KUALA LUMPUR (May 2): 1Malaysia Development Bhd's (1MDB) US$3.5 billion (about RM15 billion) settlement with International Petroleum Investment Co (IPIC) "deserves at the very least" Malaysia's Public Accounts Committee (PAC) chairman Datuk Hasan Arifin's acknowledgement.

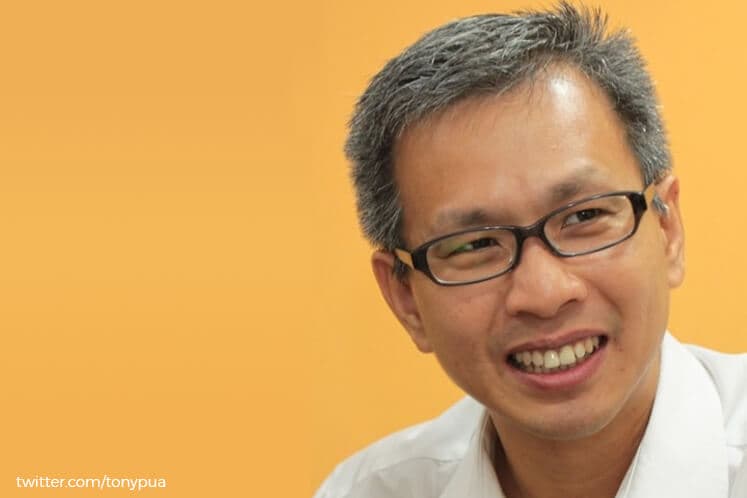

Petaling Jaya Utara MP Tony Pua said in a statement today the matter deserved the PAC's attention as the committee has been tasked to scrutinise government-related expenditures.

"The fact that the loss of US$3.5 billion is staring at Malaysian faces today deserves at the very least an acknowledgement from the chairman of PAC, the very institution conceived to check and scrutinise Government-related expenditures.

"After all, why would the Government then under all rational circumstances concede to the demands of IPIC if there was nothing incriminating on the part of 1MDB?" Pua said.

The Malaysian Government wholly owns 1MDB. At the time of writing, the Government and Hasan had not issued statements in response to Pua's statement.

Last week, 1MDB and IPIC said in separate statements that both companies had agreed on a settlement involving the US$3.5 billion worth of 1MDB bonds, which mature in 2022. The agreement also involves Aabar Investments PJS and Minister of Finance (Inc) Malaysia (MoF Inc).

According to IPIC's statement to the London Stock Exchange, "1MDB and MoF Inc undertake to IPIC to assume responsibility for all future interest and principal payments under the two bonds issued by 1MDB Group companies that are guaranteed by 1MDB and IPIC: (i) US$1.75 billion fixed rate 5.75% notes due 2022 issued by 1MDB Energy (Langat) Limited and (ii) US$1.75 billion fixed rate 5.99% notes due 2022 issued by 1MDB Energy Limited."

1MDB said in its statement that it "will, amongst others, make certain payments to IPIC and will assume responsibility for all future interest and principal payments for two bonds issued by 1MDB Group companies due in 2022".

According to 1MDB, it will meet these obligations primarily via monetisation of 1MDB-owned investment fund units.