KUALA LUMPUR: Bank Negara Malaysia (BNM) governor Tan Sri Dr Zeti Akhtar Aziz has reaffirmed that the country’s banking system is resilient, and will not collapse in the event of loan defaults by highly leveraged entities such as 1Malaysia Development Bhd (1MDB).

The governor said the weakening ringgit, which was trading at 3.7040 against the US dollar yesterday, was not a result of concerns about any potential default by 1MDB on its debt obligations.

The government strategic investment fund had reportedly accumulated debts amounting to RM42 billion as at end-March 2014.

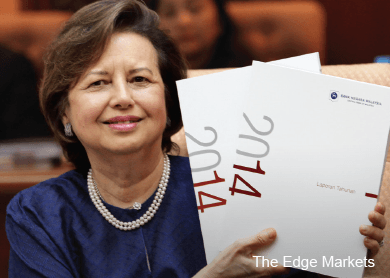

“From time to time, there is an entity that is highly leveraged and we will look at the potential implication of that highly leveraged entity on our banking system,” she told reporters after launching BNM’s Annual Report 2014 here yesterday.

She said the main contributing factors to the ringgit’s performance, which was its weakest in six years, were external developments from different monetary policy changes that are occurring, as well as the drop in Brent crude oil prices that had fallen by 50% from June last year to US$57 (RM211) per barrel currently.

“In 2014, there was also another factor causing the weakening of the ringgit, which was the fact that there were significant [fund] outflows by large Malaysian institutions that were making investments abroad, but these institutions should recognise at this point of time to [limit] these investments for their own benefit given that our currency has depreciated and also in the interest of the economy,” she said.

When asked if there were signs of Malaysian residents speculating on the ringgit overseas, Zeti said no.

“The ringgit is not internationalised, which is bound by the definition that the ringgit cannot be lent to non-residents, which previously was a source of financing for speculators, so in that sense it has reduced the prospect of speculative activity,” she said.

On the ringgit’s poor performance, the governor reiterated her stance that the currency is undervalued, as there are strong fundamentals in the country to support the currency.

“Our international reserves of BNM as at Feb 27, 2015 was at US$110.5 billion, which is sufficient to finance 7.9 months of retained imports and 1.1 times the short-term external debt, and we believe we are one of the stronger economies in the region, with unemployment levels at less than 3%,”she said.

Zeti said the country has well-developed financial markets that can absorb volatility in the currency market.

On whether the ringgit’s weakening is a cause for concern for businesses, the governor said it is vital for foreign exchange exposures to be managed now.

“That is why we have liberalised our [foreign] exchange administration rules … now businesses can hold foreign exchange accounts, engage in hedging activities that are not limited to a certain amount or time period, and therefore with all these flexibilities and information that they have they (the businesses) need to be well positioned to manage foreign exchange exposures,” she said.

The ringgit had fallen 12.9% from 3.2804 against the US dollar a year ago.

The governor also highlighted that BNM conducts quarterly solvency stress tests for banks which will be able to detect any vulnerabilities in the financial system.

On reports alleging that 1MDB had resorted to offshore financing activities to avoid BNM regulations, the governor declined to comment.

“We cannot comment on any single borrower or any single institution, [as] I am prohibited by law to talk about any single borrower or institution,” she said.

Zeti also declined to comment on reports calling for BNM to investigate the alleged money laundering by businessman Low Taek Jho and his associates in the acquisition of Utama Banking Group via PetroSaudi International (Seychelles) Ltd using illicitly obtained funds from 1MDB.

“All we can say is that if there are any contraventions to the Anti-Money Laundering Act by any single individual or organisation, BNM will investigate [if the underlying offence pertains to laws administered by BNM],” she said.

This article first appeared in The Edge Financial Daily, on March 12, 2015.