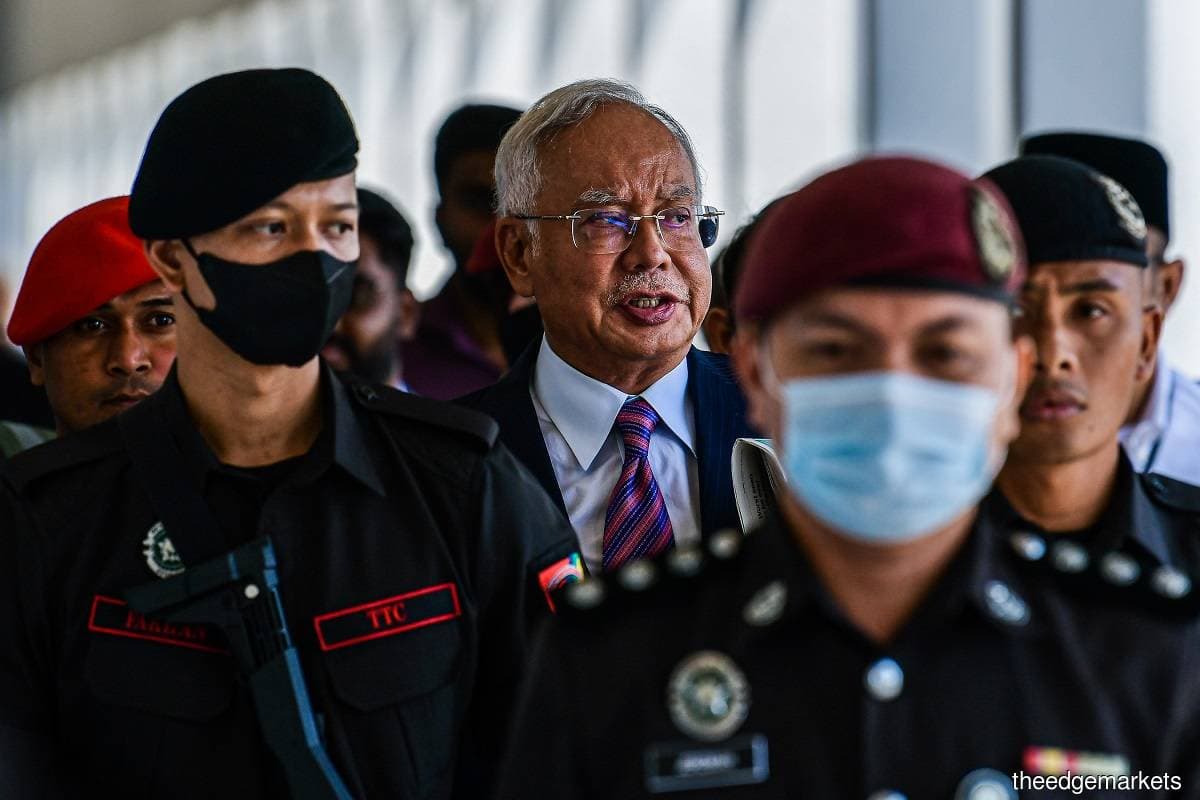

KUALA LUMPUR (April 2) : Former prime minister Datuk Seri Najib Razak's fourth trial related to funds stolen from 1Malaysia Development Bhd (1MDB) will start on Monday (April 3). In this new trial, he is facing six charges of criminal breach of trust (CBT) involving the misappropriation of RM6.64 billion of government funds for the repayment of 1MDB debts, including US$1.2 billion to Abu Dhabi-based International Petroleum Investment Company (IPIC).

The four-day trial, in which former Treasury secretary general Tan Sri Dr Mohd Irwan Serigar Abdullah is also facing similar charges, is slated to take place until Thursday before High Court judge Datuk Muhammad Jamil Hussin.

Last week, the Federal Court, in a majority decision, dismissed Najib's review bid for his first 1MDB-related case involving the strategic investment fund's former subsidiary SRC International Sdn Bhd, thus affirming his conviction and sentence.

Najib has been behind bars since August last year, after having been found guilty of all seven charges — three each for money laundering and CBT, and one for abuse of power — in relation to RM42 million belonging to SRC. He was sentenced to 12 years in jail and a RM210 million fine for the abuse of power offence, and 10 years in jail for each of the CBT and money laundering charges. The jail sentences are to run concurrently.

In his second 1MDB case, he was charged with abuse of power in tampering with 1MDB's audit report, with former 1MDB president and chief executive officer Arul Kanda Kandasamy accused of abetting him. They were both acquitted by recently elevated Court of Appeal (COA) judge Mohamed Zaini Mazlan without either of their defence called earlier last month. The prosecution is appealing against their acquittal.

The third 1MDB case, where Najib has been accused of four counts of abuse of power and 21 counts of money laundering involving RM2.28 billion of 1MDB funds, is still ongoing in the High Court here before another recently promoted COA judge, Datuk Collin Lawrence Sequerah.

The case is commonly known as the 1MDB-Tanore trial, so named because it involved 1MDB's dealings with Tanore Finance Corp, a company the prosecution contends is linked to fugitive financier Low Taek Jho (Jho Low), and through which 1MDB's money had been allegedly siphoned into Najib's accounts and laundered.

The former PM also faces another money laundering trial involving RM27 million SRC funds, which has yet to begin.

Meanwhile, in this IPIC case, Najib and Irwan were first charged on Oct 25, 2018. But the case had to take the back seat for a while to make way for the SRC trial, the main 1MDB trial, and the audit report tampering trial.

Najib will be represented by Tan Sri Muhammad Shafee Abdullah, while Datuk K Kumaraendran will appear for Irwan.

Irwan, along with Arul Kanda, is also facing a lawsuit brought by 1MDB against them in May 2021, alleging breach of fiduciary duty, breach of trust and conspiracy. Among others, the strategic development company is seeking US$6.59 billion from the duo as a result of the purported breach that resulted in the strategic development company paying a sum of US$1.83 billion to 1MDB-PetroSaudi Ltd, which was converted into stakes in Brazen Sky Ltd, and subsequently converted into an investment in Bridge Global Fund.

1MDB also alleged that the duo's alleged breach of duties and breach of trust had resulted in a payment of US$1.265 billion to IPIC as part of a consent award dated May 9, 2017, and in US$3.5 billion being misappropriated from 1MDB to Aabar Investments PJS Ltd or Aabar BVI, an entity set up in the British Virgan Islands to fake it as IPIC's subsidiary, Aabar Investments PJS.

Meanwhile, it was reported on Feb 28 that IPIC and Aabar Investments PJS had agreed to pay the Malaysian government US$1.8 billion as settlement over a legal dispute involving a settlement agreement between 1MDB and IPIC. Malaysia had filed a challenge in a London Court against the agreement, which was negotiated during Najib's administration, claiming it was procured by fraud.