This article first appeared in Forum, The Edge Malaysia Weekly on February 13, 2023 - February 19, 2023

To the surprise of many, China ended its draconian Covid-19 restrictions just before the Lunar New Year. Before that, outside analysts were predicting gloom and doom. Long-term holders of Chinese onshore equity had complained that the 10-year average return of Chinese stocks (according to S&P indices) was 4.23% compared with 14.3% for US equity. In contrast, Chinese bonds returned a 4.05% annual yield over the same period compared with -0.61% for US bonds, owing to the massive sell-off last year from higher US Federal Reserve rates.

Investors in China’s financial markets are therefore divided between Chinese bears, who fear high domestic debt and the impact on Chinese companies from the US-China geopolitical rivalry, and China bulls, who think that the market is oversold.

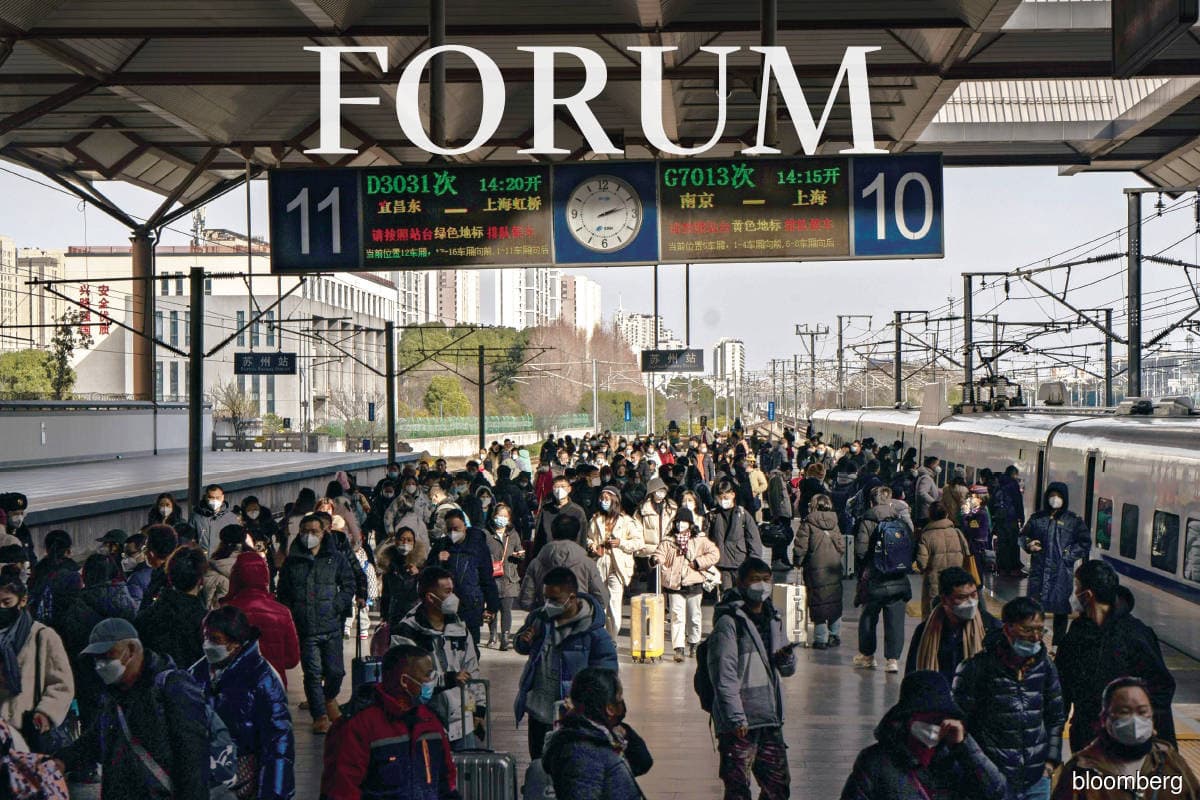

For the optimists, the recent rebound in economic activity was encouraging. There were 36.8 million daily passenger trips made in the seasonal rush to hometowns, which was 50% above last year’s levels. Domestic tourism revenue grew over 23.1% last year during the holidays, and retail sales increased 6.8% year on year. But the country remains a long way from normalcy. Nomura analysts pointed out that daily passenger trips in the festive period remained 47% below pre-pandemic levels, while international flights were 12.4% of the equivalent period in 2019.

The situation is changing rapidly. In the fourth quarter of 2022, China’s National Bureau of Statistics (NBS) reported that the economy had an annualised growth rate of 2.9%, exceeding glum market predictions of 1.8%. Since most of the reversal of Covid-19 restrictions only took place in December 2022, after Chinese President Xi Jinping’s visit to the G20 Summit in Bali, there is hope for further optimism amid the gloom. Anticipating quicker results from policy easing, analysts recently raised expectations of China’s growth for 2023 to 5.3%, up 50 basis points. For example, international flight bookings from China via travel portal Trip.com quadrupled in the first days of the Lunar New Year, as the government began loosening restrictions.

Since late 2022, China’s government has seen the need for dire and decisive action. The latest International Monetary Fund Article IV report on China estimated that real gross domestic product growth slowed to 2.6% last year, weighed down by repeated Covid-19 lockdowns, which cut retail sales down to 0.2% growth from the prior year. Consumption growth, seen as the future engine of growth, added only 1.0% to overall GDP, compared with 5.3% in 2021, and fell behind investment growth. Consequently, high inflation that blighted most of the world in 2022 was absent in China. Instead, policymakers needed to shore up domestic confidence fast.

Other than the easing of Covid-19 restrictions, the second most important policy shift was a 16-point directive to address the property sector last November, which significantly reversed the policy stance from risk control to reviving the sector. Since early 2021, China has tightened liquidity to domestic property developers to enforce deleveraging. By 2022, many developers were in various states of financial duress. Anecdotally, some bond analysts in Hong Kong began rebranding themselves as distressed debt specialists because their bond holdings in these companies were underwater. More urgently though, investment in China’s property sector shrank 10.0%, since annual property sales as measured by floor space declined by 24.3%. The slowdown threatened other parts of the economy too. Sales of heavy-duty trucks, a proxy for the construction industry, hit a multiyear low and continued to contract at the start of 2023.

The new economic team in Beijing is willing to signal support for the property sector. Regulators have gone one-step further by naming some high-quality developers as “systematically important”. In the long term, this tiering of developers could lead to further market consolidation, easing excessive construction and reducing enforcement efforts against smaller, financially weak developers. For now, achieving a positive psychological effect on markets will do.

The government has also used tax incentives amounting to RMB4.2 trillion (RM2.7 trillion) to support companies in 2022, equivalent to about 0.5% of GDP. Collectively these measures have had some effect. In a survey of companies across China conducted by UBS, 48% of respondents reported an increase in hiring in the fourth quarter of 2022, up from 38% in the quarter prior, with half of the respondents expected to increase hiring in the first quarter of 2023.

The market bulls have bought into this fundamental policy shift and expect the country to maintain loose monetary policy and expansionary fiscal measures to stabilise growth amid global uncertainties. China and Hong Kong stock indices have rallied sharply since reaching a low point in October last year but still trail where they were at the start of 2022. The IMF Article IV report revealed how China’s growth is pivotal to global trade and growth. As the second largest economy in the world, the country has shown its ability to maintain confidence in the renminbi, which has strengthened to 6.78 against the US dollar, compared to a low of 7.32 as late as November 2022. China’s balance of payments continue to be in surplus, mainly due to lower service deficits.

Fundamentally, there is still basic investor caution. Definitive data of China’s recovery has not yet transpired, while external factors remain both challenging and volatile. International trade will be more difficult as China’s traditional export partners continue tightening their belts amid inflation. At the same time, ongoing tensions with the West jeopardises high-tech imports to China that are vital inputs to its investments into high level technology.

All these factors contribute to an elevated risk premia for investing in China, while policymakers must thread the needle of reviving growth without causing excess. Love it or loathe it, the China market is an elephant that cannot be ignored, nor can it be contained, because it is too large and too interconnected to the global economy. Investors have to harden their will and be prepared for a bumpy road.

Tan Sri Andrew Sheng writes on global issues that affect investors. Tan Yi Kai is a Malaysian multi-asset trader based in Hong Kong.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.