This article first appeared in The Edge Financial Daily, on October 27, 2015.

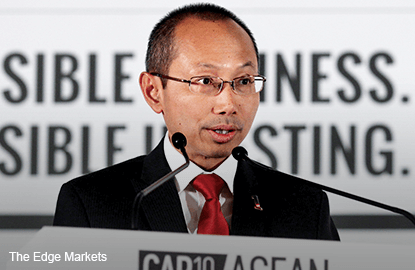

KUALA LUMPUR: The injection of RM20 billion into ValueCap Sdn Bhd would not be from the government nor be guaranteed by the it, said Minister in the Prime Minister's Department Datuk Seri Abdul Wahid Omar.

KUALA LUMPUR: The injection of RM20 billion into ValueCap Sdn Bhd would not be from the government nor be guaranteed by the it, said Minister in the Prime Minister's Department Datuk Seri Abdul Wahid Omar.

Abdul Wahid said the RM20 billion would be sourced from state equity investment firm ValueCap's three shareholders Khazanah Nasional Bhd, Kumpulan Wang Persaraan (Diperbadankan) (KWAP), and Permodalan Nasional Bhd (PNB).

He said the fund would invest in undervalued listed companies with good fundamentals and long-term growth potential, and that investments would be carried out in stages, based on the right price and timing.

This will indirectly contribute positively towards the activities of listed companies and towards the economic growth of the country in general, he said.

Abdul Wahid said the injection of fund from ValueCap's shareholders would be made in terms of bonds, and external funds or other forms of capital will only be considered if it was approved by the board.

"The investment fund is not aimed at helping any [particular] company, be it bumiputera or non-bumiputera. The investment is based on the philosophy of long-term but not short-term investment.

"It is based on the thorough and careful evaluation of the financial performance of the stocks," Abdul Wahid said this in a written reply to Shah Alam member of parliament (MP) Khalid Samad last Thursday, which was made available to the press yesterday.

Khalid asked the Prime Minister to state the source of the RM20 billion that would be used to help the Malaysian stock market, and whether the ministry had made any research on whether the RM20 billion would be able to improve the current stock market.

On Sept 15, PKR secretary-general and Pandan MP Rafizi Ramli expressed concern that the RM20 billion would eventually be used to buy undervalued shares and that the fund would be directed to buy shares from companies that are deemed close to Umno and Barisan Nasional for the purpose of making short-term profits for those with vested interests.

Meanwhile, Abdul Wahid said ValueCap would invest in companies with strong balance sheets, stable cash flow and good governance.

In addition, companies that declare good dividends and defensive stocks would be picked, such as Malayan Banking Bhd (fundamental: 1.4; valuation: 2.25), United Plantations Bhd (fundamental: 1.95; valuation: 1.10) and real estate investment trusts with dividend yield of more than 5% a year.

He said that ValueCap had recorded a stellar performance with a return of equity investment of more than 16.3% a year between 2003 and 2013.

As at end-2014, ValueCap had an accumulative profit of RM8.5 billion, of which a total of RM8.4 billion was allocated back to the shareholders in the form of dividends.

ValueCap was established in 2002 and Prime Minister Datuk Seri Najib Razak announced the injection into the fund on Sept 14, with the hope that it would shore up the local stock market, which has taken a beating from negative news flow, low oil and commodity prices, and alleged financial irregularities at state-owned strategic investment fund, 1Malaysia Development Bhd.

The Edge Research’s fundamental score reflects a company’s profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations. Go to www.theedgemarkets.com for more details on a company’s financial dashboard.