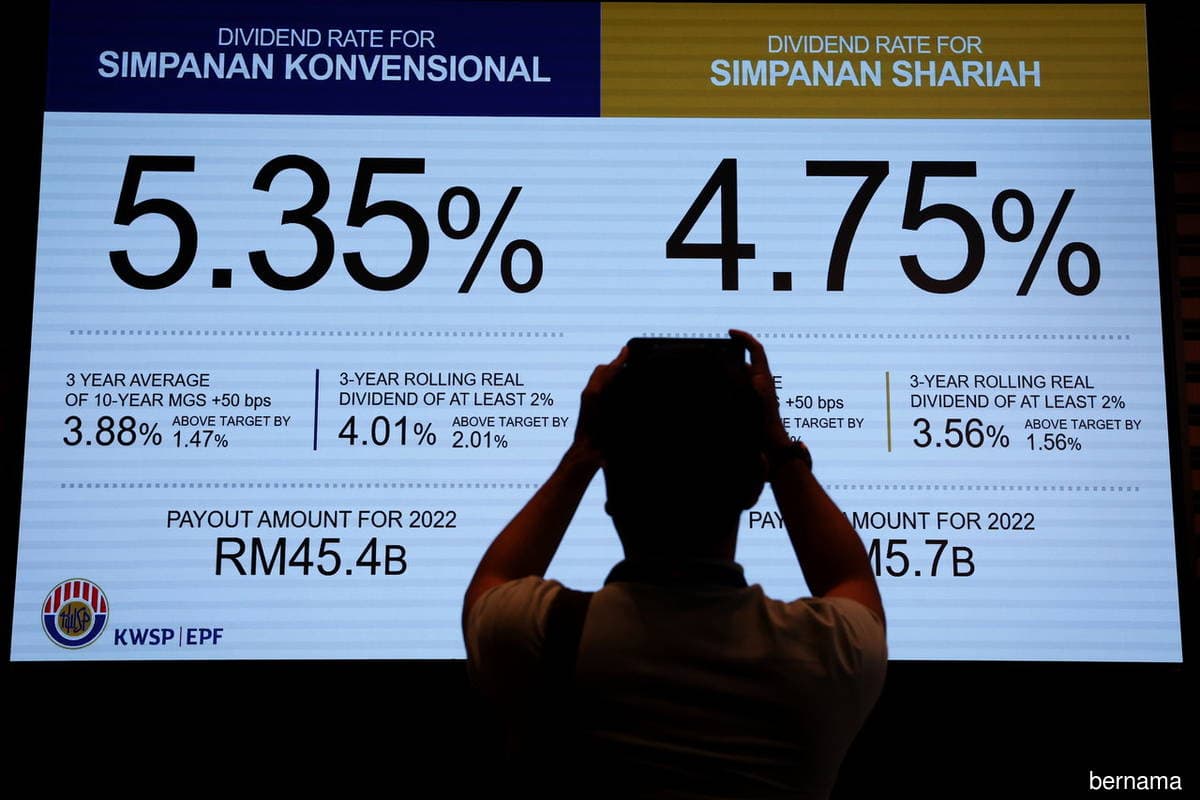

KUALA LUMPUR (March 4): The Employees Provident Fund (EPF), the country's largest pension fund, has declared a dividend rate of 5.35% for conventional savings for 2022 — lower compared with 2021's 6.1% rate, with payout amounting to RM45.44 billion.

The EPF’s dividends for conventional savings had ranged from a low of 5.2% (2020) to a high of 6.9% (2017) over the past decade.

The dividend rate for shariah savings for 2022, meanwhile, stood at 4.75%, with a payout totalling RM5.7 billion.

This brings total payout for 2022 to RM51.14 billion — a 9.8% decline from RM56.72 billion in 2021.

The EPF had declared dividends of 6.1% for conventional savings and 5.65% for shariah savings in 2021.

The fund also recorded lower total gross investment income of RM55.33 billion in 2022, down 19.7% from RM68.89 billion in 2021, dragged lower by high market volatility and lower valuations across equity and fixed income markets. The equities asset class contributed RM30.54 billion, or 55% of the EPF’s total gross income, lower compared with the RM41.06 billion recorded in 2021. Foreign listed equities, which yielded a return on investment of 9.27%, continued to be the driver of returns for this asset class.

EPF chairman Tan Sri Ahmad Badri Mohd Zahir said notwithstanding the weak performance of equity markets in 2022, not all sectors were affected as some, such as energy, plantation, financial services, and consumer staples, fared reasonably well compared to other sectors.

"The EPF’s diversification strategy across different sectors and geographies has been effective in capitalising on profit opportunities and generating returns," he said in a statement on Saturday (March 4).

Read also:

EPF’s investment income falls nearly 20% year-on-year for 2022 amid weak markets

EPF posts first-ever drop in assets under management amid withdrawals, weak market conditions

Pandemic-era withdrawals significantly eroded savings levels of Bumiputera and Indian EPF members, says fund's CEO