'WE are not going to be sullied by a single project'

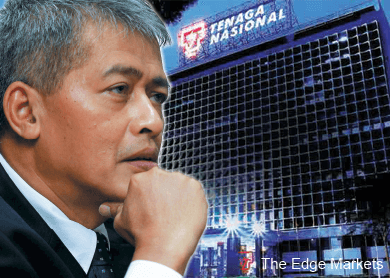

Since taking office in 2012, Datuk Seri Azman Mohd has been a tough man to get hold of, preferring to stay out of the media spotlight. But as he heads into his second three-year term with Tenaga Nasional Bhd starting July, he shares his ambitions for the company and clears the air over issues like 1MDB’s Project 3B and Tenaga’s competitiveness.

The Edge: Managing Tenaga is a challenging job. How do you find it?

Datuk Seri Azman Mohd: Very exciting and very interesting. I think we are just about to begin the growth of Tenaga. We are benchmarking ourselves against the world. Generation, transmission and distribution (T&D) — our technical performance in all three is now at international standards.

Now, alhamdulillah, we have a quite good financial performance that will help us maintain those technical performance. With a stable financial standing, you can afford to invest in so many things — building capability and making sure people are going to sustain this growth.

Your contract has just been renewed for a second three-year term, starting in July. Why did you decide to stay on?

I think the three short years, my first term, was [spent] laying the foundations. Somebody needs to finish it and make it stable. I am glad I have another term to make all the revision I’ve already made for Tenaga to come to a more concrete level. I think there are exciting times ahead.

There is a full transformation we are embarking on that will make us world-class.

There is a lot of value in Tenaga, but we did not have time to unlock it before when we were struggling for survival. Now that everything is running smoothly, we can look to unlock value by improving efficiency.

We call it a lean organisation, but don’t mistake it as a headcount cut. We have 35,000 people and we are looking at how to unlock that value.

Some of our core units can be turned into subsidiaries that work on a P&L (profit and loss) accountability. Why be a cost centre when it can stand on its own and be profitable?

Is it challenging working with the unions? Does having such large unions make it hard to automate certain processes?

On the contrary, [actually]. The unions are working very well with us. We bring them overseas so they can see for themselves how their counterparts do things.

Take smart metering, for example. No meter reader is required at all. They (the union leaders) say, ‘We know that is the future, we accept it. But let’s try a redeployment strategy so they (the workers) can be channelled to do different jobs.’

I think one of the things we worked on was building trust in the relationship. In Malaysia, at the moment, that is a missing commodity — where people keep questioning everything.

If I don’t have that (trust) in my people, and I have to explain everything, it takes much longer to do things. But we have the trust here.

We do things for the company. If we make the cake bigger, they (the staff) will also get more.

The local market is saturated. Where is the growth potential for Tenaga?

If you look at IBR (incentive-based regulation), a fixed return, then we are tagged to the GDP (gross domestic product) of the country. That’s it. That is life. You get 7.5% return on rate base (RORB). You comply with all the syarat-syarat (regulations) and you improve your operational efficiency. But once I reach the optimal level, what else is there?

There is no choice, I have to look outside. We will look for generation first. It is the most promising at the moment. Of course, we are looking at the others also.

We looking at countries that fulfil our risk appetite and have a high rate of growth. Maybe six months from now, you will hear more news.

Fortunately, Tenaga’s brand reputation is very good. We are not going to be sullied by a single project. The board will not let us, not for a single project to hurt our reputation. We can never let one project make Tenaga fall.

Project 3B

What is the status of Project 3B?

I want to clarify that at this moment, we have not received any offers from the Energy Commission (EC) or the government to take over the project. However, whatever the decision of the government, it will be subject to commercial considerations and in line with our corporate governance.

But are you interested to take over the project?

We are interested, no doubt, but it is not up to us. It is in the EC’s hands [on what to do with Project 3B].

However, we feel that we are in a perfect position to do this project. Given our record of completing such projects, as opposed to the IPPs’ (independent power producers), we are in a good position to complete it with minimum delays.

Keeping the lights on has been our mantra.

The bottom line is, who is going to suffer if there is a [power] shortage?

Are you in discussion with 1MDB or Edra Global Energy Bhd on the terms of taking over Project 3B?

We have not yet been offered the project by the government or the EC.

Have you done due diligence on the project?

As a company, we explore every option, but we do not have any commitment at all with any parties. It is not our decision to do anything at the moment. As far as we know, it is the government’s decision to transfer the project.

Do you think Project 3B is viable as it is?

The project is viable. However, the project cost must be revised. Because interest rates and forex (foreign exchange) have changed. The levelised tariff has to be revised to take into account these changes in forex. Some of the things — the infrastructure and so forth — may not be adequate.

Did 1MDB put in a bid that did not have enough infrastructure?

In the bidding process, a lot of people want to cut corners and minimise things. We believe strongly that whatever we do, commercial considerations, we want to keep the lights on. We want to make sure that there is reliable electricity and a reliable plant.

What infrastructure are you referring to?

I don’t think I want to share that. We believe we have to review the whole project to make it feasible, including the levelised tariff.

Will this result in substantial cost escalation?

No, I do not think so. But we cannot do it at that (the original) price. We believe that this review can be made very transparent to the EC. The EC will have an open book with us in this respect.

How much extra will it cost?

A lot of people are interested in this project, so I am not keen to share this. Malakoff [Corp Bhd] has already expressed its interest.

We understand that the site is challenging due to the extensive land reclamation. Would it make sense to scrap Project 3B and plant up elsewhere, cheaper and quicker? Does Tenaga have the capacity to do it elsewhere?

We believe it makes sense to continue this project. All the problems that 1MDB has had, we believe we can work them out.

Even with the extensive land reclamation required at Jimah, Selangor?

For me, the fastest will be this project, rather than a new project. Land preparation [at another site] itself will take years. Settling the land will take time.

What about the site you proposed when bidding for Project 3B?

We don’t own the other site anymore either, since we did not win the bid. Of course, we have other sites, but it will take time.

What happens if Project 3B isn’t saved?

If decisions are made fast, the project will only take six months longer. But we must proceed now.

Otherwise, the EC will have to come up with contingencies, which include the extension of power plants that are about to expire. We need to accelerate other projects and make sure there are no other delays. Alternatively, the EC can come up with a super-fast project. And we believe only Tenaga can do that.

What would happen to the penalties that 1MDB and Mitsui & Co owe, estimated to be RM220 million, if Tenaga were to assume Project 3B?

You would have to ask the EC about this, but it is not the way we approach 3B. The EC should come up with a figure (levelised tariff) to reflect today’s cost. If we can do the project at that level, then we will say yes. This will safeguard Tenaga from overspending.

What is the minimum internal rate of return (IRR) you are willing to take for this project?

Our weighted average cost of capital (WACC). It is decided by the EC.

What was the original return you were willing to take on Project 3B?

It was so long ago. But it was above our WACC. It is our hurdle rate or the project isn’t good enough for us.

What price will you pay for the project? Will you pay a premium?

No premium. The principle is that we will pay Edra for whatever cost they have put in. To make the project viable, they may have to take a haircut.

We are not going to do any bailout here. We don’t see anyone who can do this better than us — financially, professionally. If we are given a good tariff and they (Edra) take a haircut, if needed, for us, all bets are off.

Because Jimah Power Station is in close proximity and there is a lot of shared infrastructure, do you have to acquire the remaining equity in Jimah?

No. We will acquire Project 3B so that it is self-contained. We want to do things clean.

The decision lies with the government, but if the price is not right, can you say no?

Yes. We are a listed company. We have our own governance. Everything must be subject to the governance. The final decision lies with our board. That’s the difference with a listed company — we have very high governance.

On Acquiring Edra

What is Tenaga’s position on acquiring Edra as a whole, or even a strategic stake?

As far as we know, Edra is on track to an IPO (initial public offering).

What if you were given the opportunity?

This is a difficult situation. We are a power company. We do power generation. If any opportunity comes along, we will consider. It is our core business. But, of course, the question is, at what price?

It must add value for the shareholders. As a listed company, we cannot do otherwise. It has to be a fair price. A good price even. In fact, we are in a position to get a very good price, you know?

Has anyone from 1MDB approached you to discuss the possibility of acquiring Edra?

No. Officially, no one has approached us.

Have you spoken to Khazanah Nasional Bhd on the takeover of Project 3B, as well as Edra?

Khazanah is our largest shareholder and is always in the loop.

Project 4A

It is understood that Project 4A was submitted to the EC for approval and the tariff was about 12% higher than the reference rate — Prai. Why is this the case?

Costs have increased due to changes in forex and interest rates.

Are you confident in getting the tariff approved?

The decision is up to the EC. If they think the tariff is too high, they can always give the project to someone else.

On Competition

The EC recently announced the New Energy Dispatch Arrangement rules that pave the way for a merchant market, where IPPs compete to generate power, as opposed to relying on fixed PPA (power purchase agreement) terms. What are your thoughts on this?

In a competitive environment, we stand a very good chance. Even in the bidding process [for new projects], we are very competitive as long as our hands are not tied. We like to be proud, to say that we are good and can win in any competitive system.

Having said that, though, there is a different school of thought — that as an emerging country, as a country that is growing rapidly, a different system may work better.

We have a PPA system. Whether it is a liberalised or non-liberalised market, it is good for a certain type of country for a certain time. I think the timing is crucial. We need to make the right decision — whether this kind of system is adequate for Malaysia at this point in time. We are not saying one system is good and the other is bad. They have different characteristics. We have to take cognisance of that fact.

If you are confident in any competitive system, would you advocate open tender over direct award?

We are a proponent of the 3M model. That calls for an open bidding process. We have won on open tenders — Prai and Project 3A.

One of the disadvantages of open bidding is that people want to cut corners. People want to give the lowest levelised tariff [to win]. They may underdesign. This has happened in the past.

When some of the plants go down, sometimes they put a spin to it and blame us.

It depends on what the government wants. The government wants more players, so it uses open bidding. But then, people give a very low levelised tariff and are unable to complete it, or they are not able to run it reliably.

It’s true that they can be penalised. But the cost is still more than the penalty.

How do you find the plant-up programme over the past few years?

The major change [in the plant-up programme] — we were supposed to have open bidding, but recently, it has not been so.

Early on, the EC was telling us it will be an open-bidding process. But it hasn’t been 100% in line with that. The EC must have their reasons for that. But for us, as a power company, we have to keep the lights on. Not only we have to keep the lights on [but also] we have to make sure our customers get the best deal.

Of course, we are not in a position to control everything. The EC and the ministry have their own reasons to do what they want. But within their context, we will maintain these two points.

On Transparency

What is the status of the IBR?

Our accounts are already unbundled. It is up to the EC to share them. We need to educate the public. It is not as simple as publishing them. Sometimes when people do not understand, a lot of spin can be put into them.

If you want to make them public, we have to make some proper disclosures so people can understand what we are talking about and are on the same page.

Malaysia has enough misunderstandings as it is. We don’t want to add to them. But we are all for transparency.

Without the disclosure of the accounts unbundling, Tenaga can potentially cross-subsidise its generation unit with the regulated T&D unit. Is this the case?

No. When the EC looks at our T&D returns, it looks at return on rate base. It is capped at 7.5%, averaged over three years. It does not include generation. We can’t cross-subsidise.

T&D returns are virtually risk-free and capped at 7.5%. Does this mean that generation, which is risky, requires a higher rate of return? Inversely, if Tenaga is willing to accept returns lower than 7.5% for risky generation, shouldn’t it be willing to settle for a lower return on regulated T&D assets?

In generation projects, we don’t use our RORB. We use project IRR. You can compare the two, but it is not apple to apple. I am not sure how much we make on each project, but it must have a positive net present value.

We consider them as separate businesses. For generation projects, there is a very clear rate of return, a hurdle rate that we have to clear — our WACC. However, that varies over time due to interest rates.

As for T&D, it is very clear — 7.5% over three years.

The industry has been suffering from margin compression. Yet, Tenaga’s earnings and share price have been performing very well. Why the divergence? Is Tenaga making excessive profits?

Unfortunately, there is a predictability of regulated returns. This has been the bane of investors who do not see predictability. Before, every time fuel costs go up, we have to start appealing for higher tariff. But with ICPT, fuel is a pass-through.

Are you worried about a rebound in fuel prices?

Under IBR we are not affected because it is a pass-through. Last time, when prices go up, our faith goes down. But theoretically, fuel is strictly a pass-through.

Our tariff has gone down and we have some savings from the recent [low] fuel prices. It is up to the government what it wants to do with that. I can’t comment on behalf of the government. I just collect.

Are you confident in how the ICPT works? You still don’t make the decision on the tariff hike.

It still needs to be tested. So far, we are having a good run. To answer your question, nobody knows the answer until it has been tested.

What is the situation with the gas supply?

Everything above 1,000 mmscfd we are paying market prices. Anything below, we are paying RM15.20. It is subsidised natural gas.

How are you importing the LNG?

Hundred per cent from Petronas. They are still working out the open access. We are not able to buy from other sources yet. The mechanism is not yet in place.

Can you confirm that Tenaga is in talks with JAKS Resources Bhd to undertake the 2x600mw coal power plant project in Vietnam?

If it makes commercial sense, we will do it. It has not been brought to the final board. We still want them to come up with a good financial offer. We are still negotiating.

This article first appeared in The Edge Malaysia Weekly, on May 18 - 24, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.