notably Barclays Capital and UBS, forked out a combined fine of US$1.95 billion to pay regulators in the US, the UK and Switzerland for manipulating the Libor benchmark. The controversy led Bank Negara to tighten rules on the fixing of onshore rates for the ringgit as evidence emerged that traders in Singapore banks were plotting to manipulate the foreign exchange market.

The central bank also had its work cut out when it raided Genneva Malaysia Sdn Bhd, Pageantry Gold Bhd, Caesar Gold Sdn Bhd and Worldwide Far East Bhd, which were operating illegal investment schemes using the sale and purchase of gold to camouflage their activities. About 142.7kg of gold and cash amounting to RM101.92 million were seized by the financial regulator.

On the political front, the third protest rally by the Coalition for Clean and Fair Elections (Bersih) grew bigger and stronger as more than 100,000 people took to the streets of Kuala Lumpur for a “sit-in rally” on April 29 to demand transparent electoral practices. The subsequent crackdown by the riot police saw the use of 967 tear-gas munitions on protesters and 512 arrested.

The effects of the global financial crisis was still felt four years on as many countries plunged into an economic recession. According to the Credit Suisse Global Wealth Report, total global household wealth fell 5.2% to US$223 trillion from mid-2011 to mid-2012. It was the first annual decline since the 2008 crisis, following widespread equity price declines and relatively subdued housing markets.

Was China’s subdued growth in 2012 a sign that things were going downhill? After experiencing rapid growth for more than a decade, the world’s second largest economy started to experience a painful slowdown and has been struggling to regain its foothold since.

Overall, the world economy grew at 2.45% while Malaysia’s growth was more than double at 5.6%. The country’s inflation rate stood at 1.7% and the ringgit had a pretty decent year with foreign investors flocking to Southeast Asian markets. At one point, the ringgit appreciated to 2.994 against the greenback but it closed lower at 3.06 at the end of the year. The KLCI improved 10% to end the year at 1,688.95 points.

It was also a year that stirred apprehension all around as the end of the ancient Mayan long-count calendar, which spans roughly 5,125 years starting in 3114 BC, reached the end of a cycle on Dec 21, 2012. Rumours of an apocalypse stirred worldwide anxiety as many believed that the end of the Mayan calendar marked the end of the world.

2013

Water Snake

The Year of the Water Snake is traditionally a year when everything is in a constant state of agitation, and 2013 lived up to its reputation. After four tumultuous years of leading the country, Datuk Seri Najib Razak finally called for the 13th general election (GE13) on May 5. Malaysia’s 13.3 million eligible voters, of which 2.6 million cast their ballots for the first time, were on tenterhooks, apprehensive of a possible shift in the country’s leadership.

For a short period, it did seem like it, as Pakatan Rakyat made significant inroads. But despite bagging less than 47% of the popular vote — its worst-ever electoral performance — Barisan Nasional still won 60% of the 222 parliamentary seats. Shortly after GE13, global rating agency Fitch revised Malaysia’s sovereign credit rating outlook to “negative” from “stable” as the government’s debt rose to 53.3% of GDP at end-2012. This eventually led to cuts in petrol and diesel subsidies to rein in the budget deficit.

Bank Negara also introduced the Financial Services Act 2013 and the Islamic Financial Services Act 2013, which gave the central bank a better regulatory and supervisory structure over the country’s financial institutions. The laws were focused on pre-emptive measures to safeguard the interests of depositors and policyholders as well as to provide a transparent framework for authorised institutions to carry out regulated financial activities.

On the global front, Cyprus became the fifth country — after Greece, Portugal, Ireland and Spain — to have a fiscal meltdown after the global financial crisis. At a point, the country’s leaders intended to freeze savings accounts, impose tax on savings and compensate depositors with shares in bankrupt banks, causing widespread panic and unrest. But in the end, the government agreed on a €10 billion bailout package given by the International Monetary Fund, European Central Bank and European Commission.

The failure of Cyprus and the draconian scheme to use savings to bail out ailing financial institutions saw rising interest in crypto-currencies, particularly bitcoin. The price of a single bitcoin rose from US$11 in November 2012 to US$900 in November 2013. On Jan 29, bitcoin was priced at US$371.59.

But nothing tops the time when then US Federal Reserve chairman Ben Bernanke indicated the possibility of tapering the quantitative easing programme as the US economy was showing improvement. His remarks sent markets around the world into a tailspin with fears of rising interest rates and liquidity shrinking.

Overall, the performance of the economy showed slower growth in many of the emerging markets as leading markets gained strength. Central banks in the US, Japan and Europe pumped money into their economies and maintained low interest rates.

The world GDP growth for the year was 2.6% while Malaysia’s GDP fell sharply to 4.7% from 5.5% in 2012. The country’s inflation rate stood at 2.2% and the ringgit depreciated to 3.28 against the US dollar. The stock market, however, continued to improve and the KLCI closed 10.5% up at 1,866.96 points.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.