This article first appeared in The Edge Malaysia Weekly, on November 2 - 8, 2015.

Depending on who you ask, Malaysia’s Budget 2016 is one that is prudent with conservative but achievable goals, or unconvincing with no solutions to the country’s “real” and structural issues. But there should be no argument as to which way the Malaysian economy is heading next year.

Depending on who you ask, Malaysia’s Budget 2016 is one that is prudent with conservative but achievable goals, or unconvincing with no solutions to the country’s “real” and structural issues. But there should be no argument as to which way the Malaysian economy is heading next year.

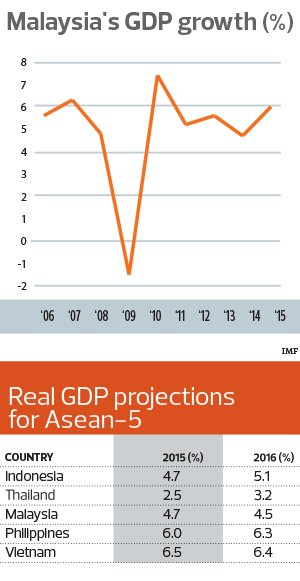

The Ministry of Finance (MOF) has projected gross domestic product (GDP) growth to moderate to 4% to 5% in 2016, a touch below the 4.5% to 5.5% anticipated under the revised Budget 2015. It is made, Prime Minister Datuk Seri Najib Razak said, with the awareness that the Malaysian economy will not be spared from a slowdown in the global economy, declining commodity prices and the depreciation of the ringgit.

As such, Malaysia must put her fate in her own hands, and the domestic economy will have to pick up the slack of exogenous elements and push forward. But, can it be done with the recently tabled budget?

The Malaysian Institute of Economic Research reported that consumer confidence in Malaysia sank to an all-time low of 70.2 points in the third quarter of 2015. At the same time, the Business Conditions Index dropped for a second consecutive quarter to 86.4 points as overall manufacturing sales declined amid lower new domestic and export orders.

In fact, MOF’s assumptions in Budget 2016 do not give much to cheer about. The Economic Report 2015/2016 projects that private consumption growth will slow from 6.8% in 2015 to 6.4% and private investment growth to decline marginally to 5.1% from 5.2% in 2016.

Meanwhile, public consumption will stutter to 3%, from 3.6% next year. Total trade is expected to shrink 0.9% this year, with gross exports to contract 0.7% (revised from 1.5% growth). Exports will recover in 2016 but growth will be weak at just 1.4%.

Observers also noted that apart from the large development expenditure allocation of RM50 billion to kick start the 11th Malaysia Plan, Najib’s Budget 2016 is lacking in tangible economic stimulus. On the contrary, taxes on the rich have increased. Malaysia’s hands are tied owing to her national debt and fiscal constraints.

The bright spots in the budget are the increase in financial support to lower income groups through handouts like the Bantuan Rakyat 1Malaysia (BR1M) scheme with a RM5.9 billion allocation, an increase in the minimum wage and civil servants’ pay and extension of the Goods and Services Tax (GST) zero-rated list.

However, economists doubt that these will have an impact on boosting consumer spending.

Economist Lee Heng Guie tells The Edge, “If you look at the impact of BR1M and wage hikes over the last two budgets, it was to mitigate the rising cost of living.” He opines that the extra grants and higher wages do not raise peoples’ purchasing power because of the higher cost of living.

HSBC Research economist Lim Su Sian believes real GDP could slow to 3.6% in 2016. She says in an Oct 24 research note, “There currently exists a high level of precaution among consumers, particularly with regard to the labour market outlook — an area that the budget did not address.”

“Consequently, it is difficult to see the handouts and wage hikes suddenly translating into sustainably stronger private consumption. Higher minimum wages will also be an additional burden on firms, many of whom are already grappling with excess capacity amid a fall in both external and domestic demand, as well as rising import costs (due to the ringgit’s weakness).”

Further, public spending growth, which is expected to grow marginally, has been made based on “very optimistic” revenue assumptions. The oil price is assumed to be US$48 per barrel, with oil revenue of RM31.7 billion. GST collections are projected to surge to RM39 billion. This should offset the loss in earnings from oil-related activities next year. However, GST collection is precariously dependent on domestic consumption levels.

“It is a tight budget they are running. So, any shortfall from their assumptions would mean that they will need to revise their budget and targets,” says Lee.

Despite these factors, the consensus among economists is that GDP growth of 4% to 5% is still within reach.

“Private consumption growth has been strong in Malaysia, even when consumer sentiment was weak in 2Q2015. It has been stronger than economists’ expectations and so there is no reason to expect any strong headwinds from that in 2016. We expect the economy to start picking up in 2Q2016,” says MIDF Research economist Izzuddin Yusuf, who has a 4.8% GDP growth estimate.

The International Monetary Fund (IMF) recently revised the GDP growth forecast for the Asean-5 countries — Malaysia, the Philippines, Indonesia, Thailand and Vietnam — to an average of 4.6% in 2016. For Malaysia, the IMF anticipates GDP growth of 4.7% this year and 4.5% in 2016.

The forecast is within MOF’s range.

There may be headwinds ahead for Malaysia but in setting a lower GDP target, economists say the government has already factored in the downside risks to the domestic and global economies. They will not be alone in hoping that to be true.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.