This article first appeared in City & Country, The Edge Malaysia Weekly on February 27, 2023 - March 5, 2023

Almost 89% of freehold residential development Perfect Ten — by Hong Kong-based developer CK Asset Holdings Ltd — on Bukit Timah Road in Singapore has been taken up since its launch in December 2021.

During a recent media tour of its sales gallery in the city state, the company said the development comprises 230 units in two 24-storey towers on a 104,531 sq ft tract and that 205 units had been sold as at Feb 15 this year.

Perfect Ten is slated to be the tallest new development on Bukit Timah Road. It is within a five-minute drive from Orchard Road and an eight-minute walk from Newton and Stevens MRT stations.

Offering two- and three-bedroom units with built-ups of 753 to 1,281 sq ft, about 80% of the units will have panoramic views of Bukit Timah and the surrounding lush greenery, while the rest of the units will face the cityscape.

All three-bedroom units and selected two-bedroom units are designed with private lift lobbies. All units will feature appliances and fittings of European brands such as Miele, Gaggenau, Villeroy & Boch, Duravit and Hansgrohe.

“Perfect Ten was the best-selling project in District 10 as well as the Core Central Region in 4Q2022. The average selling price was around S$3,000 psf, with the project achieving its highest price of S$3,576 psf for a three-bedroom penthouse unit, for a total purchase price of about S$4.58 million,” said the developer.

“The indicative prices of Perfect Ten’s remaining units start from about S$2.4 million for the two-bedroom units and about S$3.6 million for the three-bedroom units. The buyers’ profile is a mix of owner-occupiers and investors. Some 84% of the buyers are locals and permanent residents while the remaining 16% are foreigners.”

Based on the 177 units sold from 2022 to February this year, the median price of the development is S$2,979 psf, according to property agency OrangeTee & Tie Pte Ltd CEO Steven Tan.

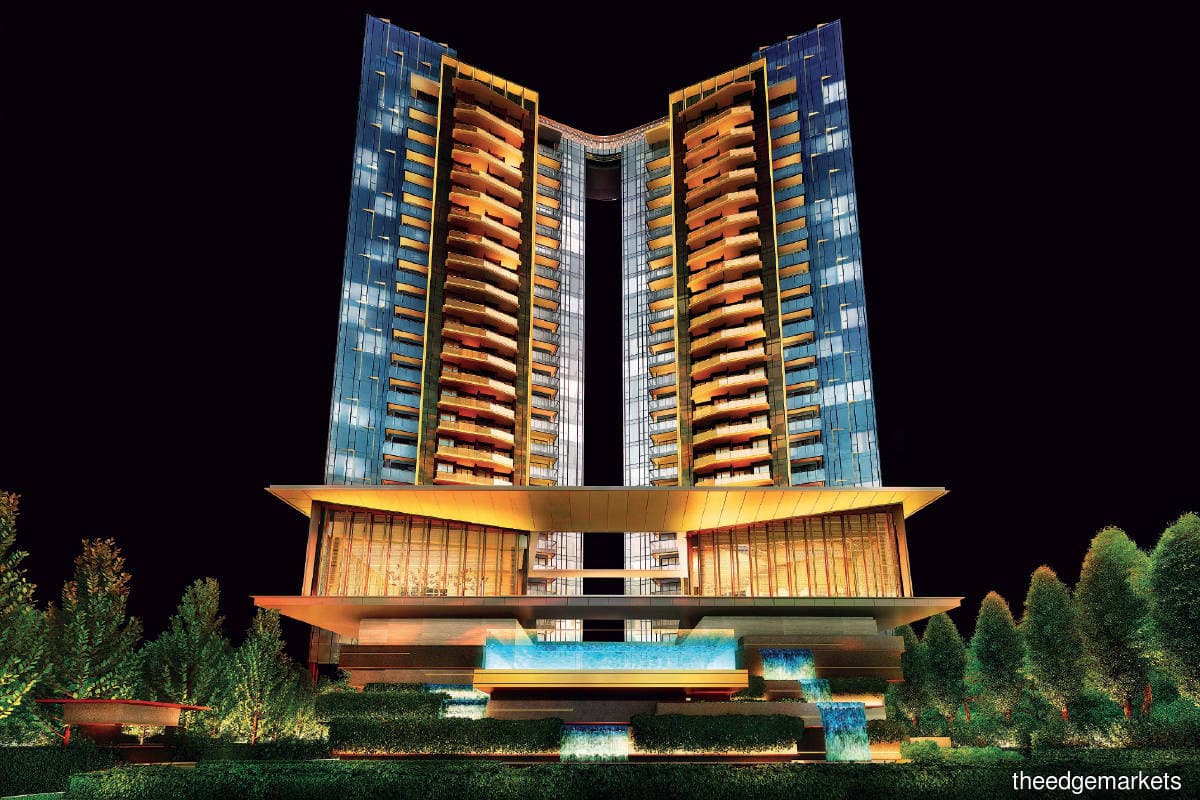

Designed by world-renowned DP Architects, the twin towers is inspired by the Japanese concept of “ma”, which relates to all aspects of life. According to the architect, “ma” is described as a pause in time, an interval or emptiness in space. It is the fundamental time and space from which life grows.

The concept is also interwoven into Perfect Ten’s purpose-designed facilities and recreation zones, starting from the 100m generous setback from the main road, where the 80m-long landscaped driveway leads to the drop-off area, which features a 5m-high rose gold canopy. Other facilities include a clubhouse, a 50m-long infinity pool and a serene roof garden.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.