This article first appeared in The Edge Malaysia Weekly on January 9, 2023 - January 15, 2023

COMPANIES are not expected to refrain from paying higher salaries this year even though challenges abound, chiefly because their options are limited if they want to retain talent, which is in short supply.

Moreover, human resources consultants say employers would be wise to incur additional costs to retain their talent rather than preserving cash for the year ahead as they would end up incurring more costs. Some have observed a corresponding increase in demand for employee benefits.

Businesses will need to bite the bullet and pay higher salaries even as they continue to face a host of challenges, including the collective impact of two years of Movement Control Order restrictions due to the Covid-19 pandemic, high inflation and rising interest rates, China’s infection woes since reopening in December and geopolitical tensions arising from the Russia-Ukraine war.

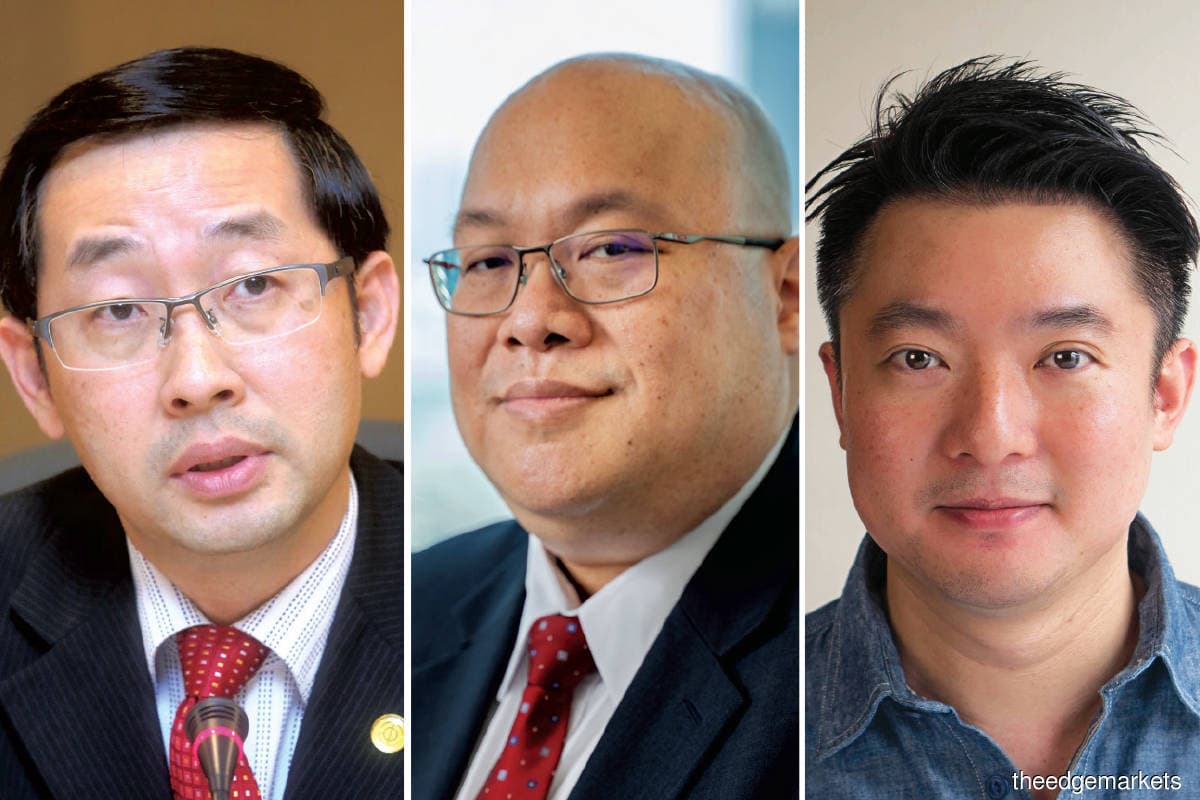

Higher salaries are inevitable, Datuk Koong Lin Loong, treasurer-general and chairman of the SMEs committee at the Associated Chinese Chambers of Commerce and Industry of Malaysia, tells The Edge. He stresses that the race is on for talents and salaries play a big role in convincing employees to stay.

“Salary raises are critical now. Employers have no choice but to pay higher salaries or risk losing talents, as we have seen over the course of the pandemic. Large overseas firms are making counter-offers to Malaysians for functions that were previously fulfilled by their citizens. These corporations are setting up offices in Malaysia for local hires as this arrangement is cheaper than hiring talents in the organisations’ home country,” Koong explains.

“These jobs [from foreign corporations] entail high salaries too, higher than what these Malaysian talents can command from other big corporations locally because white collar talents here are considered cheap labour. Malaysian employers are not able to pay more simply because product prices cannot go much higher. It is a chicken-and-egg situation for both worker and employer.”

And Koong ought to know, having recently shelled out almost RM300,000 in renovation costs to set up a staff lounge for his company’s employees to unwind and socialise — all in the effort to retain staff.

“You can’t claim to lack the cash flow to pay higher salaries. Many companies are facing this financial predicament, yet need to pay more to retain their workforce. Having enough talents to perform safeguards your company’s future. Without your talents, you are gone,” he emphasises.

Koong believes that the usual annual salary increment of 5% to 8% is the “minimum to be demanded”, and that employees now expect a pay raise of at least 8% to 10% to cope with high inflation and heightened cost of living.

According to the Malaysian Employers Federation (MEF) Salary Surveys for Executives and Non-Executives 2022, the forecast average salary increase for 2023 is 5.44% for executives and 5.43% for non-executives, slightly higher than the 5.26% and 5.35% respectively enjoyed last year following the reopening of the Malaysian economy in April.

The MEF surveys also show that 93% of employers in 2022 granted salary increases to all or certain executive and non-executive employees — a significant increase from 65.2% in 2021.

The forecast for bonuses in 2023 is 2.18 months and 2.06 months for executives and non-executives respectively, compared with 2022’s actual bonus payout of 2.06 months and 1.77 months. More than 80% of the respondent companies granted bonuses in 2022, says the MEF.

In addition, US-based asset management firm Mercer’s Total Remuneration Survey (TRS) 2022, which polled 637 organisations, found that employees in Malaysia can look forward to a median salary increase of 5% this year. The firm said the median salary increment in Malaysia is above the Asia-Pacific average of 4.4%, and indicated that the retail and consumer goods sectors are expected to see the biggest salary hike of 5% in 2023, up from 4.5% and 4.6% respectively in 2022.

It is noteworthy that Prime Minister Datuk Seri Anwar Ibrahim announced an additional RM100 in the annual salary increment and a special financial assistance of RM700 for civil servants Grade 56 and below, as well as the creation of 50,000 job opportunities. These were part of the Consolidated Fund (Expenditure on Account) Bill 2022, which continue the initiatives mooted by the previous administration, that was passed by the Dewan Rakyat recently.

High inflation, investment in higher-quality service

“The biggest factor driving employee demand for higher salaries is the rapidly rising inflation rate. Employees want to see salary increments, including cost-of-living adjustments apart from just an increment in their base pay. We saw this demand in PwC’s Workforce Hopes and Fears Survey 2022 (Malaysia report), with 32% of the respondents saying they are very likely to ask for a raise,” says PwC Malaysia director (people and organisation) Mohammad Iesa Morshidi.

He explains that employees recognise that they cannot accept salary increments that are equal to or less than the increase in inflation rate, as this would only help them to cope with the current economic conditions without bringing about any “real increase in wealth”.

“In response, many companies have had to adopt different working models and pivot to find new revenue streams. This paved the way for the creation of new roles and new areas of responsibility, making the job market employee-driven,” says Mohammad Iesa.

“Employees with highly sought-after skills and capabilities are more aware of their worth and expect appropriate compensation packages in line with the value they bring to the company. Employers will need to shift their perspective and view this as an investment in higher-quality service from their employees rather than an additional expense.”

If employers had to choose, he believes they would be wise to incur additional costs to retain their talents rather than preserving cash for the coming year. “Several market studies in recent years have revealed that it may cost employers up to 12 months of an employee’s annual salary to replace them if they decide to leave because they feel they are underpaid for the value they bring to the company.

“While employers may feel they can always replace the job leavers with the additional cash they have saved, they would undoubtedly end up incurring far more than they have preserved. This is not a sustainable strategy to manage their workforce in the long run.”

Increasing weightage on employee benefits

As employers manage shifts in talent expectations, consultants have observed a corresponding increase in demand for employee benefits.

“Employers need to consider their talent pool’s unsaid and unmet needs around work flexibility, workload and overall work-life integration,” notes The Talent Expectations Survey, an independent survey commissioned by Randstad that reveals insights on the latest talent trends surrounding work-life balance, work arrangements and work environments by surveying more than 1,200 respondents in Hong Kong, Singapore and Malaysia from July to September 2022.

Work-life balance had a weightage of 90% to 95% from respondents from all three places, while more than 35% said they would not accept a job if it did not provide flexible working hours.

PwC’s Mohammad Iesa points out that employees also expect their employers to absorb the expenses to set up home offices and purchase monitors and ergonomic office chairs for everyday use, as well as prepare allowances for better WiFi plans, increased electricity bills and even mobile subsidies.

In addition, Mednefits Malaysia co-founder and country manager Clarence Zhang points out that the demand for benefits-in-kind that promote camaraderie among staff, as well as benefits related to employees’ health (medical inpatient and outpatient coverage) and the upgrading of skills, have also risen.

Understandably, not all employers have the luxury of providing their employees with both higher salaries and more benefits-in-kind. Mednefits suggests a way to decide if providing employee benefits will be feasible for the company.

“If the total cost of replacing an employee plus the recruitment of a replacement plus low employee engagement comes up to more than a benefits package per employee, it may be a good opportunity to reconsider providing or expanding your benefits package,” says Zhang.

He points out that demand for optical care and wellness programmes, encompassing a wide range of benefits such as gym memberships, supplements, yoga classes, mental healthcare and physiotherapy, were identified in Mednefits’ 2022 Employee Benefits Trend Report, which provides a benchmark for human resources decision-makers in Singapore and Malaysia for the review and implementation of their employee benefits plans. The report also reveals that 52% of the survey participants view employee benefits as a means of generating greater employee engagement, while 49% see employee benefits as a tool to increase employee retention and attract talent.

Zhang notes that while only about 20% of employers provide wellness benefits, more companies are starting to do so. “Employers are emphasising mental wellness because nearly seven in 10 Singaporeans and one in three Malaysians struggle with mental health,” he says, adding that even Traditional Chinese Medicine is trending as one of the fastest emerging new medical benefits as it is well accepted in Singapore and Malaysia.

Malaysia may not be ready for four-day work week

Although corporations in developed nations have begun trialling the four-day work week to gauge its feasibility, the concept is still foreign to Malaysians.

While workers are purportedly more refreshed as they use the extra day to recharge and invest in upgrading and upskilling activities, which ultimately leads to a more efficient workforce, local industry players have stressed that Malaysia, as a developing country, currently faces low productivity and labour issues and would not be able to implement the four-day work week.

“At the moment, we only see a handful of larger companies launching a pilot or trial programme of the four-day work week. The majority of our clients do [however] practise flexible workplace arrangements,” says Mednefits’ Zhang.

He suggests that employers view flexible benefits as a top level strategy to improve employee engagement and retention. It should be dynamic — “rolled out as a pilot test with feedback collected, and constantly [adjusted] according to responses and changing needs of the workforce”.

Instead of working four days a week and taking the fifth day off, some employees may prefer that their companies sponsor their upgrading or upskilling courses, he adds.

“Put in this perspective, the flexibility of having shorter working hours given by the employer to the employee will then put the onus on the employee to focus on ways to work smart rather than just working hard,” says Zhang.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.