ASIAN markets ended mostly lower last week with confidence buffeted by myriad issues, domestic and external. It seems unlikely that sentiment will see sustained reversal in the near-term.

Chinese stocks slumped anew following a brief respite, despite and after the government intervened with draconian measures to support stock prices. This underscores the inherent difficulty in attempting to manage the stock market. The prevention of market forces in finding fair price levels distorts allocation of resources and creates a moral hazard for the future.

It remains uncertain the extent of any spillover effect from the stock market into the real economy. By most accounts, whilst retail investors make up about 80% of total market activities, stock ownership, by and large is still fairly narrow.

Nevertheless, since the selloff coincides with an economy that is still comparatively opaque to foreigners and already slowing down, investors are paring back growth expectations.

The unfolding slowdown in the world’s second largest economy has been the driving force behind the current slump in commodities.

Brent crude futures slipped further last week, hovering below US$53 per barrel at the point of writing. With supply forecasted to keep rising — from US shale producers, Opec as well as resumption of output from Iran — while demand growth remains lacklustre, weakness in oil price is likely to persist for some time yet.

At the same time, the odds are growing for the US to start raising interest rate in September, lifting the US dollar higher. A strong greenback coupled with the drop in commodity prices and slowing growth will keep the pressure on emerging markets.

The ringgit traded well above the 3.80 peg to the US dollar adopted during the 1997 Asian financial crisis through the past week. It closed at 3.825 last Friday.

A weaker ringgit should boost export earnings, but much of the benefit is being offset by weaker than expected demand for a wide range of products on the back of sluggish global economy.

Our falling currency will, unfortunately, result in higher import costs, which is one of the key factors behind rising prices in recent months. The other being GST. Rising prices, in turn, dent consumer purchasing power and hurt consumption.

Heading into reporting season for 2Q2015 earnings, I have modest expectations. Corporate earnings results will, more likely than not, continue to disappoint.

As such, I do not foresee any catalyst for a sustained broader market upturn, yet, even though the FBM KLCI closed on a stronger footing last week. The benchmark index recouped all of its losses from the earlier part of the week on Friday.

Nevertheless, there are still companies that will do well. I believe Willowglen is one. The company is a leading provider of Supervisory Control and Data Acquisition (SCADA) solutions, a system used to monitor and control industrial processes and facilities in various industries such as power plants, transportation, oil and gas, water and wastewater, and municipal and building service. With some 83% of revenue derived from Singapore, it will benefit from the strengthening Singapore dollar.

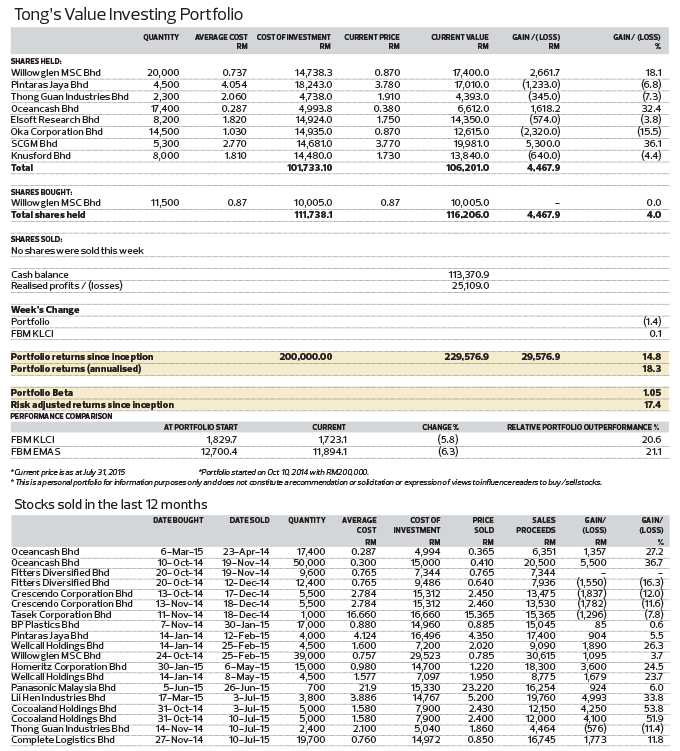

I acquired an additional 11,500 shares in the company at 87 sen per share. This pared my cash holdings to RM113,371. My portfolio is now about 51% invested.

Total value for my portfolio was down 1.4% last week, paring total returns since inception to 14.8%. Nonetheless, I continue to outperform the benchmark index, which is down by 5.8% over the same period, by some distance.

This article first appeared in digitaledge Weekly, on August 3 - 9, 2015.