This article first appeared in The Edge Financial Daily, on May 19, 2016.

KUALA LUMPUR: Bluetooth device maker Salutica Bhd made a firm debut on the ACE Market of Bursa Malaysia yesterday at 86.5 sen, 8.13% or 6.5 sen higher than its offer price of 80 sen, though it pared some gains at the end of trading hours to close at 82.5 sen, still 3.15% or 2.5 sen higher.

It saw some 74.03 million shares traded, making it the fourth-most active counter on the local bourse.

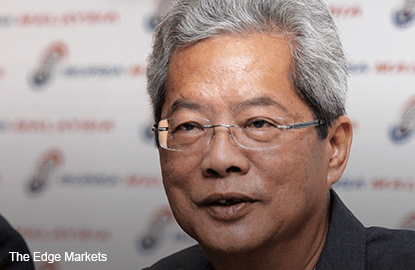

Salutica managing director and chief executive officer James Lim said the stock’s debut performance was a great start for Salutica, and that the company is optimistic about its growth potential as the Bluetooth-enabled device market is still not saturated.

“It is not like the smartphone market, which is getting saturated. The Bluetooth market is different; it has not reached a point where companies are shipping billions of Bluetooth [devices] a year,” he told reporters after the company’s listing ceremony yesterday morning.

Besides being primarily involved in the design, development and manufacture of consumer electronic products, such as Bluetooth devices, Salutica also makes other electronic products, and precision parts and components — like optical light guides, 3D glasses and electronic door locks — for external brands.

This year, the company’s revenue will be driven by its existing multinational clients and its FOBO-brand tyre pressure monitoring system, known as FOBO Ultra, which will be launched by early July, said Lim.

“We are aiming to get clients in the heavy and commercial vehicle segment with FOBO Ultra,” he said, adding that Salutica is also in talks with a potential client to develop a USB-powered product with touchscreen functions.

Salutica said it had successfully raised RM62.4 million of proceeds from its initial public offering (IPO). Of the proceeds, 40.1% or RM25 million will be channelled towards its capital expenditure for purchase of new machineries and equipment.

Its IPO involved the issuance of 101 million shares, comprising a public issue of 78 million new shares and an offer for sale of 23 million existing shares. The retail tranche of the IPO of 19.4 million shares was oversubscribed by 9.98 times.

Based on its closing price yesterday, Salutica’s market capitalisation stood at RM320.1 million.