This article first appeared in The Edge Financial Daily on April 27, 2018

KUALA LUMPUR: CIMB Group Holdings Bhd said it could perform “materially better” in its financial year ending Dec 31, 2018 (FY18), as it aims to not just hit, but overachieve, all of its T18 targets.

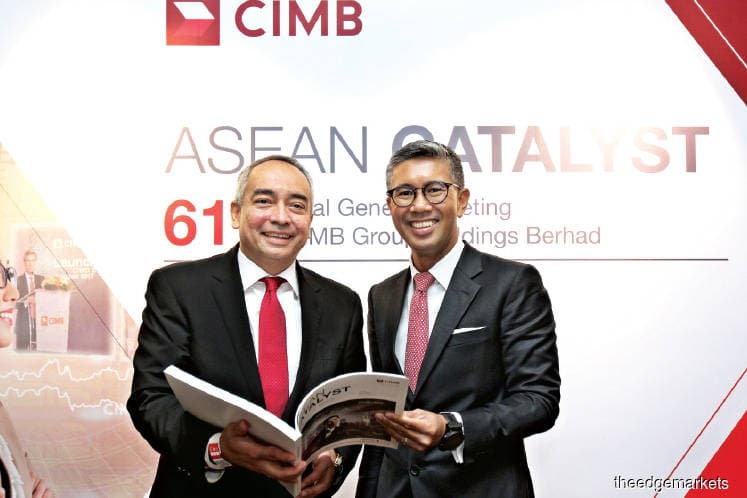

“We are cautiously optimistic about 2018, and that’s quite a positive statement. Our focus is to exceed our T18 targets at the end of this year, and by definition, if we think we can exceed our T18 targets, then we would do materially better this year,” said its chairman Datuk Seri Nazir Razak at a press conference after CIMB’s annual general meeting here yesterday.

T18 – short for Target 2018 – refers to a set of goals set out by the banking group in 2014, which includes achieving 10.5% to 11% return on equity (ROE), cost-to-income ratio (CIR) of 50%, common equity tier 1 (CET1) of 12%, and a combined income contribution of 60% from consumer and commercial banking segments.

Currently, CIMB has exceeded its CET1 target at 12.2%, but is shy of its other targets – with ROE at 9.6% as at end-2017, CIR at 51.8%, and income contribution for the aforesaid segments at 57.2%.

Additionally, the group is targeting a loan growth of 6% — stronger than the overall Malaysian banking industry — this year, driven mainly by its consumer, wholesale and corporate banking segments. Deposit growth is also expected to grow in tandem with its loan growth.

“For the first four months, we have been on track. We feel that we are able to meet that (loan growth) target in Malaysia, but [we] will see some challenges though in other countries,” said group chief executive officer Tengku Datuk Seri Zafrul Aziz, adding that loan growth should hover around 5% in its Indonesian and Thai markets.

While costs are poised to grow every year, Tengku Zafrul added that the group is moving in the right direction, and aims to bring down its CIR to less than the targeted 50% this year, from 51.8% as at end-2017.

“Costs grew 2% to 3% as shown in the past three years, and it still goes up every year because we will need to make investments. We will need to ensure income goes up faster,” Tengku Zafrul said.

He added that adoption of the newly-implemented financial instrument standard, Malaysian Financial Reporting Standard 9 (MFRS 9), should cause minimal impact of 50 to 70 basis points on capital growth of the group, mainly coming from its Indonesian operations.

Noting shifts in the banking landscape led by the fourth industrial revolution, Nazir said CIMB has begun processes in developing a new blueprint for the group post-expiry of T18.

On Wednesday, the group announced its zero-fee interbank fund transfers for its online platform CIMB Clicks and mobile banking apps, Clicks and EVA, in view of the growth in electronic transactions.

Nazir said CIMB will look beyond just offering digital banking options, as technology has “devastating effects” on many incumbent businesses and standing still is not an option.

“[We] have to think about collaborating with other companies such as financial technology (fintech) [players], about the advent of global payment players such as Alipay and Tencent, and how [we] will adjust [our] business to compete with that new reality,” he added.

The group said the fee waiver would have minimal impact on the bank’s non-interest income, and hopes other banks would follow suit in support of the country’s cashless society agenda.

As at end yesterday, CIMB had a market capitalisation of RM66.42 billion, after its counter finished the day three sen or 0.42% up at RM7.20.