(Aug 7): The Penang government wants the Finance Ministry to state whether capital controls would be imposed after the ringgit fell to its lowest in 17 years.

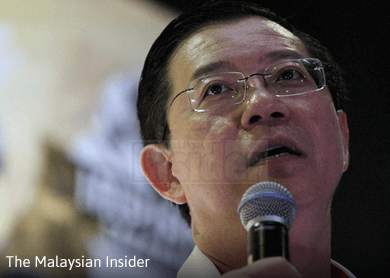

Chief Minister Lim Guan Eng said today it was time for Prime Minister Datuk Seri Najib Razak, who headed the ministry, to state Putrajaya's position on the matter clearly.

He said there was speculation now that capital controls would be imposed with the value of the ringgit weakening and continuing to plunge.

"If the government does not state that capital controls will not be imposed, the stock market will also be affected.

"It is now time for the finance minister to make the statement and state its position clearly. So at least the stock market can continue to function.

"Or else, it will just continue to drift and go downwards because of the fear of capital controls," he told a press conference at his Komtar office today.

Capital controls are residency-based measures – like transaction taxes, other limits or outright prohibitions – a government in a country can impose to regulate flows from capital markets into and out of the country's capital account.

Lim also expressed grave concerns about the falling ringgit, which might even fall to 4.0 to a dollar.

Yesterday, the ringgit was pegged at RM3.92 against US$1.

He said there were international fund managers forecasting that the currency would drop even further to 4.10.

"This is very worrying and frightening. All this is following policies that failed and embarrassing financial management.

"The policies failed because of the implementation of the goods and services tax (GST) that is unable to heal the financial condition of the country.

"It is all self-inflicted because of policy failures and financial scandals like the 1Malaysia Development Berhad controversy that has cost us investor confidence," he said.

Lim, a trained accountant, also expressed concern over the dwindling foreign reserves of the country.

It was reported that Malaysia's foreign reserves fell from US$140 billion (RM541.24 billion) in the first quarter of 2013 to US$100.5 billion by July 15 this year.

Over the same period, the currency's external value fell from 3.2 a dollar to 3.8.

The foreign reserves, like a country’s debt levels, are an indicator of a country's economic health.

"We lost US$40 billion in two years but we still failed to defend the currency.

"Many analysts and economists are saying if we use the foreign currency reserves, it will not work because of the sentiments that are influenced by weak financial fundamentals.

"So no matter how much you throw in, you can't stop the slide of the ringgit. We have spent so much and still the slide continued," he said, adding that if the central bank did not intervene, it could have been worse.

Lim said the inevitable could not be prevented and the ringgit could continue to fall.

"When you run out of money, the slide will be worse. That 4.10 (forecast) is frightening. It is time for the finance minister to make a serious statement," he said. – The Malaysian Insider