This article first appeared in Corporate, The Edge Malaysia Weekly, on May 23 - 29, 2016.

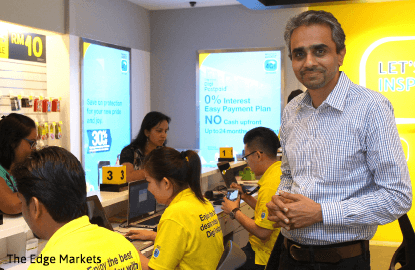

ALBERN Murty is the first Malaysian to be appointed CEO of DiGi.Com Bhd, which is majority owned by Norway’s Telenor Group. In his first media interview since taking over, Murty talks about the challenges faced by DiGi in an ever-changing industry landscape, including the need to balance paying dividends and investing in the business as it transforms into a digital player.

The Edge: It has been a challenging first year. What have you been doing about it?

Albern Murty: The three things that I always talk to people about are growth, customer and talent.

We have always been a growth company and need to continue being a growth company. Now, growth is going to be fuelled by us embracing the internet — first, through the network and then, taking services and products to the market.

The second part is [centred] around customers. DiGi has always been known as that guy who says, ‘I’m not afraid of getting feedback.’ We listen to what they want and we will try to give them what we can.

The third part is a little bit more on internal reflection — talent. We look at people very differently in DiGi. Yes, there is a strong culture. DiGi has always been known for innovation and simplicity — we want to own that DNA but we want to add one more layer on top of that, which is the people. I want to clearly differentiate us as a place where people [not only] enjoy the work but also grow and develop together with the organisation.

In Q4 (the fourth quarter), we managed to grow year on year. We were not measured purely by subscribers. Our real measurement is market share and service revenue growth. We had a service revenue growth of 0.2%, which was basically flat [compared with] 2% to 3% growth on average in the previous years. But it was not surprising for me because we could always see that trends were coming down. If you ask me what happened in 2015, part of it was because the industry contracted, and also the consumer sentiments post-GST (Goods and Services Tax) as well as economic sentiments.

So, put it all together and we had a perfect storm, which basically we need to manoeuvre and manage around. There were two choices — one, we just defend, but that’s not what we did. We went out there and innovated. We went out there with two prepaid value propositions and we fine-tuned our postpaid [plans].

DiGi saw its ARPU (average revenue per user) and margins fall, while subscriber numbers picked up. Will this be the trend going forward?

First of all, service revenue growth has always been our key KPI (key performance indicator), along with customer satisfaction and Ebitda (earnings before interest, taxes, depreciation and amortisation) margins. Not subscriber growth.

Subscriber growth that we saw in Q1 was also an effect of seasonality. We always see customers, especially in prepaid, who swing in for a few quarters, then swing out.

Nonetheless, we are happy with the subscriber growth because we are now going into new markets that we didn’t address before. Now, we are close to 90% [in] 3G coverage, and 4G is at 73%. We are starting to access pockets we couldn’t before. That’s organic growth.

The ARPU that you are seeing now is impacted by newer customers who are either using another SIM or from lower usage, or from just price competition.

DiGi has the fewest postpaid customers among the Big Three. Have you seen an improvement in the profile of your postpaid customers?

I think it goes back to why we are happy with our network. We have a great internet network, we have 4G, on a par with leaders in the industry.

For Q1, our postpaid subscribers grew 8.2% year on year to 1.9 million.

There are supplementary users, there are first-time postpaid users and there are mid, high and super-high customers. We have plans for all those segments and we see growth across all segments.

As for the overall quality, the ARPU for postpaid is holding. It was constant in Q1, at RM80.

Is there a price war?

Yes, the market is very aggressive [when it comes to] competition. I think customers are enjoying the benefits right now. But competition needs to be sustainable … [for] investments. We must make sure that we make enough money to invest.

[Under] the current market situation, I don’t think it is sustainable. I think competition is great for customers, but it has to be at a level where we are able to reinvest in providing future technology and networks. The competition now, I don’t think it’s going to enable a lot of players to make those investments.

Previously, 3GB was RM78 to RM80. Now, 3GB is below RM50 — it has dropped by about 30% to 40%. It’s driven by competition, but it has to be sustainable competition. What I would focus on is not so much on the price but what the customers need. And we are able to provide for that need, which, I think, the current plans are more than enough.

Has the new entrant been disruptive?

If you look at just pricing, pricing in general, you don’t need to be [a] new or old [entrant]. It is a strategy to gain market share. It is used in all industries. I think it is a reflection of who needs to grow faster and [in the] shorter term, [who] will be the one to trigger it.

Do you think it will get worse with two new entrants?

I think, first of all, they will be offering very different products and services. Secondly, I think everybody has a growth and a profitability target. We (telecommunications companies) will all be sort of okay and rationalise.

Whether it gets better or worse, it will depend on the market. For us, we will focus on getting the right customers at the right plans and at the right levels.

If you look at more mature markets, [they have] three to four telcos, depending on the size of the country … maybe five. It depends on what is ideal, but I believe competition is healthy and companies that are able to invest in the network, invest in the customers and invest in the reach will sustain [in the] longer term.

Do you see a period of intense competition coming in followed by a consolidation? Can the market support six operators?

I don’t think so. I don’t know if the market can support six operators, but it is quite different. When it comes to full mobile, there is still probably four. That is still sustainable. The current level of competition will not get worse. It will stay there for the rest of the year.

Do you see webe as a threat, because it will be able to leverage its fixed-line infrastructure?

I can’t comment on them, specifically because I don’t know what they plan to roll out yet. We will just have to wait and see what they launch. But they are also a company that has to grow fixed (as opposed to mobile) as well, and they have to make sure that it is a business that is complementary. They have their own strategy, and I believe they will grow in different areas, not just the mobile space.

Telenor has lower margins elsewhere. Do you think the industry can normalise at lower margins?

What we have guided is that margins will be flat this year. We cannot just look at the price war … [we need to] focus on becoming a more efficient operator as well. There have been a lot of improvements, in terms of IT, network and the cost structure that we are actually running.

As we move into the digital space, there are a lot of things that have to be changed, things that have to be automated. For example, the MyDigi app. We have over 500,000 customers using the app to self-serve, making it faster for us to respond and quicker to resolve [issues].

We have to empower customers more, with self-help apps. You don’t need to call anybody. You just need to use an app to activate something. Back end-wise, we need to make sure that you are able to do that.

We also have compression technology where we compress data, to optimise what is delivered on the network to customers’ devices.

The back-end transformation is going to be the key for us to become an efficient operator. We need to look at IT, billing and the network. In other countries, RAN (radio access network) sharing has been the next step.

The incumbent telcos have a lot of overlapping infrastructure. Do you think RAN sharing is one area where telcos can collaborate and reduce cost? (RAN sharing allows operators to share infrastructure hardware. Tower sharing only allows sharing of the physical sites, but hardware is duplicated.)

I am a big supporter of this. DiGi has collaborated with Celcom to roll out Fibre. There is no way we would have been able to roll it out as fast as we did without the collaboration.

In more mature markets, RAN sharing and tower sharing is something that is done. We are already doing tower sharing, but there is still a lot more that can be done there. We have already made an announcement on our partnership with edotco with regard to tower sharing.

But there is no RAN sharing in the country at the moment. Domestic roaming has been done, where we (telcos) carry each other’s traffic. But RAN sharing is different — it is the next step.

When do you see RAN sharing taking off?

I hope sooner than later, but that is something for the industry to work towards. We have done it in other markets with Telenor — Sweden, Norway. We already have the expertise and we know how the model works. But here, the industry still needs to make the decision.

Has the Big Three sat down to talk about RAN sharing yet?

No, but the industry is already collaborating in other areas, so it’s only a matter of time. It won’t be that far off.

Elsewhere, telcos operate with lower margins. Can Malaysian telcos?

The scale and number of subscribers are different. The customer base is also different. The profitability and attributes of the companies are also different. Are the margins too high? I believe that the margins, as we guided, are needed to sustain these levels, to run the business and provide the products and services that we do.

If margins come under more pressure, will you have to trim dividends?

We have to make that decision at that time, but we have a dividend commitment of at least 80%. We won’t go below that.

Between dividends and capital expenditure (capex), which will give way first if it comes to it?

None. We just have to make sure that we deliver on our ambitions. We have to look forward by five years as well. Not only we have to grow the business but we also must become a digital player. If you look at our five-year plan, we have to be an internet company. Our core services today, in the future, you might know them as frills maybe, while the core business will be around internet and digital services.

If we don’t start the transformation now, we will face the challenging situation that you are asking about. Our plan is not to get to that point. [We plan] to transform now. To monetise non-core and digitise the products and services we offer today, bring a lot more efficiency to our back-end capability and empower customers to do a lot more.

What are your thoughts on the spectrum re-farming?

Our disadvantage was that without the low-band spectrum, we couldn’t [penetrate] further, which is why we are very happy with the current spectrum allocation. We are still waiting for the government to finalise the spectrum’s commercial value. We will know that soon. We hope the government runs this same process for the other bands — 700MHz, 2600MHz, 2300MHz. Those bands are all extremely valuable for internet. It’s a major national resource.

Does it encourage more competition?

I would separate the two. One is providing services and experiences. We need spectrum. Spectrum should be given to the guys who have invested in the networks and customers. By all means, they should have the spectrum for commercial value. Now, will this intensify the competition? I don’t think so. I think when we have the spectrum, if we have the commitment to deploy, to roll out the network, you need to run a profitable business that enables you to continue to invest. Investment is not a one-off thing. We have invested continuously, about RM900 million, on capex and that’s just capex. Forget about opex (operating expenditure) in terms of sustaining the networks.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.