This article first appeared in The Edge Financial Daily on February 25, 2020

KUALA LUMPUR: Carlsberg Brewery Malaysia Bhd and Heineken Malaysia Bhd’s market capitalisation combined eroded RM2.03 billion yesterday as the two brewers topped the list of losers on Bursa Malaysia.

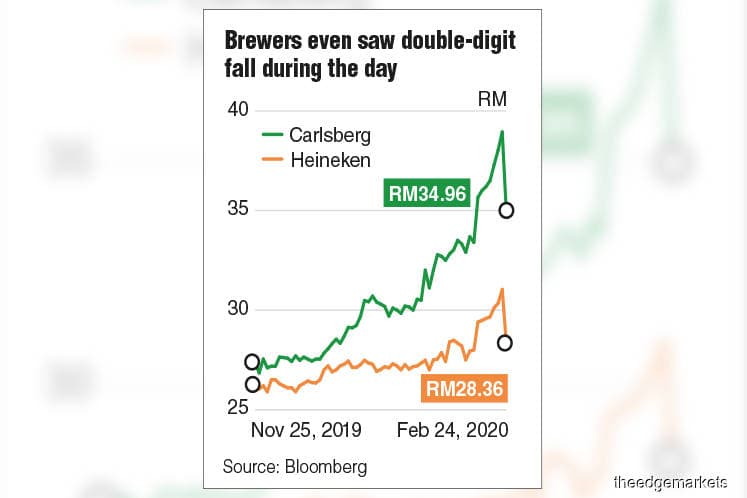

Carlsberg’s share price closed RM3.98 or 10.22% lower at RM34.96, its largest one-day drop since Aug 5, 2009 (-10.89%). Earlier, the counter fell 16% to an intraday low of RM32.70.

Heineken shares closed 8.63% or RM2.68 lower at RM28.36, its largest single-day fall since June 24, 2013 (-9.87%). Earlier in the day, it was down as much as 13.34% to RM26.90.

At yesterday’s close, Carlsberg’s market capitalisation was RM10.69 billion, while Heineken was valued at RM8.57 billion.

Profit-taking was expected for the two counters after they hit all-time highs last Friday, but yesterday’s sharp fall was also due to a selldown on Bursa following political turmoil in the country that started at the weekend.

Both breweries had announced a stellar performance for the year ended Dec 31, 2019 (FY19). Carlsberg reported its highest-ever annual net profit of RM291.02 million and declared total dividends of RM1 per share.

Heineken, since changing its financial year end in 2016 to Dec 31, saw its highest full-year net profit at RM312.97 million, and declared total dividends of RM1.08 a share.

According to Bloomberg data, there are 11 research houses covering Carlsberg, with one “buy” call, four “holds” and six “sells”. At the current share price, the counter has an upside of 2.5% to its target consensus target price (TP) of RM33.56.

Heineken has six “buy” calls, three “holds” and two “sells”, with a consensus TP of RM31.94, implying a 12.62% headroom from its closing price.