This article first appeared in The Edge Malaysia Weekly on September 28, 2020 - October 4, 2020

Between Sept 26 and Oct 2, two key events will play out on the global political and economic arenas. On Sept 29, the first US presidential debate between incumbent President Donald Trump and the Democratic Party’s nominee Joe Biden will be held and televised live.

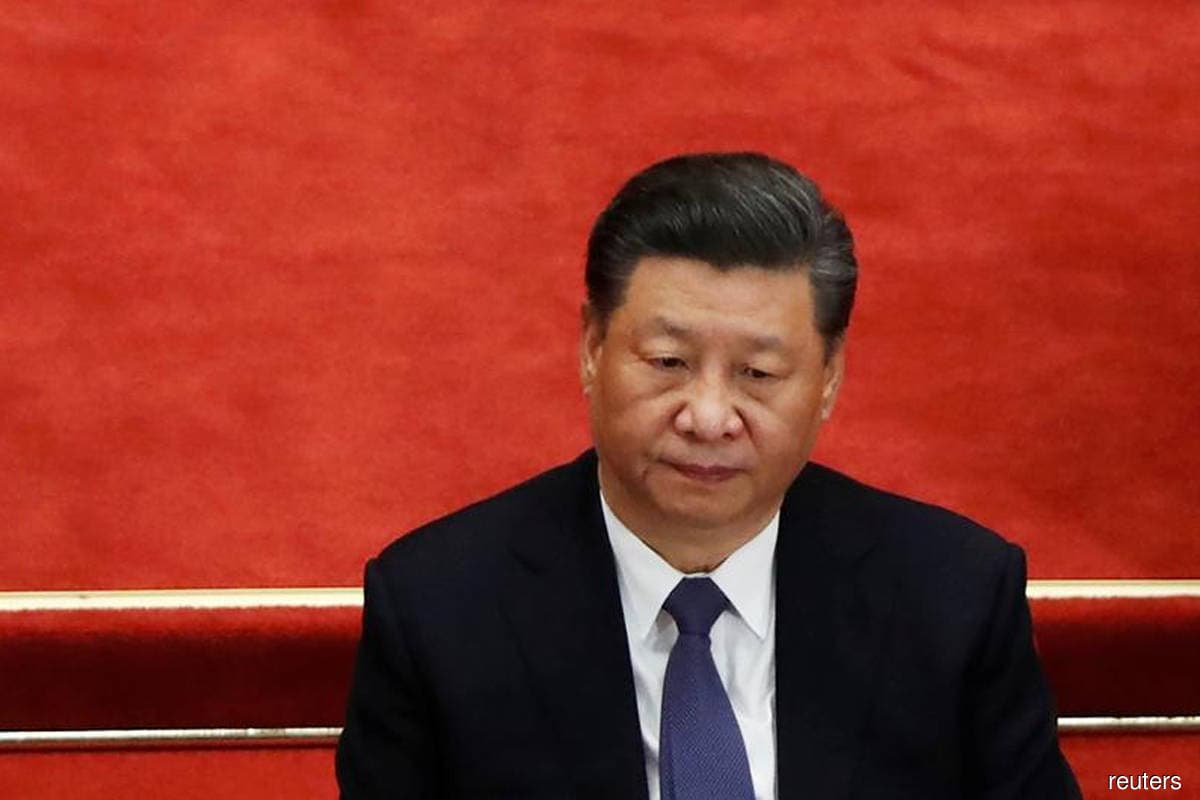

On the other side of the Pacific, President of the People’s Republic of China Xi Jinping will deliver his key policy speech on Oct 1 in conjunction with the 71st anniversary of the country’s founding. This will be followed by a week-long holiday.

Both events are expected to showcase the leaders’ economic and political vision for their respective countries, and give a further glimpse of where the two nations may be headed in their often-thorny relationship.

At last Tuesday’s 71st United Nations’ General Assembly meeting, which was held virtually because of the Covid-19 pandemic, Trump accused China of unleashing the coronavirus, while Xi urged the world to avoid “stigmatisation” and work together to fight the pandemic.

Meanwhile, domestically, the end of the six-month moratorium on loan repayments on Sept 30 is expected to have major ramifications on the economy and the stock market performance.

The Department of Statistics will be releasing Malaysia’s external trade statistics for August on Sept 28 and external trade indices on Oct 2. On Sept 30, the department will release Malaysia’s Producer Price Index for local production.

On Aug 28, MIDF Amanah Investment Bank Bhd had revised Malaysia’s export growth forecast to -3.5% year on year (y-o-y) from an earlier projection of -8.3%, as it anticipates the improving trend in July to continue for the rest of the year, in line with the resumption of activities globally.

On the political front, the Sabah state election will be underway on Sept 26, with the new chief minister expected to be sworn in on Sept 28. A total of 73 seats will be contested.

The snap election was called after the 15th Sabah State Legislative Assembly was dissolved by Governor Tun Juhar Mahiruddin on July 30, when the Parti Warisan Sabah government led by Datuk Seri Shafie Apdal lost its majority through a series of defections.

Between Sept 27 and 30, Vietnam will announce its gross domestic product (GDP) growth for the third quarter — the first economy to do so. According to an estimate by United Overseas Bank, the country is forecast to chalk a 5.5% y-o-y growth, up from 0.4% in the second quarter.

Meanwhile, the People’s Bank of China will release its official manufacturing and non-manufacturing Purchasing Manager’s Index (PMI) for September on Sept 30.

According to Bloomberg, China’s manufacturing PMI is likely to accelerate to 51.5 from 51 in August, whereas non-manufacturing PMI will ease to 54.9 from 55.2. A reading above 50 indicates expansion of economic activities during the period.

South Korea will be releasing trade numbers for September on Oct 1. Economists have projected exports to expand 4.2% y-o-y, compared with -9.9% in August, while imports are seen contracting between 4.3% and 4.5% y-o-y during the month, which would be an improvement over the contraction of 16.3% y-o-y in August.

On the monetary policy front, two major Asian central bank policy decisions will be announced on Oct 1. The Reserve Bank of India (RBI) is expected to keep its policy unchanged, according to economists surveyed by Bloomberg.

Bangko Sentral ng Pilipinas is expected to keep its monetary policy unchanged in October, UOB notes. BSP is likely to continue evaluating the transmission of its existing policy actions on the economy and the fiscal measures to address the pandemic.

Singapore will release its month-end bank loans and money supply data for August on Sept 30, the preliminary third-quarter Urban Redevelopment Authority private-home price index on Oct 1 and the official PMI for September on Oct 2.

Elsewhere, market attention will remain on the US Federal Reserve as several Federal Open Market Committee members speak in public for a week. They include Loretta J Mester, John C Williams, Neel Kashkari, Richard H Clarida and Randal K Quarles.

In Europe, European Central Bank president Christine Lagarde is scheduled to speak at the European Parliament on Sept 28. This will be followed by the Sept 29 release of a slew of economic data for the European Union for September, including consumer confidence and economic, industrial and services sentiment.

The Bank of Japan will release its large manufacturers’ sentiment index for the third quarter on Oct 1. Bearish sentiments are expected to continue, given the -26 forecast by economists, albeit an improvement over the second quarter’s -34.

Japan will also release its Consumer Confidence Index for September on Oct 2, with economists projecting an increase to 32 from 29.3 in August, which would signal a firmer recovery in the country’s economy.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.