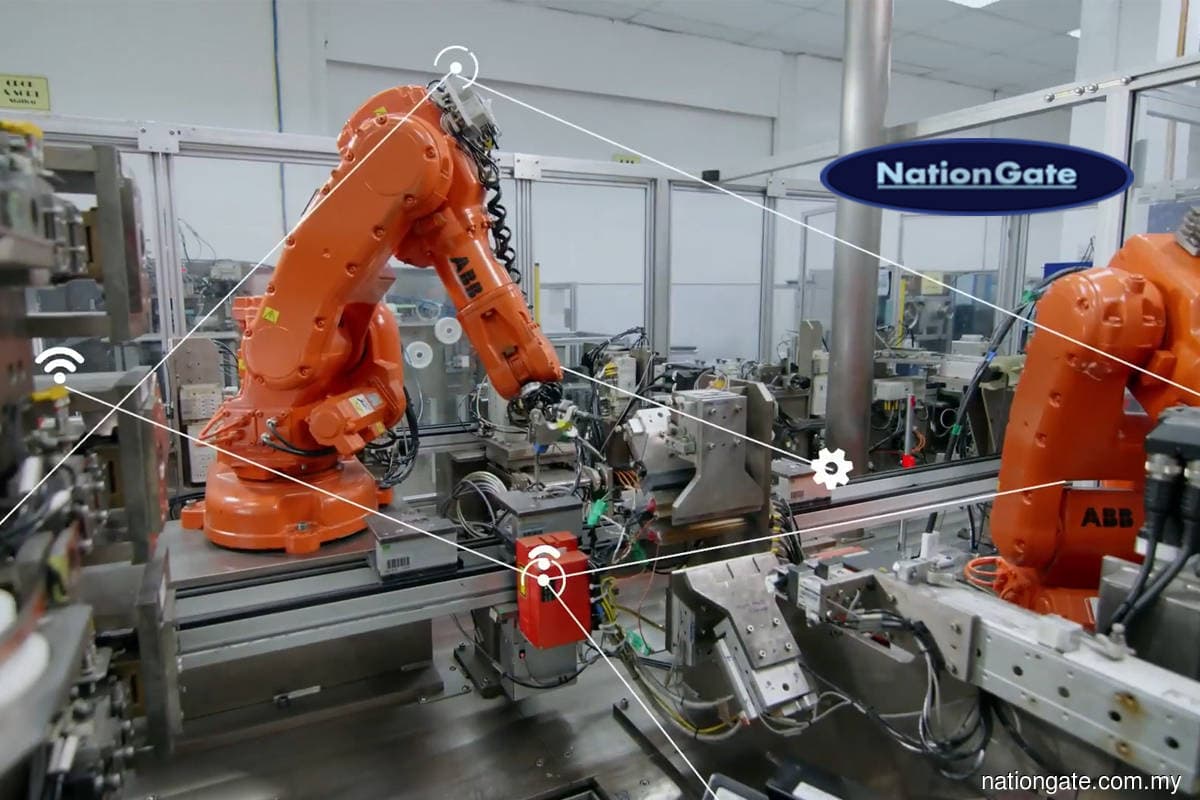

KUALA LUMPUR (Jan 4): Electronics manufacturing services (EMS) provider NationGate Holdings Bhd said the public portion of its initial public offering (IPO) has been oversubscribed by 16.49 times.

The group received a total of 20,444 applications seeking 1.81 billion new shares valued at RM689.16 million for the 103.70 million new shares that were made available for public subscription, according to a statement on Wednesday (Jan 4).

Its Bumiputera public portion of shares was oversubscribed by 9.10 times, after the group received a total of 9,431 applications for the 523.50 million new shares, while for the remaining public portion, a total of 11,013 applications for 1.29 billion new shares were received, which represented an oversubscription rate of 23.88 times.

The 103.70 million new shares for eligible directors, employees and persons who have contributed to the success of the group have been fully subscribed.

Additionally, the placement agent confirmed that the 518.48 million shares made available for application by way of private placement to selected Bumiputera investors, as approved by the Ministry of International Trade and Industry, and selected investors had been fully placed out.

According to managing director Ooi Eng Leong, the group was delighted to see strong support from retail investors, and the subscription amount received indicates the public’s confidence in the group’s business model and future plans.

“NationGate’s prospectus opening period was during the year-end holiday season. The support garnered is an encouraging sign, as the company embarks on its next phase of growth as a public-listed company,” said Ooi.

“Part of the proceeds will enable NationGate to purchase various raw materials, consumables and electronic components consumed for the company’s EMS activities in tandem with the expected growth in its EMS business activities.

“It will also enable NationGate to part-finance the acquisition of new machineries and equipment to expand its EMS service offerings and surface mount technology assembly capacity to cope with rising demand from its existing multinational customers and new customers in the next 36 months,” he added.

The group expects its IPO to raise RM165.50 million from the public issue of 435.53 million shares, with an issue price of 38 sen per share.

M&A Securities Sdn Bhd is the adviser, sponsor, underwriter and placement agent for the IPO exercise.

Read also:

PublicInvest values ACE Market-bound NationGate at 54 sen a share

TA Securities values ACE Market-bound NationGate at 70 sen a share

EMS provider NationGate aims to raise RM165.5m from ACE Market IPO

ACE Market-bound NationGate inks underwriting agreement with M&A Securities

Electronics manufacturing service provider NationGate gets nod to list on ACE Market