A profound shift was seen in the last year, investors began to recognize that companies with strong environmental, social and governance practices outperformed during the pandemic. This response resulted in a change in the way institutions invest. The MSCI 2021 Global Institutional Investor survey found that 79% of investors in Asia-Pacific increased their ESG investments in response to the pandemic. Kenanga Investors Berhad and its sustainability partner, Northern Trust Asset Management answer some of the key questions facing Asian investors looking to build both resilient and revenue-generating sustainable portfolios.

Why is sustainable investing becoming an increasingly important topic?

The adoption of sustainable investing is growing, driven by global investor sentiment that environmental, social and governance (ESG) data and analytics can add to investment performance. In Asia-Pacific, ESG assets under management (AUM) in the institutional space have grown on average more than 30% per annum over the last five years, according to data from Broadridge, mainly due to the strong inflows seen in 2020.

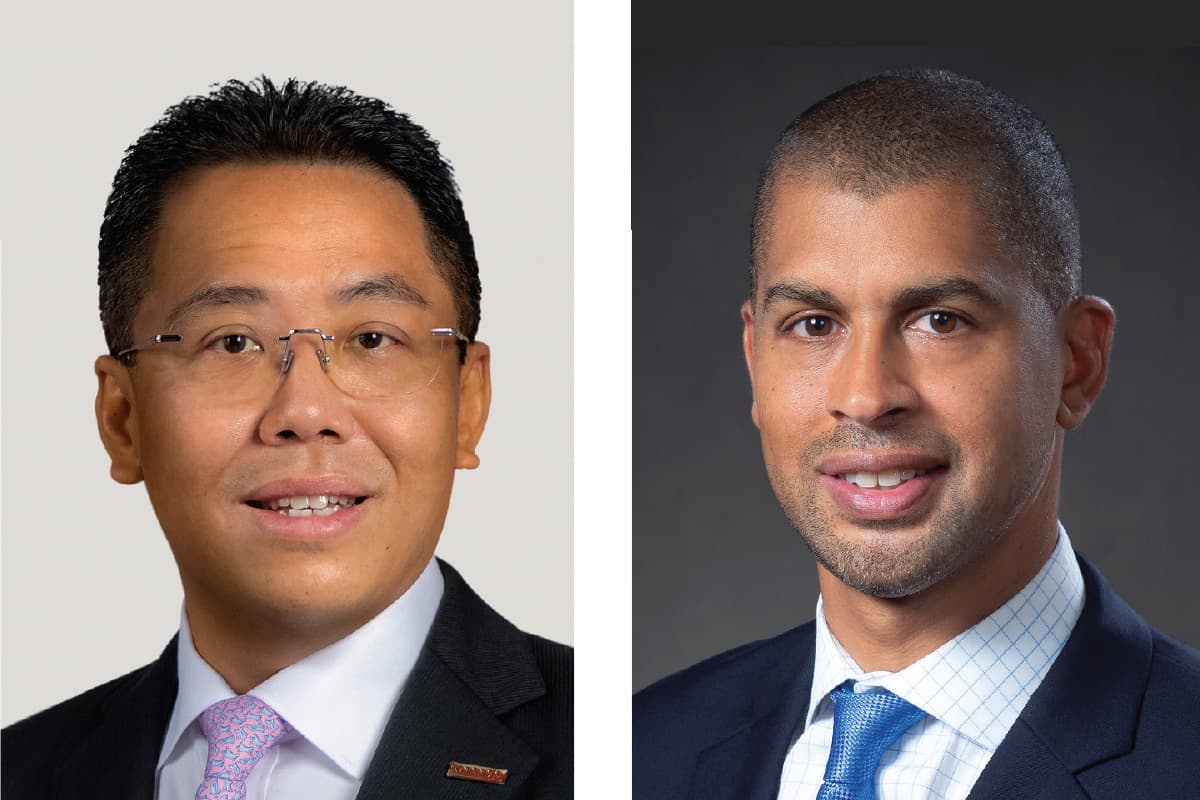

In the Asia-Pacific region, the demand for ESG solutions is undeniably becoming more popular, especially with numerous governments and their financial regulators set on promoting sustainable investing, says John McCareins, Managing Executive & Head of Asia-Pacific, Northern Trust Asset Management, who cites, as examples from among many in the region, the Monetary Authority of Singapore’s US$2 billion green investment programme and the Financial Services Commission of South Korea’s series of ESG and responsible investing initiatives.

How extensively is sustainable investing being adopted by Asian investors?

“For Northern Trust Asset Management in Asia-Pacific, our ESG AUM has grown more than 60% in the last three years, while more than 65% of our assets contain some ESG element,” McCareins points out. “And ESG investing in Asia is expected to continue its strong growth momentum over the next five years, with countries like Malaysia, Hong Kong, Singapore and South Korea leading.”

However, for most Asian investors their sustainability journeys are still in their early adoption phase. Some investors, like sovereign wealth funds and public pension funds in the region, have started their journeys by excluding controversial business lines like tobacco or gambling, or by adopting passive investment strategies that track ESG indices. Investors further down the pathway to ESG integration have set quantifiable targets, like reducing their carbon exposure.

In the intermediary market, Ismitz Matthew De Alwis, executive director and chief executive officer, Kenanga Investors Berhad, notes that “Local asset managers who are interested to develop global sustainable investing capabilities, are looking for global asset managers as potential partners not only for knowledge sharing, but to also co-develop ESG solutions that meet their investors’ objectives and deliver exceptional client experiences.

What are the risks and opportunity of sustainable investing?

In spite of the growing number of tools and capabilities that investors have today to facilitate sustainability across passive, active and quantitative investment capabilities, investor concern focuses on risk. De Alwis says, “Certainly, the Covid-19 pandemic has illustrated the linkages between the health of the global society and that of global financial markets. Increasingly, investor thinking has moved, beyond the historic way of viewing sustainable investing as a means of just aligning investments with values or ethical codes towards one of seeing it as an opportunity to build more resilient portfolios.”

McCareins offers “Consistent with our view that investors should be compensated for the risks they take, we believe evaluating companies’ performance using ESG criteria enhances our forward-looking view of risks and opportunities. This analysis bolsters our ability to future-proof portfolios with an aim to grow clients’ capital.

Where can investors find the opportunity and performance in ESG investing?

“We believe material environmental, social and governance factors are pre-financial indicators that can affect a company’s future financial viability and clients’ long-term risk-adjusted investment returns. When managed well, they can position a company for success and when mismanaged, they can result in significant risks,” says McCareins.

“From our perspective, sustainable investing does not automatically entail a compromise on performance. The focus here must be on running due diligence and identifying a strategy that aligns investors’ targeted performance objectives with their values,” says McCareins.

“A well-designed ESG strategy can help manage risks around climate change, data security and governance issues, control sector deviation and stock-specific risks, and produce a more resilient portfolio,” De Alwis confirms, which was demonstrated during the H1 2020 sell-off when ESG portfolios performed better overall relative to non-ESG peers.

“The pairing of risk premia factors like quality with ESG is also important as this helps identify companies with longer-term planning around ESG risks while maintaining financial health and delivering profitable results,” De Alwis explains. “High-quality financials — strong cash flow, conservative balance sheets and high return on capital — still matter. This is because quality and ESG, taken together, represent two dimensions of the same underlying theme: sustainability. This also means potentially excess returns in the long run.”