This article first appeared in The Edge Financial Daily on September 12, 2019

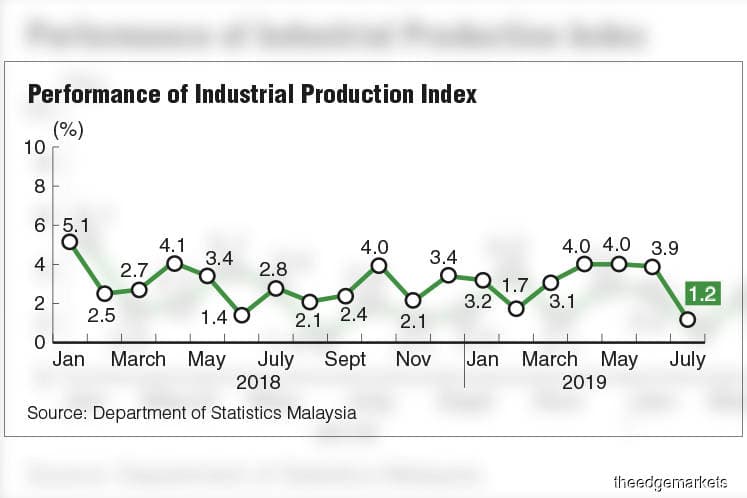

KUALA LUMPUR: Malaysia’s industrial output growth slowed to 1.2% year-on-year (y-o-y) in July, its weakest pace so far this year, pulled down by a sharp decline in mining activity amid weak crude oil output.

Industrial Production Index (IPI) growth accelerated to 3.9% y-o-y in June.

Department of Statistics Malaysia chief statistician Datuk Seri Dr Mohd Uzir Mahidin said the output of manufacturing and electricity saw an increase of 4% and 2% y-o-y respectively, in July. The gains, however, were offset by an 8.4% y-o-y contraction in mining output.

“The decline [in the mining sector index] was due to the decrease in the crude oil and condensate index of 22.7%. Meanwhile, natural gas index increased by 7.3%,” he said in a statement yesterday.

In a separate statement, the department announced that the country’s manufacturing sales grew 6% y-o-y in July to RM74.2 billion from RM70 billion a year ago. On a month-on-month basis, the sales value was up 5.1% or RM3.6 billion.

Mohd Uzir said the growth was driven by the increase in non-metallic mineral products, basic metal and fabricated metal products (7.4%), petroleum, chemical, rubber and plastic products (5.9%) and electrical and electronics products (5.8%).

RHB Investment Research economist Vincent Loo Yeong Hong views July’s weak IPI reading as a temporary blip caused by weak crude oil output.

“Manufacturing activity remains healthy and resilient, even in the face of protracted US-China trade frictions. This may be due to trade diversions from companies involved in the global supply chain that are looking to diversification to circumvent the trade tariffs,” he said in a note to investors yesterday.

“Looking ahead, we maintain our expectations for Malaysia’s economic growth to moderate to 4.5% for 2019 and 4.3% in 2020,” Loo added.

MIDF Research foresees IPI performance to continue expanding at a steady pace in the second half of 2019 (2H19) as the trade war factor remains a major downside risk to global trade activities and manufacturing production in particular, as it has the highest weightage in the overall IPI.

“For 1H19, IPI growth averaged at 3.3% y-o-y. Based on the latest macro trends and indicators, we maintain our forecast figure at 2.9%. The manufacturing sector, which holds [about] 70% of IPI weight, is expected to perform modestly in 2H19 amid escalating trade tensions and that could drag the overall IPI performance this year.”