This article first appeared in The Edge Financial Daily on February 11, 2020

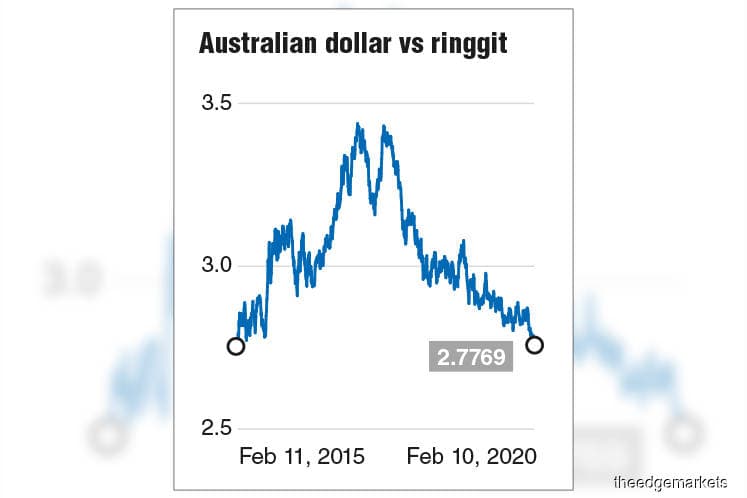

KUALA LUMPUR: The Australian dollar was trading at its five-year low versus the ringgit yesterday to settle at 2.7603 as at the time of writing, remaining below the 3.0 mark, as the country’s imposed widespread ban on non-citizens arriving from China delivered a fresh blow to the bush fire-hit country.

The currency had earlier tumbled to its 10-year low of 2.7412 against the ringgit on Jan 31 as investors weighed economic damages that may trickle down from the double whammy of the fast-moving Wuhan virus outbreak and raging blaze.

Australia is among the latest countries to impose a Wuhan virus travel ban, which bars non-citizens from entering the country until 14 days after they have left or transited through China.

With China being Australia’s No 1 export market, its largest source of international students, a major source of foreign direct investment and its largest agricultural goods market, it is no doubt that the Australian dollar is bearing the brunt as the ban adds more downside risks to its economy. According to its government data, Australian exports to China stood at US$93.04 billion (RM386.12 billion) in value and reportedly accounted for about one-third of all Australian exports.

On tertiary education, the International Education Association of Australia and chair of the International Education Global Reputation said Chinese students account for a third of all of Australia’s international students, and if they are unable to come to the country to start or resume their courses, Australian institutions stand to lose as much as a whopping A$8 billion, or approximately RM22.20 billion.