Muhibbah Engineering (M) Bhd

(Dec 18, RM1.83)

Initiate “buy” with a target price (TP) of RM2.74: Muhibbah Engineering’s business is segregated into four core segments: i) infrastructure construction; ii) crane manufacturing via a 61% stake in Favelle Favco Bhd; iii) shipyard; and iv) concessions involving road maintenance and airport operations which generate stable earnings.

The other business activities include manufacturing and supply of aircraft maintenance docking systems, providing turnkey intelligent transport system solution, and manufacturing of non-carbon required papers.

Prospective catalysts include: a) awards of job packages under Refinery and Petrochemical Integrated Development project and mega infrastructure projects in Malaysia, particularly the remaining RM2.2 billion worth of jobs for West Coast Expressway; b) stronger growth in crane orders; c) improvement in profit contribution from shipbuilding business; and d) higher recurring income from both of its associate companies involved in road maintenance and airport operations.

Downside risks include a slowdown in global economic growth, deferment of 10th Malaysian Plan, Economic Transformation Programme projects, and volatility and decline in oil prices.

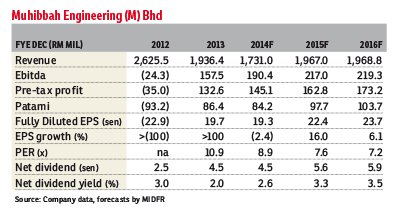

Our financial year 2014 (FY14) to FY16 earnings estimates of 19.3 sen, 22.4 sen and 23.7 sen respectively imply a compound annual growth rate of 11.2% over the next two years. This will be backed by a decent outstanding order book of RM2.5 billion and upcoming new jobs.

We initiate coverage on Muhibbah Engineering with a “buy” recommendation and a TP of RM2.74. Our TP is derived based on FY15 sum-of-parts valuation, implying an appealing forward price-earnings ratio (PER) of 12 times. — MIDF Research, Dec 18

This article first appeared in The Edge Financial Daily, on December 19, 2014.