KUALA LUMPUR (March 6): Putrajaya has instructed banking institutions that recorded substantial profit to help low-income earners, commonly known as the B40 group, through their corporate social responsibility (CSR) programmes.

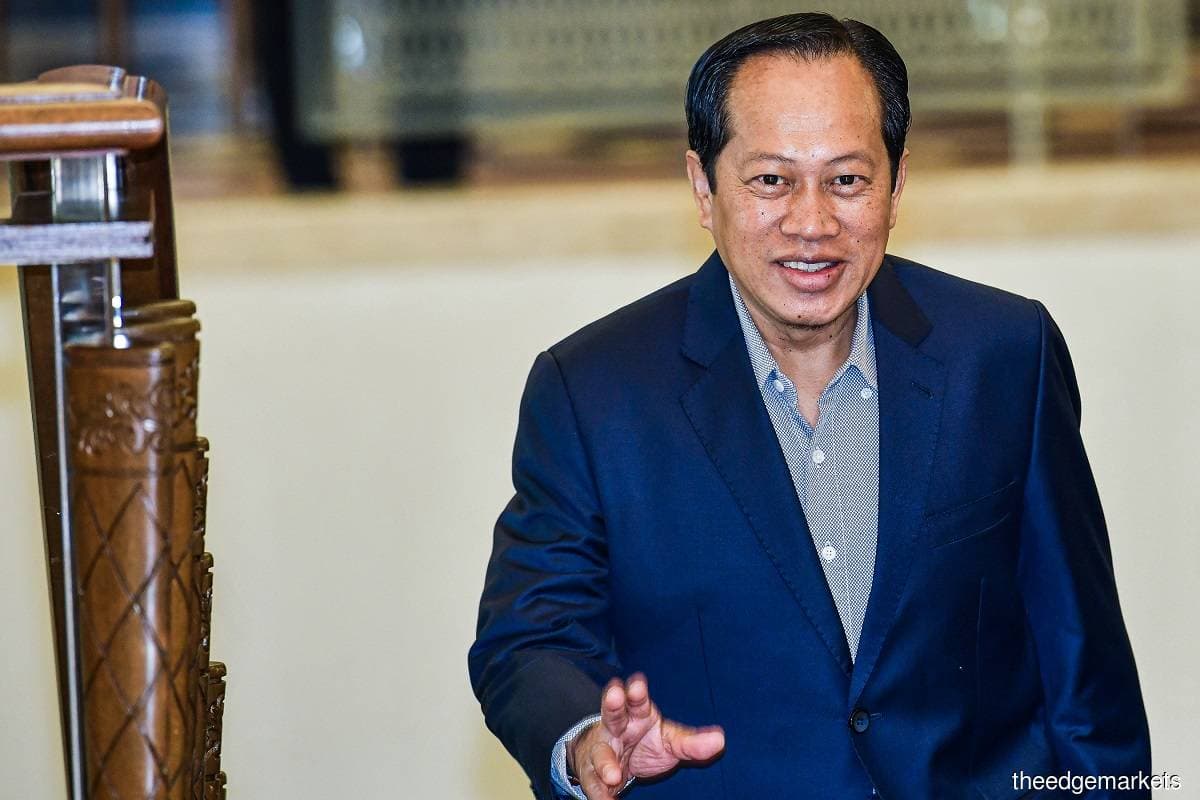

Deputy Minister of Finance I Datuk Seri Ahmad Maslan told the Dewan Rakyat that Prime Minister Datuk Seri Anwar Ibrahim, who is also the finance minister, has instructed banking institutions to undertake their CSR programmes as a form of aid to help the B40 groups.

The deputy minister noted that the government does not impose any windfall tax on banks which remained profitable during the pandemic period.

“That is also a form of aid to the people, which will be announced possibly during the Minister of Finance’s winding up speech for the policy stage of revised Budget 2023 debate, on the required CSR [programmes] by profitable banks to help the people,” said Ahmad on Monday (March 6).

Ahmad was responding to a question by former Sabah Chief Minister Datuk Seri Mohd Shafie Apdal [Warisan-Semporna], who asked whether the government would impose any windfall tax on financial institutions which recorded substantial profits during the pandemic period.

“Bank Negara Malaysia did not benefit [when overnight policy rate (OPR) increased], it was those financial institutions that benefited,” said Shafie.

The issue arose when Shaharizukirnain Abd Kadir [PAS-Setiu] asked whether the government did a study on the effect of the increase in OPR on the B40 group that is hard hit by rising monthly loan repayments.

In this regard, Ahmad said not all borrowers are affected by the increase in OPR because the increase to monthly instalments only involves loans with floating interest rates.

As at December 2022, fixed rate loans constituted 50.3% or 6.4 million accounts of the total loan accounts in the household sector, said Ahmad.

Among low-income borrowers, meaning those with income of less than RM5,000 per month, it is estimated that 54.8% or 3.5 million accounts of their total loan accounts are based on fixed interest rates, he added.

“Although this OPR increase will affect borrowers and depositors, this move is appropriate and necessary to ensure inflation is under control and the economy remains stable. A healthy economy and more stable price conditions will provide a better spillover effect to all citizens,” said Ahmad.

The government is slated to start delivering winding up speeches by all ministries for the policy stage of revised Budget 2023 debate this Wednesday (March 8) after six days of debate.

The policy stage of the revised Budget 2023 is scheduled to be passed by Thursday barring any unforeseen circumstances, before entering the debate at committee stage, where the Dewan Rakyat will deliberate on the details of all items in the federal government’s estimated expenditures this year.

For more Parliament stories, click here.