This article first appeared in Wealth, The Edge Malaysia Weekly on February 27, 2023 - March 5, 2023

To keep abreast of stock market news, retail investors tend to visit several investment websites and forums for the most up-to-date information. There is no one-stop centre that they can go to and exchange opinions with other investors.

To address these pain points, Indonesia-based digital brokerage and mutual fund distributor PT Stockbit Sekuritas Digital launched the Stockbit mobile application last year in Malaysia after spending about four years gradually improving it. The app had garnered about 30,000 real-time users as at Feb 20.

“The simplest way for people to understand what we are is that we’re basically a ‘Facebook for investors’ — a local community meant for investors,” explains Saachi Asok Kumar, the firm’s country manager in Malaysia.

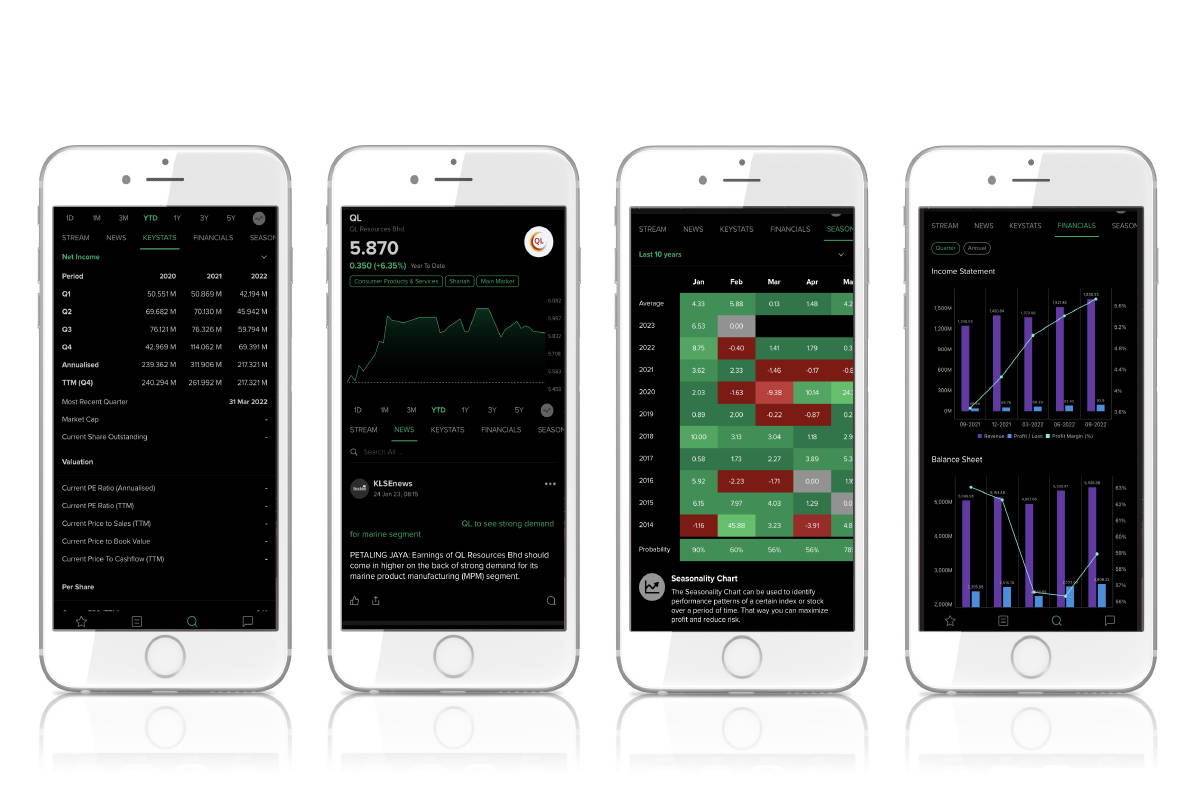

Compared to existing investment websites and online forums that offer PC-based platforms, Stockbit focuses on one that is accessed via your smartphone. It aims to provide investors with necessary market information with just a few taps on the screen.

“Today, in Malaysia, it’s very difficult for you to keep up with the market because you don’t have a platform that can consolidate all these things and notify you whenever there’s news that’s relevant to you. At Stockbit, you can know what’s happening to the stocks you’re interested in, filter out the noise and be able to stay up to date with what’s relevant to you,” says Saachi.

“We have access to research reports that we then share on the platform. Let’s say you’re interested in the company MyNews. You would click on MyNews on your phone and scroll down [Stockbit’s] stream to see what retail investors and analysts are saying about the company.”

To keep user interest growing, Saachi and his team continually upload financial data to the app. Users can look up a stock and see up to 10 years of its fundamental data.

The app offers a user-friendly interface to allow the exchange of knowledge and opinions on companies in focus.

Saachi says: “Unlike typical social media platforms of the day, here at Stockbit, the content is skewed towards what investors will be interested in. The tools and features that we are developing will be things that are relevant to investors.”

Social media plays a pivotal role in encouraging young investors, especially beginners. Stockbit’s Instagram profile has close to 12,600 followers, where most of the posts teach non-investors and new investors the basics, such as how to open a CDS account and how to read a cash flow statement or balance sheet.

Interestingly, 77% of its users are Millennials, or those born between 1981 and 1996. This particular group shows a burgeoning interest in investments.

The Securities Commission Malaysia’s 2021 annual report supported this rising trend. It said digital brokers, which enable investors to open stock trading accounts fully online, had gained an impressive retail market share of 5.45%.

It also said 251,000 brokerage accounts were opened in that year alone, up 50% from 2020. Millennial investors comprised the majority of those accounts.

Reducing fraud and scams

Saachi believes that with better dissemination of reliable and professional information, Stockbit can contribute to regulators’ efforts in countering investment fraud.

Malaysia has recorded a drastic increase in online scams, including those related to investments, in the two years since the outbreak of Covid-19. The commercial crimes investigation department of the Royal Malaysia Police reported 71,833 scams involving more than RM5.2 billion in losses from 2020 until May 2022. Loan and investment scams alone amounted to 11,875 cases last year.

“In 2020 and 2021, there were so many cases of stock market ‘gurus’ and ‘sifus’ popping up. And many of these people have, by and large, disappeared as the retail interest died down. Part of the reason these people have the opportunity to pop up is that the information is not easily accessible,” says Saachi.

“However, the average person who may not know how to invest in stocks or does not have the time to stay up to date with the markets, when they see their friends getting good returns, will be influenced and get into the market. But the problem is that they don’t know where to start and they become vulnerable to these pitfalls.”

There has been a rise in investment scams on the platforms listed on Bank Negara Malaysia’s Financial Alert List. And most of the so-called “investment gurus” and “sifus”, if not all, are not qualified to relay investment information, observes Saachi.

“Don’t get me wrong, there are certified investment gurus that provide good content. But by and large, many of these teachers are unlicensed. What they tend to do is charge a large sum of money to get the uninitiated enrolled in courses that teach them the most basic stuff, such as opening a trading account. These basics can be found through a simple search on Google.”

To provide genuine content for investors, the company builds relationships with investor relations firms to convert and authenticate content on the Stockbit app. Other means of generating reliable data on the platform include user-generated discussions, research reports from licensed brokerage firms, news reports from nationally recognised newspapers and FactSet, a global business and data analytics provider.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.