This article first appeared in Personal Wealth, The Edge Malaysia Weekly on November 26, 2018 - December 2, 2018

More banks are planning to replace their front-office employees with chatbots and conversational user interfaces to serve clients and enhance customer experience, according to multinational law firm Baker McKenzie’s latest report.

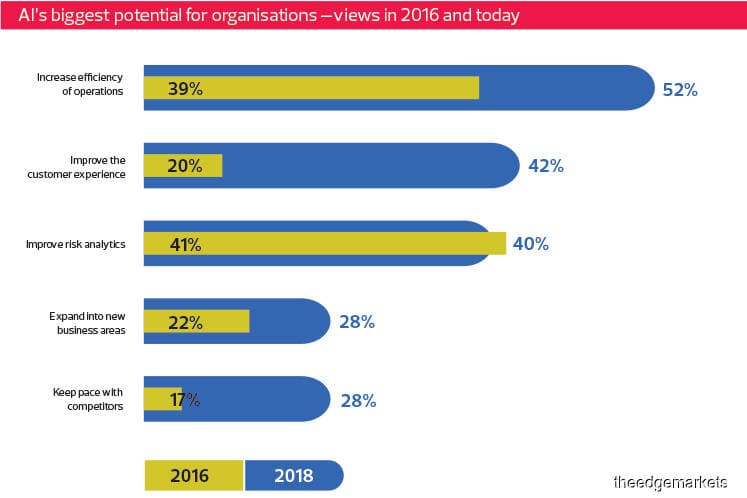

“In 2016, only 20% of the survey respondents said the biggest potential of artificial intelligence (AI) was its ability to improve the customer experience. In 2018, this figure more than doubled to 42%. No other segment saw such a sizeable jump in just two years,” says the report.

How can this be done? An example is the launch of Bank of America’s mobile app a year ago, which allows its 25 million customers to chat via voice or text messaging with its virtual assistant, Erica. Meanwhile, Swiss investment bank and financial services company UBS Group AG has been “experimenting with a digital clone of its chief economist using the computer gaming industry’s latest animation techniques”.

The report, titled Ghost in the Machine:

Revisited, was published on Nov 14. It looks at how financial institutions are incorporating AI into their services and pointing out that other financial services companies, such as insurers, are also leveraging the technology to enhance their customer experience. China-based Ping An Insurance is one of the leaders in this field. “It is using AI-enabled solutions in its customer centre to speed up car insurance claims and even to develop music to boost user stickiness among its 400 million-plus clients,” says the report.

The report, which was produced based on the feedback of 355 senior executives with financial institutions and financial technology (fintech) companies globally, says there is a growing number of financial institutions aiming to leverage AI to increase the efficiency of their operations (from 39% in 2016 to 52% in 2018), to expand into new business areas (from 22% to 28%) and to keep pace with their competitors (from 17% to 28%).

Fears and challenges

However, the report points out that fears and challenges in the financial services sector are slowing down the development of AI technology in the industry. One of the biggest concerns is job displacement. This is despite the fact that most of them believe the technology can benefit financial institutions in various areas, particularly in credit assessment, risk management and compliance.

Another concern is that financial institutions may not fully understand the risks related to AI. “A large number of respondents remain concerned that all AI-related legal risks have not been understood by their organisations. In the light of the ongoing debate on the potential abuse of data, there is recognition that ethical risks need to be more carefully considered, as well as an admission by many that they are confused about how to respond,” says the report.

The biggest challenge for financial institutions is the cost of implementing AI systems. The report says 53% of the respondents with smaller companies cited cost as their biggest hindrance while 37% of those with large companies said so.

The second key challenge is the shortage of specialist skills to operate the AI technology (36% of smaller companies and 50% of large companies) while the third is cybersecurity concerns (21% of smaller companies and 30% of large companies).

The lack of understanding by regulators regarding fintech and its impact on the current financial services sector is another obstacle to AI technology being more widely adopted and implemented, says the report.

Regulations yet to catch up

The report points out that 32% of the respondents believe that regulators have yet to improve their understanding of AI and fintech. “Some regulators have been slow to see this coming, adopting a wait-and-see approach, while others have been very proactive, making statements about the rules they expect companies developing the technology to follow. It would be good to see more regulators take the latter approach and make statements about what they expect to see,” it says, quoting Maria McDermott, director of corporate affairs and risk management at global fintech firm Know Your Customer Ltd, as saying.

The company provides know-your-customer and anti-money laundering solutions.

The report singles out the Monetary Authority of Singapore as one of the forerunners of fintech regulations as it recently announced that it was working with a group of industry players to develop a guide to promote the responsible and ethical use of AI and data analytics by financial institutions.

The report also mentions that the development of AI in the financial services industry in the EU could be slower due to its stricter rules and regulations on protecting personal data. The UK’s Financial Conduct Authority has been at the forefront of innovation in financial services and is promoting machine learning to make better decisions and creating “machine-readable rules”.

John Price, commissioner at the Australian Securities and Investments Commission, is quoted in the report as saying that regulatory issues on the use of AI in financial markets have become “sharper and more nuanced recently”. “More focused questions are being asked about accountability — who is responsible for the algorithms making what can be life-changing decisions? There is also a focus on issues such as algorithm bias and how to deal with algorithms that have gone wrong.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.