This article first appeared in The Edge Malaysia Weekly on March 25, 2019 - March 31, 2019

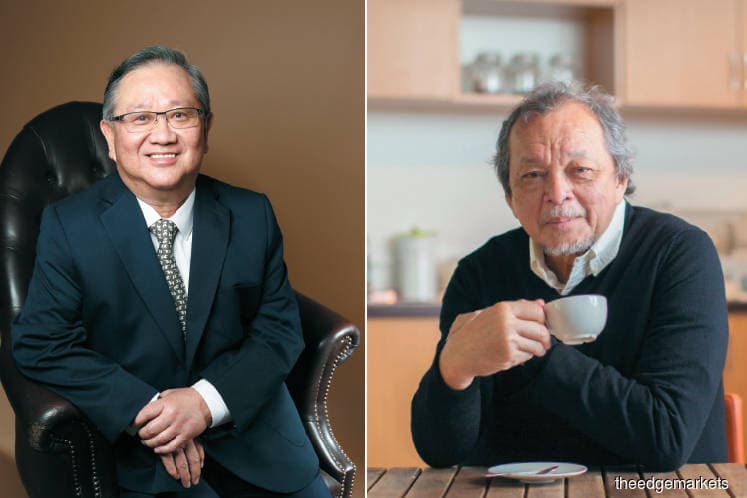

TWO old friends, Tan Sri Wan Azmi Wan Hamzah and Datuk Seri Terry Tham, have come together once again to become partners in business.

Last Tuesday, Eastern & Oriental Bhd (E&O) announced that Wan Azmi had taken up a 9.09% stake in the company via a private placement of new shares for RM127.6 million.

This is Wan Azmi’s second appearance as a substantial shareholder in E&O. He invested in the company from 2006-2011. Together with Tham and GK Goh Holdings, he sold his shares to Sime Darby Bhd in 2011 at RM2.30 apiece. Now, he has come back in at 98 sen.

In 2016, Tham re-emerged as the largest shareholder in E&O with a 21% stake after buying a block of the shares from Sime Darby.

In February this year, E&O embarked on a fundraising exercise to raise RM250 million to RM550 million. It needs fresh funding for the next couple of years as the Seri Tanjung Pinang (STP2) reclamation phase is nearing completion. Building work, mainly infrastructure, has started. The high-end property developer also needs funds to pare down its gearing to reduce interest costs.

E&O’s fundraising exercise was not well received by the market largely because of depressed sentiment and a property sector that has yet to emerge from the doldrums. In fact, its share price plunged 18% to an eight-year low the day after the cash call was made.

So, in these depressed market conditions when cash calls are likely going to be given the cold shoulder, is Wan Azmi helping out an old friend who once, long ago, had done the same for him?

By happy coincidence, Wan Azmi is flush with cash from the sale of his 30% stake in SPLASH (Syarikat Pengeluar Air Selangor Holdings Bhd), held through Sweetwater SPV.

Wan Azmi says he was asked by his friend what he was going to do with the money. “I said I will look around, I have no plans. Then they asked if I would consider (investing in E&O) if they needed (to raise funds) and I said, show me your plans, tell me your story. It depends on pricing, it depends on a lot of things,” he tells The Edge in an interview.

But nothing happened until two weeks ago, when two senior E&O officers went to his office and started negotiations. “That’s when I agreed to pay 98 sen (almost 15% above the market price at the time). My chief investment officer said to me, ‘Boss, you have become soft’,” laughs Wan Azmi.

So it is about helping out an old friend?

“I value friendship but friendship is not worth RM130 million,” Wan Azmi quips, chuckling. “So if I’m putting in that sort of money, it’s because I think I’m going to get a fair return.”

The savvy investor is not too concerned about the current downturn in the property sector and is confident he will get his returns. “I would say, without being too precise about the numbers, I’m really coming in at a good part of the cycle, the bottom end. I don’t know how quickly it’s going to come out of that, but if I take a six-year view, then I’m reasonably confident that I should get a very good return from this investment.”

How?

“I think, today, during this cycle, a lot of the issues are clearer ... where we had put valuation as a future reclamation, it is now no longer that; a third of that is already delivered. The 253 acres under STP2 must represent Penang’s most prime, high-end residential development area. And it’s ready to go, it’s no longer a twinkle in the eye. You can actually walk on it today.”

He adds that E&O’s risk profile has improved very much and the market has allowed him to go in at a considerable discount to what he thought was not an overpayment by Sime Darby in 2011.

“So, it’s well poised to take advantage of any recovery and I do expect a recovery … Penang should lead the recovery as it is a little more robust, marketwise, than Kuala Lumpur.”

Wan Azmi will probably be putting in more than RM130 million once E&O gives details of its rights issue, which some analysts say could be held in May. He may have to cough up RM30 million to RM40 million if he subscribes for the rights.

Analysts opine that its major shareholders — Tham, Sime Darby and Wan Azmi — will likely take up the rights.

While the market felt that it takes a brave man to make a cash call at this time of the cycle — a global slowdown and weak demand for higher-end properties — Tham believes that E&O must move on despite the market uncertainties.

“In the event of a potential tightening of money supply and credit squeeze, we believe in seizing the opportunity now. Waiting may not necessarily be the better option. By raising funds now, our objective is to have E&O’s position assured for the next few years — a period that is vital to the success of our flagship STP2 development. In so doing, we also invite our valued shareholders to participate in the next growth trajectory of E&O,” he tells The Edge.

Ties that bind

Wan Azmi and Tham’s friendship goes all the way back to the 1970s, when they were students in London. In fact, according to some mutual friends, it was Wan Azmi who bought Tham his first beer and taught him to fill up his first betting slip during those young and wild days.

The duo’s business partnership dates back more than 30 years to the late 1980s, when Tham sold his Subang Jaya office to Wan Azmi in return for General Lumber shares. No cash was involved. As Tham tells it: “The land title of the office was immediately used to appease my friend’s uncompromising lenders.”

It would appear that Tham was lending his friend a helping hand. And perhaps, today, Wan Azmi is returning the favour, with the confidence that it will bring him fair, if not good, returns. He knows E&O well. “There is little to dislike about the company,” he says.

General Lumber was in fact Wan Azmi’s first venture into entrepreneurship after he bought an 8.8% stake in the loss-making company. He successfully turned it around and from there, thanks also to the super bull run of the early 1990s, built his business empire.

In his stable were companies such as General Lumber (later known as Land & General), RJ Reynolds Bhd (JTC), Rohas EUCO Industries (which has morphed into Rohas Tecnic) Bell & Order Bhd, Amway (Malaysia) Holdings Bhd and E&O.

A triple coronary bypass surgery in 2001 caused him to review his priorities. “That one single event was the start of a steady shift from entrepreneur-manager to detached investor,” Wan Azmi says.

Wan Azmi gave up all board positions in PLCs, while strategic and influential-sized stakes were pared down and treated as portfolio investments. “However, some entrepreneurial initiatives had to be progressed; SPLASH was a case in point.” Since then, Wan Azmi has kept a low profile but he has investments not only domestically but abroad.

His current overseas investments include strategic substantial stakes in Steppe Cement (Kazakhstan’s largest cement manufacturer) and PureCircle Ltd (the leading producer of natural zero calorie sweetener from stevia), both of which are listed on the London Stock Exchange.

Does he enjoy being an investor more? Everything has its own time, he says. “When I decided to move away from direct entrepreneur to detached investor, it suited me and my character at that stage in my life. I don’t think I could have done it when I was younger, when I was full of energy, bubbling with ideas and wanting to get into fist fights.

“But at this stage in my life, this is a lot better. Detachment gives you clarity; you see issues better and you are also not so captive to your own ego and refuse to admit that maybe your judgement is not so correct … It’s easier now because you don’t make those decisions — it places you in an objective position.”

Tham, on the other hand, is mainly London-based these days. Technology has made it possible for him to stay on top of things in Malaysia.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.