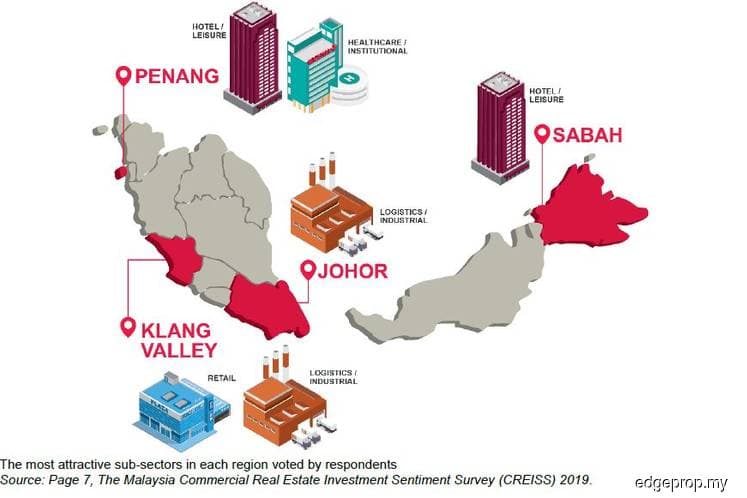

PETALING JAYA (April 2): A Knight Frank Malaysia survey has found that the logistics or industrial sub-sector is the top favourite commercial property segment that is expected to perform well this year in the Klang Valley and Johor while the hotel or leisure segment will continue to be favoured in Penang and Sabah.

The Malaysia Commercial Real Estate Investment Sentiment Survey (CREISS) 2019 included responses from developers, lenders, as well as fund and real estate investment trust (REIT) managers.

In general, the logistics or industrial sub-sector is the top pick for many respondents — to invest, lend or develop across the peninsular regions, with Johor attracting the highest level of interest, according to the report.

In the Klang Valley, more than 30% of respondents anticipate capital growth in the logistics or industrial sub-sector, likely attributed to the strong inflow of foreign direct investment (FDI) in the manufacturing sector.

Knight Frank Malaysia executive director of capital markets Allan Sim said in a press release today that the industrial property segment continues to gain traction from investors, especially among fund or REIT managers

“Concerted efforts by government agencies to create more activity in the industrial sector by riding on the global wave of industry 4.0, industrial assets have been producing favourable and stable yields,” he said.

“Investors have shown belief and confidence in the new state government’s administration and the state’s ability in attracting FDI. In line with Johor’s improved infrastructure, coupled with planned upgrade of port facilities within Johor, we foresee more regional players opting to relocate their operations to Johor,” Sim added.

Besides the selected regions in this survey, Knight Frank Malaysia noted an increasing number of key players paying attention to Negeri Sembilan and Pahang, as an alternative investment destination.

“We anticipate higher level of land banking activities among industrial players, as interest in this sector is optimistic,” said Sim.

Meanwhile, Penang continues to be favoured for its hotel or leisure and healthcare or institutional sub-sectors, supported by its UNESCO World Heritage status for George Town, its many tourist attractions as well as its position as a leading medical tourism destination in the country.

Sabah’s hotel or leisure sub-sector potential is also positive. It is experiencing a tourism boom with tourist arrivals at 3.8 million in 2018 supported by its rich natural environment and cultural diversity.

Knight Frank Sabah executive director Alexel Chen said with the healthy growth in visitor arrivals and the hospitality sector as a whole, it is no surprise that both local and foreign investors including international hotel operators are keen to enter and explore more opportunities in this growing market.

“Despite the untapped potential, it is important to recognise that concerted efforts from both public and private sectors are still needed in improving tourism infrastructure and products, tourism policies, and environmental conservation to ensure the sustainability of the industry,” he added.