KUALA LUMPUR (Feb 28): After receiving a sum of RM4 billion for the imbalance cost pass-through (ICPT) mechanism last month, Tenaga Nasional Bhd (TNB) said the remaining amount will be paid by the government in five equal instalments.

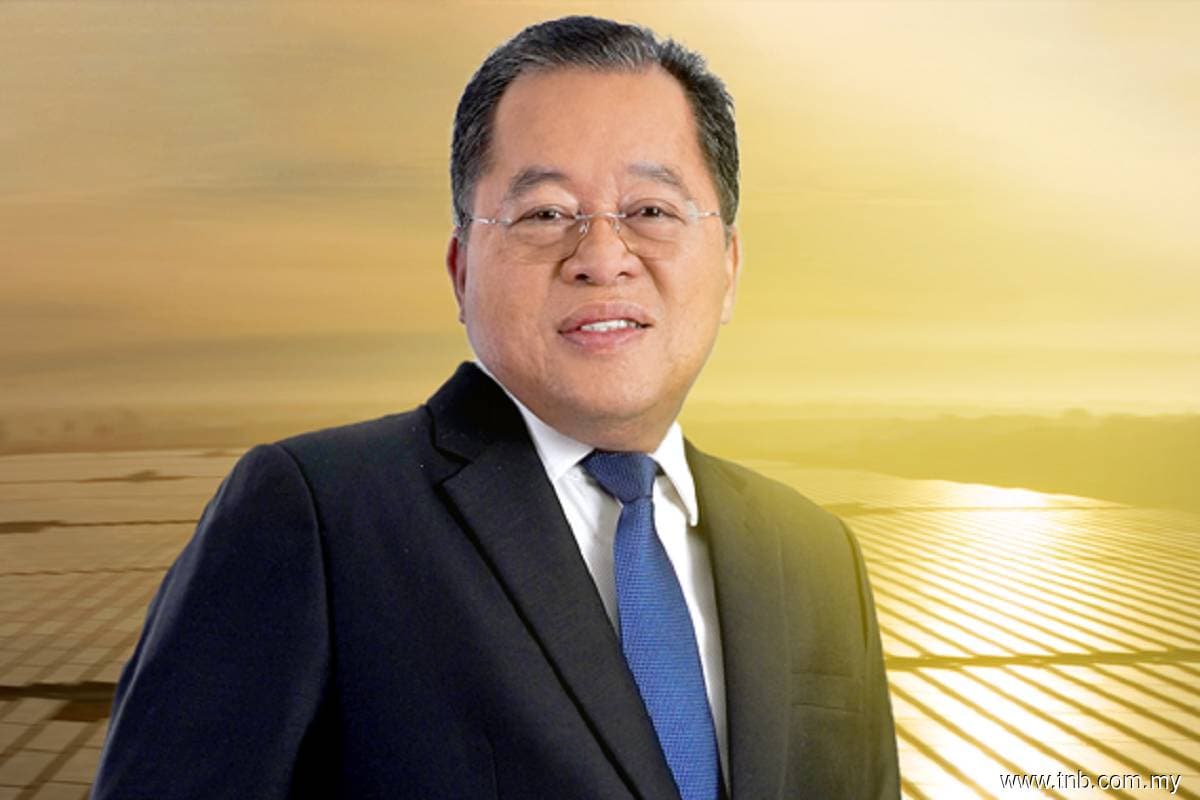

Given the high fuel cost in 2022, TNB president and chief executive officer Datuk Baharin Din said the group’s ICPT receivables remained relatively high due to the timing mismatch between the upfront payment made by TNB and recovery of the surcharges via the ICPT framework.

This came after TNB reported higher receivables of RM22.83 billion in the fourth quarter ended Dec 31, 2022 (4QFY2022), more than double the RM10.55 billion amount a year ago. On a quarter-on-quarter basis, receivables increased 2.36% from RM22.3 billion in 3QFY2022.

However, the pressure on ICPT receivables is expected to ease given the current fuel price trends and the government upholding the Incentive Based Regulation framework, said Baharin.

“From July to December 2022, TNB has obtained a full ICPT recovery of RM5.8 billion.

“[And] in the first half of FY2023, the total ICPT cost recovery stood at RM16.2 billion,” said Baharin in a statement on Tuesday (Feb 28).

“The government’s decision on the recent ICPT showed their commitment in ensuring that the industry remains resilient,” he added.

According to him, the utility giant will fully recover the net imbalance cost through the ICPT surcharge that will be passed through the non-domestic customers (medium and high voltage) at 20 sen/kWH, as well as RM10.4 billion of cost recovery from the government.

Based on the current fuel price trends, Baharin stated that the ICPT to be recovered for the second half of FY2023 is forecasted to be around RM12 billion.

At the time of writing on Tuesday, TNB’s share price was trading down 1.97% to RM9.45, giving the group a market capitalisation of RM54.31 billion.